Which Investors Invest In African Ride-hailing Startups And What Are Their Investment Patterns?

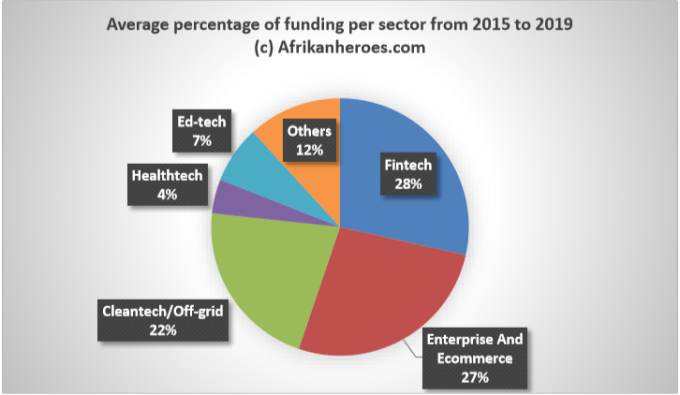

The African startup funding landscape, as promising as it is, is full of puzzles. While fintechs get, from diverse investors, the lion’s share of funds pouring into the entire ecosystem, closely followed by ecommerce and cleantechs, there are yet some insufficiently explored territories, one of which is ride-hailing.

Currently, the continent is full of players in this territory who have launched, adventurers who had quietly folded up, as well as outsiders — Uber and Bolt — who happened to have seemingly conquered all the market shares there are. In fact, one outsider, Bolt which focuses on Africa and Eastern Europe has more than $534.9 million war chest of funding and, on several occasions, has hinted that a majority of the humongous investments would be funneled into its African markets.

Now, these facts do not, in any way, spell doom for African startups desiring to venture into the continent’s ride-hailing space. As a matter of fact, there are no hard and fast rules about fundraising. But, it would only be unintelligent — and benignly naive — to ignore clues for stitching a clearer picture of how things currently work within the ecosystem.

Read also:Why Ride-hailing Is Thriving In Egypt, And Why UK’s UVA Just Joined The Race

And so, to assist entrepreneurs to gain insights into how investments in the continent’s ride-hailing space are currently constituted, we begin with a table of the investors.

| S/N | NAME OF INVESTOR | STARTUP INVESTED INTO | DESCRIPTION OF STARTUP | YEAR OF INVESTMENT | AMOUNT OF INVESTMENT | COUNTRY OF INVESTOR | COUNTRY OF STARTUP |

|---|---|---|---|---|---|---|---|

| 1 | Uncovered Fund | Gozem | Ride-hailing (Bike); Super-app | 2021 | Undisclosed | Japan | Togo |

| 2 | D1 Capital Partners | Bolt | Ride-hailing (car) | 2020 | $182m (Co-investment) | New York, United States | Estonia (Africa-focused) |

| 3 | Darsana Capital Partners | Bolt | Ride-hailing (car) | 2020 | $182m (Co-investment) | New York, United States | Estonia (Africa-focused) |

| 4 | International Finance Corporation | Bolt | Ride-hailing (car) | 2021 | $24m | USA (led by its Africa Branch) | Estonia (Africa-focused) |

| 5 | Microtraction | Plentywaka | Ride-hailing (bus) | 2020 | $300k (co-investment) | Nigeria | Nigeria |

| 6 | Niche Capital | Plentywaka | Ride-hailing (bus) | 2020 | $300k (co-investment) | Nigeria | Nigeria |

| 7 | EMFATO HOLDINGS (Holding company for Plentywaka) | Plentywaka | Ride-hailing (bus) | 2020 | $300k (co-investment) | Nigeria | Nigeria |

| 8 | Craft Silicon (Holding company for Little Cab) | Little Cab | Ride-hailing (Bus) | 2018; 2020 | $6m; $3m | Kenya | Kenya |

| 9 | Rise Capital | Gokada | Ride-hailing (Bike) | 2019 | $5.3m (Co-investment) | USA | Nigeria |

| 10 | Adventure Capital | Gokada | Ride-hailing (Bike) | 2019 | $5.3m (Co-investment) | Delaware, USA | Nigeria |

| 11 | First MidWest Group | Gokada | Ride-hailing (Bike) | 2019 | $5.3m (Co-investment) | Chicago, USA | Nigeria |

| 12 | IC Global Partners | Gokada | Ride-hailing (Bike) | 2019 | $5.3m (Co-investment) | Dubai, UAE | Nigeria |

| 13 | Novastar Ventures | MAX.NG | Ride-hailing (Bike) | 2019 | $7m (Co-investment) | Kenya | Nigeria |

| 14 | YAMAHA | MAX.NG | Ride-hailing (Bike) | 2019 | $7m (Co-investment) | Japan | Nigeria |

| 15 | Allianz X | Safeboda | Ride-hailing (Bike) | 2018 | $1.1m (Co-investment) | Germany | Uganda |

| 16 | Go-Ventures | Safeboda | Ride-hailing (Bike) | 2018 | $1.1m (Co-investment) | Indonesia | Uganda |

| 17 | Capsa Capital Partners | Instigo | Ride-hailing (Bike) | 2020 | $710k (Part of a larger $1m fundraising) | Tunisia | Tunisia |

| 18 | Naya Capital Management | Bolt | Ride-hailing (Car) | 2020 | $109m | United Kingdom | Estonia (Africa-focused) |

| 19 | Angel Investors: Aziz Ketari, Hedi Ketari, Ahmed Mhiri, Welid Mnif, Hedi Hachouch, Slim Bouzguenda, Malek Ben Ayed, Mehdi Triki; Abdelmoneim Al-Adawy (Instigo), Luvuyo Ntshayi, Soyiso Qotyiwe (Hive), Martin Villig of Bolt, Ragnar Sass of Pipedrive, Marko Virkebau of MeetFrank, Kristjan Vilosius of Katana MRP, and several other Estonian tech entrepreneur; Emilian Popa (Planet42) | Instigo; Hive; Planet42 | Ride-hailing (Bike, Instigo); Ride-hailing (Car, Hive) Ride-hailing (Car, Taxi Live Africa) Rent-to-buy (Planet42) | 2020 (Instigo); 2019 (Hive) 2019 (Taxi Live Africa) 2020 (Planet42) | $300k (Instigo); $400k (Hive) $162k (Taxi Live Africa) $2.4 million (Co-investment in Planet42) | Tunisia (Instigo); Egypt (Hive) South Africa (Taxi Live Africa) Tallin, Estonia (Planet42) | Tunisia (Instigo); Egypt (Hive) South Africa (Taxi Live Africa) South Africa (Planet42) |

| 20 | Tell Venture Automotive | TemTem | Ride-hailing (Multi-modal) | 2019 | $4m | Luxembourg | Algeria |

| 21 | Breakthrough Energy Ventures | MAX.NG | Ride-hailing (Bike) | 2019 | $7m (Co-investment) | European Union (Bill Gates-backed) | Nigeria |

| 22 | Zrosk Investment Management | MAX.NG | Ride-hailing (Bike) | 2019 | $7m (Co-investment) | Nigeria | Nigeria |

| 23 | Alitheia Capital | MAX.NG | Ride-hailing (Bike) | 2019 | $7m (Co-investment) | Nigeria | Nigeria |

| 24 | Kindred Ventures | Flexclub | Car subscription | 2021 | $5m (Co-investment) | California, USA | South Africa |

| 25 | CRE Venture Capital | Flexclub | Car subscription | 2019; 2021 | $1.9m; $5m (Co-investments) | New York, USA | South Africa |

| 26 | Endeavor | Flexclub | Car subscription | 2021 | $5m (Co -investments) | New York, USA | South Africa |

| 27 | Toyota Tsusho (Mobility 54) | Moja Ride; Tugende. | Transport payment system (Moja Ride); Lease-to-buy (Tugende) | 2021 (Moja Ride); 2020 (Tugende) | Undisclosed (Moja Ride); $6.3m (Co-investment, Tugende) | Japan | Ivory Coast (Moja Ride); Uganda (Tugende) |

| 28 | Lendable Inc. | Planet42 | Rent-to-buy transport system | 2020 | $10m (debt) | USA | South Africa |

| 29 | Global Partnerships’ Social Venture Fund | Tugende | Rent-to-buy (bikes) | 2020 | $6.3m (Co-investment) | USA | Uganda |

| 30 | Denali Venture Philanthropy | Tugende | Rent-to-buy (bikes) | 2020 | $6.3m (Co-investment) | Colorado, USA | Uganda |

| 31 | Segal Family Foundation | Tugende | Rent-to-buy (bikes) | 2020 | $6.3m (Co-investment) | New Jersey, USA | Uganda |

| 32 | Partners Group Impact Investments | Tugende | Rent-to-buy (bikes) | – | $20m (debt) | Uganda | |

| 33 | U.S. Development Finance Corporation | Tugende | Rent-to-buy (bikes) | – | Debt (undisclosed) | USA | Uganda |

| 34 | Symbiotics Group | Tugende | Rent-to-buy (bikes) | – | Debt (undisclosed) | Cape Town, South Africa; London, UK | Uganda |

