New Forex Policy Threaten Businesses in Central Africa States.

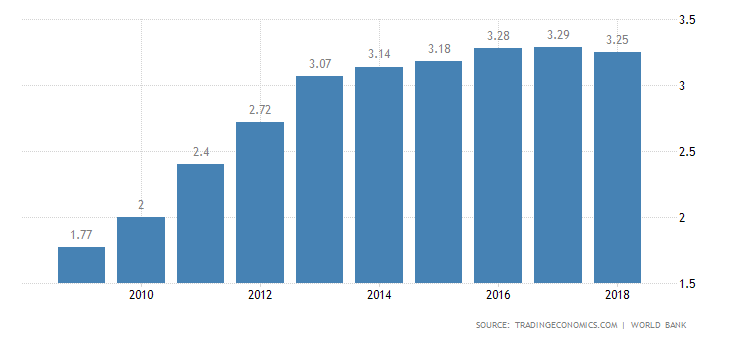

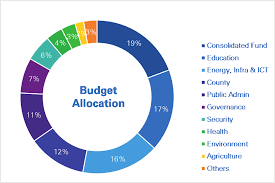

The new foreign exchange policy promulgated by the Central Bank of Central African States (BEAC) aimed at tackling financial frauds and money laundering and stems floundering foreign reserves seem to be having the opposite effects as dwindling forex and transaction delays have pushed businesses across the six countries of the BEAC in a bid fix. Many business people have decried the new rules warning that if nothing is done urgently, most businesses will crumble. The BEAC which manages monetary policies across Chad, Cameroon, Republic of Congo, Equatorial Guinea, Gabon and the Central African Republic is said to have implemented the new rules in line with the directive by the International Monetary Fund (IMF) urging it to boost its foreign reserves, which it estimated at 2.7 months of import cover at the end of last year, rather very low for a region with so much oil. The BEAC had agreed to boost this to five months by 2022 and the new rules aim to do that by forcing banks to keep their foreign exchange with the BEAC.

The BEAC said that new rules introduced in June this year will help bring the much desired order to a monetary bloc awash with petrodollars which, owing to lax controls, often end up in offshore bank accounts after bypassing local economies completely. Aside the Central African Republic (CAR) that is not an oil producing country within the group, the others are among sub-Saharan Africa’s top oil producers, whose financial dealings are among the most opaque structures in the world, thus the aim to stem the outflow. As part of the rules, all forex transfers over a 1 million CFA francs ($1,680) be vetted for approval by the bank, and that all export proceeds above 5 million CFA ($8,400) be repatriated in 150 days to a local bank account.

The BEAC equally ordered onshore foreign currency accounts shut – some of which may be re-opened with its approval – and prohibited the use of offshore accounts by companies and businesses that exists within the region without a prior approval from it. All these rules have brought untold hardship for business people who complain that the band is too small and the processing time quite laborious. Moreso, many say they now have to wait for months to get hold of hard currency which has affected their businesses as some of them can’t even meet import orders from suppliers. And those who do, don’t have enough forex to meet their needs. The period it now takes for money transfers to be affected has adversely affected a lot of businesses as foreign partners do not have the patience to wait through such snail speed process for a transaction that ordinarily takes less than 48 hours, says one affected CEO.

Speaking on the development, a spokesperson for the IMF pointed out that the revised regulations do not introduce new … exchange controls or any restriction on capital movements. Rather, they aim at clarifying certain requirements, highlighting that it was expected they would help the region adhere to the “rules of anti-money laundering and combating financing of terrorism.

Oil and Mining companies are lobbying to have the rule reviewed as it is negatively affecting their businesses says oil industry lobbyist NJ Ayuk, whose Centurion Law Group is representing some energy companies in their dispute with the bank. Speaking on the development, a representative of Eramet, a major French mining firm with operations across the region especially in Gabon pointed out that the new foreign exchange regulations do not sufficiently take into account the specific needs of mining activity, which is very export-oriented in markets denominated in U.S. dollars and euros thus the company is having an ongoing engagement with the BEAC. Reacting to the complaints, the BEAC was quoted as saying that the Bank has extended the deadline for the directive from the earlier September 1, to December 1, a development the business people say does not address the situation. Whether the Bank will reverse the rules, or relax it to accommodate the issues raised by the businesses are yet to be seen.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.