Section 12J Is Inspiring New Funds To Launch For Startups In South Africa

When Aurik Capital, an investment company in South Africa, launched its $6.6 million investment fund for startups in the country in 2019, it knew who it was targeting. It was not targeting oversea investors on whom so much resources would have to be spent in convincing to come invest in South Africa. It was targeting South Africans who wanted to run away from the country’s heavy income tax regime. A regime so heavy that for every 1 million rand ($55k) South Africans earn, they must pay over 400,000 rand ($22k) to the South African Revenue Service (SARS), the national tax collector. As a venture capital company registered under Section 12J of the country’s Income Tax Act of 2009, Aurik would offer one best way of avoiding the payment of the humongous amount. And it works like this: if a South African chooses to invest 1 million rand into Aurik, they will pay no tax. The system has been so successful that as at 2019, over 165 of such Section 12J funds had been registered. The assets under the funds’ management had also risen from R3.2 billion ($213m) to more than R6.7 billion ($448m), in 2019 alone. The unexpected increase had been attributed to more businesses and banks in wealth management advising their customers to make use of the scheme.

But then, there is a big decision South Africans investing through Section 12J would have to make: the venture capital companies would, in turn, invest their funds into startups or other permitted ventures (which are usually highly risky and long-term projects). They would also have to wait for at least 5 years to get back (if at all) their earnings, alongside the accumulated profit, if any.

Simplifying Section 12J, In Full

In simple terms, Section 12J of South Africa’s Income Tax Act of 2009, allows investors who make investments in approved Venture Capital Companies (VCC) — that then invest in qualifying small companies — a tax deduction.

Thus, by investing in a Section 12J venture capital company, the investor not only qualifies for a full deduction of the total investment amount from their taxable income in the relevant tax year, but they are also indirectly supporting the South African economy and the growth of local SMEs. Section 12J is similar to Venture Capital Trusts (VCT) in the United Kingdom, which allow individuals with high net worth to save tax and instead invest in a VCT, which will then invest in startups.

Read also:South African Government Fights MTN Over Court Application on 5G Spectrum Auction

By operation, Section 12J follows this path:

- A South African tax-paying entity approaches a VCC with its investment.

- The VCC accepts the investment for investments in its portfolio companies and issues the investor with a certificate for the amount invested.

- With this certificate, the investor approaches the South African Revenue Service (SARS) and presents the certificate. The certificate empowers the investor to deduct the full value of the investment from their taxable income in that tax year.

- Section 12J is so attractive to investors that using it investors can offset any tax on capital gains incurred from the proceeds from the sale of an asset. What this implies is that if in the current tax year a South African taxpayer has a capital gains tax case, the taxpayer will use a portion of his/her income to make an investment in a Section 12J business and write off a portion or all of the tax on capital gains owed.

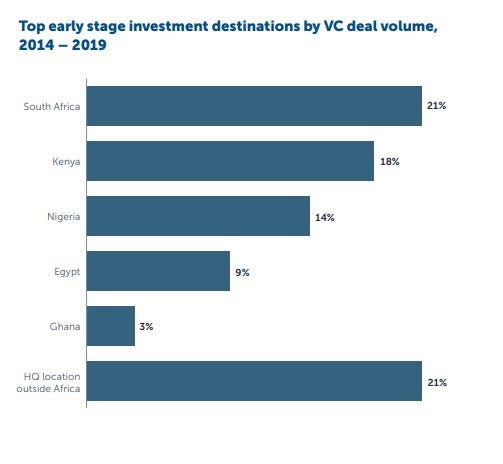

This explains why there are, today, many VC firms in South Africa and why South Africa collected more than 21% of all VC funding deals in Africa between 2014 and 2019, whereas Nigeria only received 14% of the deals, even though Nigeria is the continent’s largest economy and has more than 3 times South Africa’s population.

Read also: What Laws Support Early Stage Startups In Nigeria?

Kalon Venture Partners And E4E Africa Launch New Funds Under Section 12J

Two South African venture capital funds who have announced newest funds under Section 12J are Kalon Venture Partners, a venture capital company based in Gauteng as well as the newly launched Cape Town and Johannesburg-based E4E Africa.

Kalon Venture Partners’ fund targets innovative digital technology companies/startups, and has previously invested in startups such as Yoco, Sendmarc, Ozow, FinChatBot, Mobiz, Flow and Carscan.

In July last year, Entrepreneurs For Entrepreneurs Africa (E4E Africa), got backed by the South African SME Fund, in a founding investment of R135 million ($8.2m). The VC aims to support business models that bring innovative, agile solutions to critical sectors of the South African economy, including the fintech sector, healthcare and the sustainable agriculture value chain, as well as those with the capacity to scale inside and outside of South Africa. It has also invested in the startup Enlabeler.

“It is great to be part of a structure that can really transfer the experience, skills and contacts my colleagues and I have built up over the years to the next generation of entrepreneurs,” said Aisha Pandor, E4E Africa partner, who further noted that she had been constantly approached by early-stage entrepreneurs seeking guidance, fund and general advice.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer

South Africa Section 12J