Only 20% of Funded African Tech Startups Had a Female Founder in 2022

African tech’s gender problem is only getting worse, with just 20.2 per cent of 633 funded ventures in 2022 having a female founder, down from 21.5 per cent in 2021.

This is according to the eighth edition of the annual African Tech Startups Funding Report released by startup news and research portal Disrupt Africa, which is available free to all as part of an open-sourcing initiative in partnership with Flat6Labs, MarketForce, 4Di Capital, Mercy Corps Ventures, Newtown Partners, and InsiderPR.

The report tells the story of an impressive 2022 in which more startups raised more funding than ever before, in spite of a global downturn in investments. In all, 633 startups raised a combined US$3,333,071,000 in 2022. This represented incredible growth. The number of funded startups increased by 12.2 per cent to 564 in 2021, while the total secured funding jumped 55.1 per cent to US$2,148,517,500 in 2021.

Read also : Kenyan Fintech Startup Power Financial Wellness Raises $3M In Seed Funding Round

Yet while overall numbers are on the rise, female representation relatively declined. Only 128 of the 633 funded African tech startups have at least one woman on their founding team, which is marginally up from 121 in 2021 but still represented a percentage decline to 20.2 per cent from 21.5 per cent.

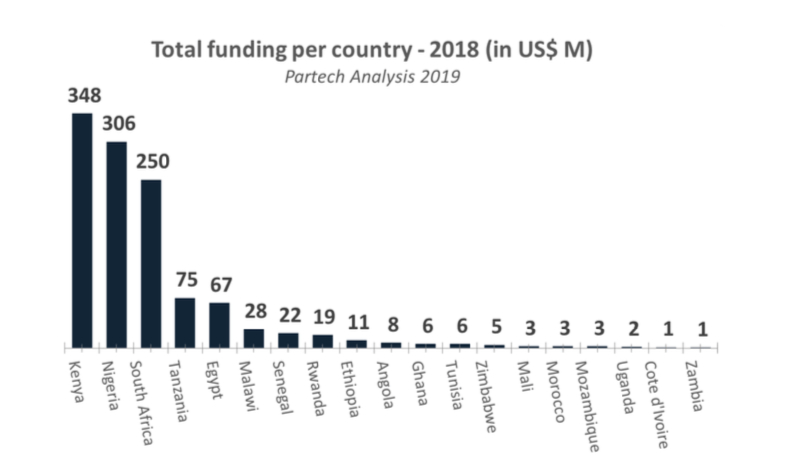

It is difficult to compare too many African ecosystems in this regard given many of them lack a critical mass of ventures raising, but we can take a look at Africa’s leading seven destinations from a funding perspective, as each of these nations had at least 20 funded ventures.

Kenya was the “best” performer when it came to female representation amongst funded ventures, with 26.4 percent of startups having at least one female co-founder. Morocco was also a relatively good performer, with 25.9 per cent, while South Africa had 23.1 per cent. Tunisia (21.7%) and Nigeria (20.6%) were marginally above average. Ghana (17.4%) and Egypt (13.7%) are underperformers.

Not great news, then. There were more positive developments elsewhere, however. The issue around non-African founders securing funding in Africa is well-documented, but is slowly but surely becoming less of a problem. In 2022, 600 of the 633 funded startups – 94.8 per cent – had at least one local in the founding team, up from 500 (88.7%) in 2021.

Read also : Cellulant, Money Q Collaborate on Cross Border Payments

Local representation, then, is growing, though 33 of the funded startups in 2022 – 5.2 per cent – were entirely founded by expats. Sixty-five (10.3%) had at least one expatriate in their founding team, down from 93 (16.5%) in 2021, while 568 (89.7%) had only local founders, up from 471 (83.5%) in 2021.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry