Kenyan Capital Markets Authority Rolls Out New Rules To Allow SMEs Go On IPO

Kenya’s financial markets regulator, the Capital Markets Authority (CMA), has announced the development of new guidelines aimed at increasing listings on the Nairobi Securities Exchange (NSE), particularly by small and medium-sized enterprises (SMEs), as the bourse enters its sixth year without an IPO (IPO).

The draft Regulations are a review of the Capital Markets (Securities) (Public Offers, Listing and Disclosures) Regulations (POLD), 2001, and attempt to address new concerns and market dynamics in order to better serve issuers and investors. Additionally, they attempt to facilitate Small and Medium-Sized Enterprises’ (SME) access to capital markets for the purpose of raising both equity and loan financing.

Read also Central Bank of Kenya Orders Banks to Ration Dollar Currency

Mr. Wyckliffe Shamiah, Chief Executive Officer of the CMA, stated that “the review of the POLD Regulations is consistent with the third Medium Term Plan (2018–2023) of the Vision 2030 Economic Blueprint by creating a conducive legal framework to support capital market financing of flagship projects.” Additionally, the Capital Market Master Plan (2014–2023) recommended that legislation be reviewed to streamline listing requirements and promote capital raising and listing on the NSE”.

Mr. Shamiah explained that the assessment is a critical first step toward aligning the legal framework with market realities, including technological advancements that have altered the way markets operate, including capital raising business models. Additionally, it tackles approval turnaround times, shelf registration, and security valuation, as well as other shortcomings in the present POLD Regulations.

“The draft Capital Markets (Public Offers and Listing of Securities) Regulations, 2022 (the draft Regulations) establish guiding principles for the establishment of fair, efficient, and transparent capital markets by encouraging and promoting timely and accurate disclosure of information to investors,” the CMA Chief Executive Officer stated. Additionally, they include provisions for investor protection and increased investor confidence in financial markets, among other guiding concepts”.

Read also Applications Open for 2022 Africa’s Business Heroes Prize Competition

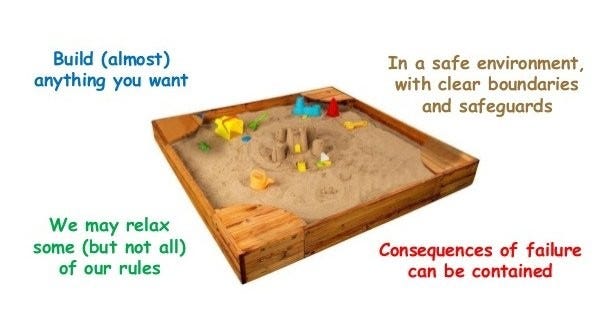

Additionally, the proposed Regulations created two new market segments: the SME Fixed Income Securities Market Segment (SME FISMS) and the Small and Medium Enterprises Market Segment (SMEMS). SME FISMS is a market sector for debt securities having an initial offer size of less than Ksh250 million or a CMA-defined value. The SMEMS is a market segment dedicated to the listing of SMES’s non-debt securities.

Additionally, Special Purpose Acquisition Vehicles (SPACS) were introduced. SPACs are issuers formed for the purpose of raising capital via an initial public offering by acquiring another business, which becomes the resulting issuer. The resulting issuer should have a distinct core business and provide shareholders with adequate returns on equity capital utilized.

Electronic offers of securities have been developed in recognition of technological improvements, taking into account the usage of the internet or other electronic/automated means. This is applicable to offers in which investors subscribe electronically or in which applications and allotments are processed and finalized electronically.

To further protect investors, the proposed Regulations apply to all offerings of securities to the public in Kenya, regardless of whether the issuer seeks listing on any Kenyan securities market. Additionally, they regulate the public offering of securities and private placements of securities, as well as the eligibility conditions for securities issuance.

Read also DPO Group Enables USSD Payment Option in Nigeria

Even if an issuer does not seek to list their securities on a securities exchange, they must nevertheless meet the eligibility criteria and adhere to the disclosure requirements. A private offer’s issuer shall not make any public advertisement or use any media or agents to tell the general public about the offer.

Restricted public offers, defined as those restricted to sophisticated investors or those communicated directly to no more than 250 explicitly selected persons in conformity with the Capital Markets Act, were also introduced. Additionally, the green shoe option and shelf prospectus have been included to accommodate an issuer’s reserved right to allot up to a defined number of securities in excess of the quantity stated for a particular offer. Shelf prospectuses are intended for distribution in the event of a restricted offering of securities.

Access the draft regulations here: https://bit.ly/3OTCq5H #capitalmarkets

Kenya SMEs capital markets Kenya SMEs capital markets

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh