Getting your startup up and running can be one of the most demanding tasks every startup founders can face. The experience could be overwhelming, but seeking advice from the right mentors could make the work less cumbersome.

Below, we share the experience of most startup owners on how they got started.

Mostapha Kandil — SWVL, (Egyptian Startup)

‘‘Obviously, I am very happy about the fact that my team and I have reached this far in such a small amount of time. When we first came into this space, everyone thought we are crazy. They thought we are taking on Careem & Uber and we wouldn’t be able to survive. No investor was willing to take us seriously. This investment by Careem proves that we can actually make it.

But happiness is not the only feeling. I am scared as well. All this hype and attention we’ve been getting esp. after Careem’s investment comes with a lot of responsibility towards all our stakeholders; captains, customers, everyone. We are trying to build something that even some governments struggle to do; a public transportation system.

It’s one of the most difficult things for countries to build a public transportation system in emerging markets and we are some 24-year-olds trying to take on this challenge so yeah it’s scary. Normally public transportation is a loss making machine in these countries as it requires huge infrastructure. What we are trying to achieve is a sweet spot between quality and pricing.

‘‘I think the biggest risk was to shift from being Petroleum Engineer to doing something else. It was not easy to study something and then end up doing a completely different thing. Also, your parents could never really understand what you’re doing. When I called my mom to tell her how I made it to Forbes after Careem’s investment. She was like ‘good for you’

For every startup, he advises:

Don’t over-engineer everything, just get it done. You’ll figure it out on the way.

2) Take risks because what you’re already doing is a risk in its own. You probably left a job to start a business so you’re already taking it. Make sure you keep doing it onwards a well.

3) Learn more by learning faster. If you do 9 experiments a week vs your competition doing 10 experiments then your competition ends up learning 52 times more over a year.

Gregory Rockson — mPharma, (Ghanaian Startup)

Gregory Rockson is the Co-founder and CEO of mPharma, a drug benefits startup in Africa. He holds a Bachelor’s Degree in Political Science from Westminster College.

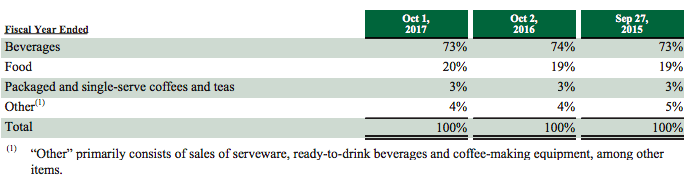

mPharma works with drug manufacturers, service providers, and third-party payers to develop products and services that improve the access and affordability of high-quality drugs for patients across the continent. He shares his experience as a startup:

‘‘It was an early morning in downtown San Francisco a few months ago and I was sitting in a Starbucks, thinking about what next to do with my life. After two successful interviews with Google, I had a good feeling that I would receive a job offer, but something just did not sit right with me. Around 9am, I received an email from a friend which had a link to an investigative article titled “Dirty Medicine” on CNNMoney. It tackled the issue of criminal fraud in Ranbaxy Laboratories, an Indian multinational pharmaceutical company. This article marked my return to Africa and my quest to use big data to help African governments develop better drug surveillance and monitoring systems.’’

At that moment, all I could think about were the 84 children who died in Nigeria in 2008 after consuming adulterated baby teething mixture and the many other families who have lost a loved one due to substandard/fake drugs. I was frustrated by the silence on the part of drug regulators in Africa.

I moved from asking myself why to thinking how. How do we develop technology solutions to address the challenges with pharmacovigilance in Africa?

Grant Brooke — co-founder, Twiga Foods (Kenyan Startup)

Three years ago, on the stage of an international pitch competition, I stood in front of judges and a thousand entrants with a single PowerPoint slide of a banana, which simply stated: “This is a Banana”. Its simplicity got a big laugh.

When in the African e-commerce space players were aiming for tens of thousands of stock-keeping units (SKUs), our banana revenue alone made us one of the largest tech commerce players in Kenya. While we are doing more than bananas now, it is worth keeping in mind that the average Kenyan household buys about 50 different consumer products a month.

To build a unicorn startup in Africa — a relatively small consumer economy — you had better be in a segment with a lot of spending.

Say no: We are good at saying no as an organisation. Lots of people want to partner with us, use us to distribute their products, to build things on our platform, to photo op with us, and so on. We are not easily distracted from our core objective of ‘selling bananas’. I was once given the academic advice: “Early in your career, say something specific about something specific, and once you do that, you can say it all.” The same holds for business: do something specific about something specific, and a few years down the line you can do it all.