| 35 | Frankfurt School Financial Services | Tugende | Rent-to-buy (bikes) | – | Debt (undisclosed) | Frankfurt, Germany | Uganda |

| 36 | ADA Microfinance | Tugende | Rent-to-buy (bikes) | – | Debt (undisclosed) | Rue Glesener, Luxembourg | Uganda |

| 37 | Yunus Social Business | Tugende | Rent-to-buy (bikes) | 2020 | Debt (undisclosed) | Frankfurt, Germany | Uganda |

| 38 | Global Social Impact Fund | Tugende | Rent-to-buy (bikes) | 2020 | Debt (undisclosed) | Jose Abscal, Madrid, Spain | Uganda |

| 39 | Oikocredit | Tugende | Rent-to-buy (bikes) | 2020 | Debt (undisclosed) | Amersfoort,Netherlands | Uganda |

| 40 | Agora Capital Partners | Tugende | Rent-to-buy (bikes) | 2020 | Debt (undisclosed) | Netherlands | Uganda |

| 41 | Shorooq Partners | QuickBus | Bus-ticketing | 2020 | Undisclosed | Abu Dhabi, UAE | Kenya |

| 42 | Echo VC | QuickBus | Bus-ticketing | 2020 | Undisclosed | Nigeria | Kenya |

| 43 | Oman Technology Fund | QuickBus | Bus-ticketing | 2020 | Undisclosed | Oman | Kenya |

| 44 | Battery Road Digital Holdings | Halan | Ride-hailing (bike; tuk-tuk) /logistics | 2018 | Undisclosed (Co-investment of multi-million dollars hinted) | Singapore | Egypt |

| 45 | Algebra Ventures | Halan | Ride-hailing (bike; tuk-tuk) /logistics | 2018 | Undisclosed (Co-investment of multi-million dollars hinted) | Egypt | Egypt |

| 46 | Change Ventures | Planet42 | Rent-to-buy | 2020 | $2.4m (Co-investment) | Tallin, Estonia | South Africa |

| 47 | Y Combinator | Yassir Algeria | Ride-hailing (car) | 2020 | $150k | USA | Algeria |

| 48 | Far Ventures | Jumpin Rides | Ride-hailing (car) | 2018 | $137k ( Funds secured through incubator programme) | South Africa | South Africa |

| 49 | BECO Capital | SWVL | Ride-hailing (bus) | 2018; 2019 | $8m (Co-investment); $42m (Co-investment) | Dubai, UAE | Egypt |

| 50 | DiGAME | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | Abu Dhabi, UAE | Egypt |

| 51 | Silicon Badia | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | Jordan | Egypt |

| 52 | Arzan VC | SWVL | Ride-hailing (bus) | 2018; 2019 | $8m (Co-investment); $42m (Co-investment) | Kuwait | Egypt |

| 53 | Oman Technology Fund | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | Oman | Egypt |

| 54 | EDventure Holdings (Through its Chair, Esther Dyson) | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | New York | Egypt |

| 55 | Raed Ventures | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | Saudi Arabia | Egypt |

| 56 | Vostok New Ventures | SWVL | Ride-hailing (bus) | 2019; 2020 | $42m (Co-investment); $8m (Co-investment) | Sweden | Egypt |

| 57 | Autotech | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | United Kingdom | Egypt |

| 58 | Blustone | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | United Kingdom | Egypt |

| 59 | Endeavor Catalyst | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | New York, USA | Egypt |

| 60 | MSA Capital | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | China | Egypt |

| 61 | OTF Jasoor Ventures | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | Oman | Egypt |

| 62 | CEO of Property Funder, Michael Lahyani | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | UAE | Egypt |

| 63 | Sawari Ventures | SWVL | Ride-hailing (bus) | 2019 | $42m (Co-investment) | Egypt | Egypt |

| 64 | Dash Ventures | SWVL | Ride-hailing (bus) | 2018 | $8m (Co-investment) | Amman, Jordan | Egypt |

| 65 | Careem | SWVL | Ride-hailing (bus) | 2017 | $500k | Dubai,UAE | Egypt |

| 66 | Plug and Play | Gozem | Ride-hailing (bike)/ Super App | 2020 | Undisclosed | USA | Togo |

| 67 | Virtual Network | Gozem | Ride-hailing (bike)/ Super App | 2020 | Undisclosed | Switzerland | Togo |

| 68 | ENZA Capital | Tugende | Rent-to-buy (bikes) | 2020 | $6.3mm (Co-investment) | Kenya | Uganda |

| 69 | Partech | Tugende | Rent-to-buy (bikes) | 2020 | $6.3mm (Co-investment) | San Francisco, USA; Paris, France | Uganda |

| 70 | OPIC – Overseas Private Investment Corporation | Tugende | Rent-to-buy (bikes) | 2018 | $5m (Debt) | Washington, USA | Uganda |

The Patterns Of Investments In The African Ride-hailing Space

Apart from having a firm grip of who the investors in the African ride-hailing space are, it is important that founders also have a fair grasp of the historical behaviours of these investors as it pertains to their investments across the continent. These are enumerated below but are not fixed as ever-changing events may have sweeping effects.

