Central Bank Of Nigeria Closes Crypto Bank Accounts. What Does This Mean For Nigerian Crypto Startups?

By the stroke of a regulatory pen, Central Bank of Nigeria, the country’s apex bank, has swept away all investments made in cyptocurrency startups in the west African country. This is coming exactly a year after the country’s Lagos state government had declared a complete ban on ride-hailing services on its major highways. It is also coming barely four months after the country’s Securities and Exchange Commission, in charge of regulating investments and securities, had issued a statement, demanding that all traders in crypto assets must register with the commission. In CBN’s latest move, by a way of a letter signed by Bello Hassan Director of Banking Supervision and Musa I. Jimoh Director of Payment Systems Management Department, all commercial banks and financial institutions in the country have been ordered to close down all bank accounts associated with cryptocurrencies.

“Further to earlier regulatory directives on the subject, the Bank hereby wishes to remind entities that transacting or trading in crypto currencies or facilitating payments for cryptocurrency exchanges is prohibited,” CBN stated in the letter.

“Accordingly, all DMBs, NBFIs and OFIs are directed to identify persons and/or entities transacting in or operating crypto currency exchanges within their systems and ensure that such accounts are closed immediately.

Please note that breaches of this directive will attract severe regulatory sanctions.

This letter is with immediate effect,” the bank further added.

The End Of The Road For Cryptocurrency Startups In Nigeria?

The Nigerian cryptocurrency startup ecosystem is booming, but the worst hit by the new directive from CBN will be local cryptocurrency exchanges many of which have recently become emboldened by the recent statement from the Securities and Exchange Commission which latched some forms of order and legitimacy onto their operations. Apart from returning them to the old ways, the ban is a big dent on investments already made into the startups by investors (most of whom are foreigners). In 2020 alone, investments amounting to over $20m were poured into three Nigerian crypto-based startups— Yellow Card, Bitfxt, and Xend Finance — two of which are cryptocurrency exchanges.

Although Nigeria has been subtly regulating the country’s cryptocurrency market, this is one regulation that has hit home the hardest. The last directive from the central bank was in 2017 when it directed all Nigerian commercial banks and financial institutions never to act as cryptocurrency trading exchange. That directive, however, permitted them to host cryptocurrency trading exchanges run by companies or individuals in Nigeria as long as those exchanges or individuals complied with all rules relating to anti-money laundering and terrorism. (Worthy of note is that under both the 2017 and 2021 regulatory directives, Nigerian commercial banks were given far-reaching powers to decide who operated a cryptocurrency account or not.)

CBN’s latest move follows the most recent warning by South Africa’s Financial Sector Conduct Authority (FSCA) against the growing cryptocurrency scams in the country. The scams relate to one of the biggest Ponzi schemes pulled out by Mirror Trading International, a South African Bitcoin trading company. The company had promised investors a 10 percent monthly return on their investments in Bitcoin. However, on 22 December, 2020 in a letter posted on Telegram, the management of the company reported that they were deceived and that Chief Executive Officer Johann Steynberg of the company might have fled to Brazil. Around 28,000 local and global investors were consequently defrauded to the tune of $644 million.

Cameroon earlier this week also published its first national risk assessment (ENR) of money laundering and terrorist financing with support from the World Bank. The report indicated that over $290m cryptocurrency-linked transactions were made by ‘terrorists’ in 2018 alone.

“While certainty on the state of play of cryptocurrency activity — especially as it relates to the number of players and volume of transactions — in Cameroon is still very much limited in the absence of exhaustive report,” the report revealed, “intelligence reports on secessionist armed groups in English-speaking regions whose bank accounts had been blocked following the initiation of legal proceedings against them for financing terrorism, show that the armed bands are now using “ambacoin” cryptocurrency network to support themselves.”

“It is also not excluded that this funding tool is also used by other criminal organizations such as Boko Haram,” the report further added.

Given that Nigeria has yet to report any substantial scams involving cryptocurrencies, there are already insinuations in some quarters that the move by the central bank may not be unconnected with the recent #EndSars protests mainly waged by young people. At the peak of the protest, CEO and founder of the social media platform Twitter, Jack Dorsey, had called on his 4.7 million followers to donate Bitcoin in support, after the Nigerian government had blocked the accounts of crowdfunding platforms set up in support of the protests. By the time the protests ended, Bitcoin already constituted about 40% of the nearly US$400k raised.

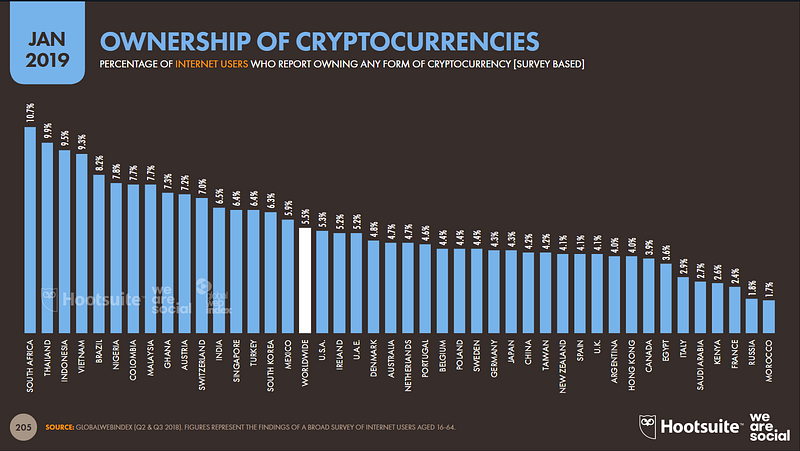

The market for cryptocurrencies in Nigeria is big. According to a recent report by Paxful, a leading peer-to-peer bitcoin marketplace, Nigeria traded 60, 215 bitcoins in the last five years (2015–2016), valued at more than US$566m, making the country the second largest bitcoin market worldwide after the United States. Trade in bitcoin also surged the highest — volume (20,504.50) — in 2020, by Coin Dance’s report.

Read also: Nigerian Cryptocurrency Startup Yellow Card Secures $1.5 million In Seed Funding Round

Moving On

The days ahead would be tough for crypto startups in Nigeria who may be torn between staying back in Nigeria and going underground to the black market, or moving to other countries while targeting the Nigerian market. Paxful had stated that Ghana, Kenya, and South Africa remain its main markets in Africa apart from Nigeria. The report from Cameroon also showed that up to 31,000 units of cryptocurrency were purchased in that country by the end of September, 2018. The Financial Services Commission (FSC) of Mauritius has equally, recently, released a regulation making cryptocurrency trading exchanges now eligible for licenses. The FSC had released a 15 — page document outlining the new standards. This was the first time the government of Mauritius would be attaching legitimacy to the securities systems trading on tokens, although from the looks of the new licensing regime, the government appears not to be interested in fully regulating the market — although they still retain the power to revoke licenses and investigate fraudulent practices.

In the meantime, some facts are certain to happen: the act of trading cryptocurrencies in Nigeria will return to its black market days and a lot of staff working for the affected crypto startups may have to be retrenched. The lives of crypto trading exchanges are also hanging on the cliff: they may either opt to file for liquidation in Nigeria or explore other alternative markets. Bitfxt had already announced it is moving to Dubai, in the United Arab Emirates, which had recently passed progressive policies allowing foreigners to set up and own more than 51% of shares in companies without local sponsors —as well as shortened paths to citizenship for foreign skilled workers.

But first, the startups would have to spend some time moving their money resident in crypto-linked accounts in Nigerian banks to other destinations. That, too, would be an adventurous journey.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer

crypto startups Nigeria central bank crypto startups Nigeria central bank crypto startups Nigeria central bank crypto startups Nigeria bank