Founded in 2014, Twiga Foods is a business to the business food distribution startup that builds fair and reliable markets for agricultural producers and retailers through transparency, efficiency, and technology. The startup is one of the best-funded on the continent,

Deji Oduntan, former CEO Gokada, (Nigerian Startup)

Build a Base then Tell Your Story

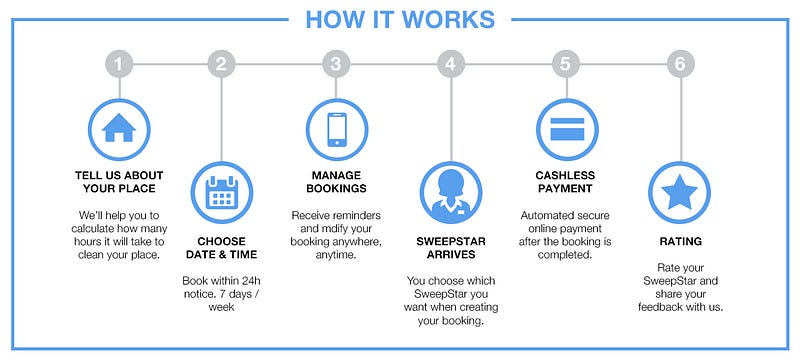

There’s a phrase that goes, ‘Build it and they will come’. I’m here to tell you it’s a lie! Build customer confidence and loyalty in your product(s)/service and once you do, tell your story with pride. Gokada had a strong organic social media following of tens of thousands before we began any serious PR work. The story is sweeter when the customer base is already in existence and it’s this customer-centricity that has sprouted significant investor interest in the industry and Gokada specifically, as news of this recent funding round indicates.

Be Laser Focused

Prior to Gokada, I led Customer Experience efforts at Jumia, where I imbibed a very important lesson: Know your target market and be laser focused. No service can work for the entire market, or indeed Nigerians, as we are a diverse people. Thus, identify a target customer segment and accelerate to product-market fit in the shortest possible time. To do this requires a lot of qualitative research and hypothesis testing. Don’t be afraid to spend time and resources into gathering insights quickly and effectively. It could be make or break.

Bank on Trust

Behavioral change was critical to the branding efforts I drove at Gokada. How do you take a nascent and almost non existent industry and turn it into an industry with promise of a sustainable future in Nigeria? I led with trust, by using operational excellence and social media to position Gokada as a brand worth trusting. We dispelled a lot of mistrust in the market about motorcycle taxis by promoting safety, cleanliness (we introduced disposable hair nets to the sector after recognizing the concerns and superstitions people had about sharing helmets) and verified drivers. This trust system was central to Gokada’s success over the past 14 months.

Nigerian Lagos-based on-demand motorcycle taxi app Gokada has proven to be up to the game. The startup has raised US$5.3 million in Series A funding with a plan to expand the number of its motorbikes and available drivers, increase its daily ride numbers as well as grow the startup ‘s team.

Onyeka Akumah — Founder, Farmcrowdy, Nigeria

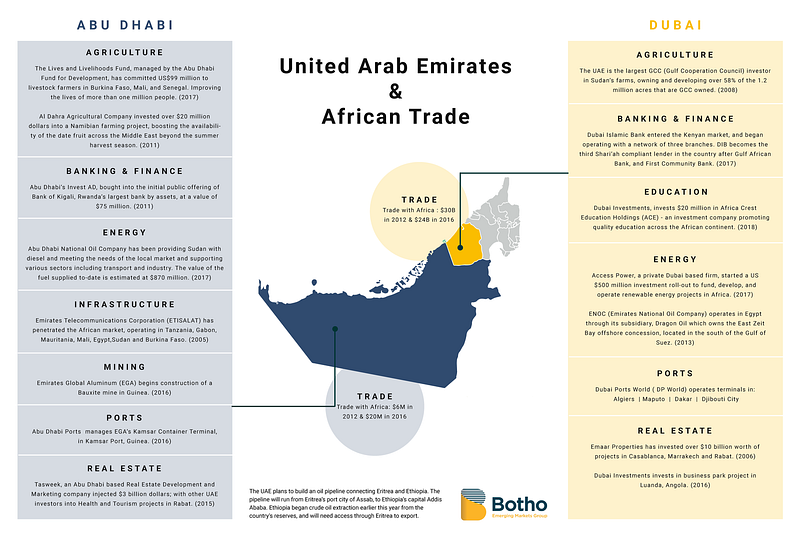

In 2015, I was looking at investing in Agriculture. I wanted to work with a farmer and trying to decide which farmer to work with, which one I would be able to invest in and he would get the work done so I can get the return on investment after the harvest. I got in touch with one of my co-founders (Ifeanyi Anazodo) and asked if he could help me identify someone to work with. We met a lot of farmers. While they were talking, I noticed that they had certain challenges they were facing — access to funding, technical know-how to improve their yields, and market access to sell whatever it is they produce. That became for me an opportunity to see how I could connect these farmers with so many other people interested in investing in agriculture beyond me, that were constantly told by this (Nigerian) administration to invest in agriculture.

He advises every startup to shun these common mistakes:

One mistake was that we raised money and felt like we could change the model immediately. It’s a mistake that many people make when they raise money or have a bit of breakthrough. It’s advisable to create your niche and stay on it. And even if you raise money, just amplify the efforts of what it is you’re doing.

One of the things that happened with Farmcrowdy is, even when we raised money, the 5 farms we started with remain the 5 farms we run till today. Although we are in a better position to scale our operations into other things and add new farms. Don’t change your model, especially if what you’re doing is working. You can add one or two things, but it’s important that you maintain what you’re doing that is working.

The second thing is, as much as I had brilliant people working with me, I was the only founder. I didn’t have people to bounce ideas off, rather I had people I only dished out instructions to execute what I had spent my time working on. Do not travel alone, that’s something I would tell everyone. You need people with complementary skill sets.

Three is when you raise money, you have to raise more. Even if you don’t have an active window for investors to come in, you need to be providing updates to potential investors that want to come in. So, it’s not when you want to raise money that you start having conversations. Let people already know your business before you have those conversations.

The other thing is, I promised myself that whatever I do again, it must be something that is making money from the onset. I’m not going to wait 3 years before I look at how to make money with any business. It must be something that I can see the margins already. It doesn’t have to make us profitable from day one, but at least I know that if we are able to get to a certain level in our operations, we will break even.

Save up as much as you can and network like your life depends on it. Tap into your network and finally, go to as many workshops as you can to brush up on your business knowledge. Always remember why you started when things get tough.

Jacqueline Shaw, Founder African Fashion Guide, Ghana

You are defined by the actions you take not the dreams you make. Because your actions are the antidote to fear, just feel the fear and do it anyway, be extraordinary in your thinking and your actions to stay relevant and to stand out in the crowd. As entrepreneurs we define the game we want to win, we are only limited by our imagination, so think bigger, and then think bigger than that.

Finally, as Nelson Mandela said, there is no passion to be found playing small, in settling for a life that is less than the one you are capable of living. Because when you are uber passionate about your WHY then your goals become non-negotiable.

Jason Njoku, Founder Iroko Tv, Nigeria

In mid 2015 I had a problem. We were months away from running out of money and needed to do something. There was no commercial solution. We needed to invent our way out of this. We had an Android app that sucked and needed to reallocate capital to product and engineering in NY in order to try and invent the future. We had just launched the channels with StarTimes and they were totally pissed at us for under performing and being a dysfunctional organisation. The deal was at real risk. Our foray into linear TV was turning into a total nightmare. Terrible start. I was living in NY, trying to lead the efforts to build our Android app.

For someone untuned to the sometime chaos of creation, IROKO was a mess. To make matters worse, I wasn’t even in Lagos. I was causing all this havoc from NY. I would drop in unannounced for a few days and retrench entire divisions. Rumours of a coup d’etat were reaching me from Lagos.

This was right in the middle of the due diligence for the $19m content and capital fund raise that closed a few months later. If I was a seasoned executive with experience, I probably would have found a way to not give people the impending sense of gloom and implosion over at IROKO, whilst negotiating the biggest deal of my life. Alas, I am not sophisticated like that. I am a simple man. I needed to reallocate capital.

But hey. It could also fail. Woefully. Nonetheless. It’s all about that deep experimentation nature and being comfortable with the 90% failure rates. But what I know now is if that were to happen, we at IROKO would fully embrace it. Accept our role in it. Do a full autopsy and then institutionalise it.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.