Investments In Africa’s Local Ride-hailing Space Tend To Focus More On The Use Of Vehicles And Along The Ride-hailing Value Chain Than On Private Cars

This is one notable pattern that has even inspired the relatively large number of investors in the African ride-hailing space.

A majority of investors (as shown above) prefer to make investments in models which do not rely on the use of private vehicles alone.

Read also:Why South African Businesses Adopted Hybrid Cloud at Increasing Rate In 2020

Thus, ride-hailing models involving the use of bikes (whether electric or not), tricycles, buses, etc. as well as those which attach themselves to the ride-hailing value chain (such as ticketing, subscription, etc.) have received the lion’s share of funding, when compared with models involving solely the use of private cars.

Even more insightful is the fact that investors prefer to rather invest in schemes involving the use of private vehicles for ride-hailing on a rent-to-own basis.

This behaviour of investors, a majority of whom are foreigners, is understandable for many reasons.

First is that car ownership in Africa is barely 2% per capita, compared to 70% in the United States and 50% in Europe. This means that there would not be enough private vehicles available for intending ride-hailing drivers.

Another is that the continent needs better transport infrastructure, more connectivity across borders, and an improved business environment to reach its vast but largely untapped ride-hailing potential. For example, according to the OECD report, only 27.6% of Africa’s 2 million kilometers of roads are paved (19% in sub-Saharan Africa, versus 27% in Latin America and 43% in South Asia). It will therefore require considerable investment to fix the thousands of kilometers of roads that need attention.

But the most disturbing factor appears to be the wide income disparity among Africans, which makes it difficulty to scale outside the continent’s major cities which, in most cases, have been colonised by leading industry players such as Uber and Bolt. As a reminder, Sub-Saharan Africa gdp per capita for 2017 was $1,563, a 3.78% increase from 2016.

In essence, any model that would not circumvent these unfavourable factors enumerated above seem to have been overlooked by the investors.

This point is further reinforced by the sudden disappearance of ride-hailing startups such as Kenya’s MondoRide (after raising $2m) as well as Egypt’s Ousta (after raising $1.25m).

With The Exception Of North Africa And West Africa, Expat Founders Seem To Have Received More Attention Than Local Founders

This pattern is particularly truer in East Africa, where investments have mostly been made into startups founded by foreigners. Whether Safeboda, QuickBus and Tugende in Uganda or Little Cab in Kenya, investors seem to have favoured mostly foreign founders. Similar pattern can also be detected in South Africa, where, for instance, startups such as Planet42, etc. are owned by expatriate founders.

However, this may not be the case for the majority of ride-hailing startups in West Africa (eg. Nigeria, Togo, Ivory Coast etc.). On the other hand, it seems that almost all the ride-hailing startups in North Africa which have raised funds from investors are owned by local founders.

Angel Investors And Non-traditional VC Firms Have Played More Active Roles In The African Ride-Hailing Ecosystem

Investments in the African ride-hailing space have mostly been driven by non-traditional venture capital (VC) firms and angel investors.

Specifically, some of the investors seem to be established transport/mobility companies looking to make strategic investments in startups disrupting their industry. This could more particularly be gleaned from Toyota Tsusho’s investment in Uganda’s Tugende, and Ivory Coast’s MojaRide; as well as Careem and Autotech’s investments in SWVL. It also seems that this point becomes truer towards North Africa and South Africa, with traditional investors holding sway in West Africa and East Africa.

Investment In The African Ride-hailing Space Is Still Relatively New

This is perhaps the only consoling fact for African founders desiring to venture into the African ride-hailing space anytime soon. Major events began in 2013, following Uber’s first launch onthe continent that year.

Investments only recently began to pick up from 2017, reaching a new industry high in 2019, when Egypt’s SWVL raised a record-shattering $42m from heavyweight investors, including from previous investor Vostok New Ventures.

Nevertheless, while the future is bright, it does continually look like African startups who may get investors’ attention in the future may be those who would offer what current industry players are offering (with either good traction or improvements); as well as those who will come up with models disruptive to the current ones.

Whether they attach themselves to the ride-hailing industry’s value chain or not may not matter.

African ride-hailing investors African ride-hailing investors African ride-hailing investors African ride-hailing investors

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer