East Africa is Global Leader of Mobile Money – Report

The East African region has cemented its position in the digital economy as the global leader with the highest penetration rate of mobile money in the world. The region has 1,106 registered mobile money accounts for every 1,000 adults, compared to 600 for the whole of Africa, 533 for Asia and 245 for Latin America and the Caribbean. In East Africa, penetration is higher with most adult subscribers owning one or more mobile money accounts.

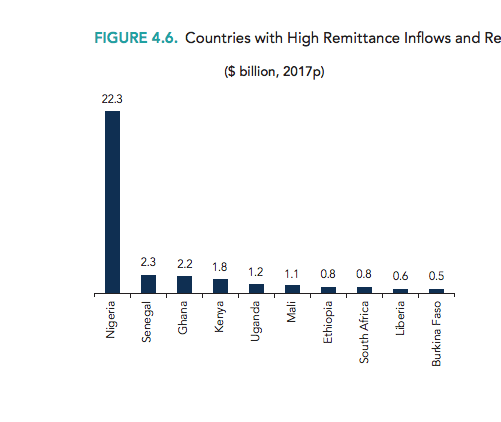

According to data from a 2021 joint report titled: Africa’s Development Dynamics’ authored by the African Union (AU) in collaboration with the Organisation for Economic Cooperation and Development which indicates that East African member states such as Uganda, Kenya, Rwanda and Tanzania lead the world in mobile money transactions, mostly because policy makers and regulators took an earlier risk to invest in innovation, which has made the financial sector more inclusive. Other countries in the region, including Comoros, Ethiopia, Mauritius, Seychelles, Somalia and South Sudan, have also launched or are in the process of launching mobile money services.

Read also:Lagos to Host Global Technology Leaders on Digital Economy

Mobile money penetration has also been a key enabler and driver of digital innovation and adoption, leading to a boost in productivity in key sectors as well as creating jobs in the digital economy with financial technology (Fintech) startups in the region operating in a wide range of domains such as education, healthcare, consumer services and agriculture.

Fintechs have developed applications that help address rural urban supply chains and market linkages through electronic retail payment systems thus reducing fraud and enabling e-commerce growth. In Kenya alone, the spread of mobile money services has helped raise at least 194,000 households out of extreme poverty and has also enabled 185,000 women to switch from subsistence agriculture to small businesses or retail as their main occupations.

Read also:Morocco, Senegal to Increase Cooperation in Business, Research

The report also notes that whereas East African governments can facilitate and regulate cross border payments, especially for mobile money accounts, currently, no interoperable mobile payment system covers the region, and the cost of creating one remains high.

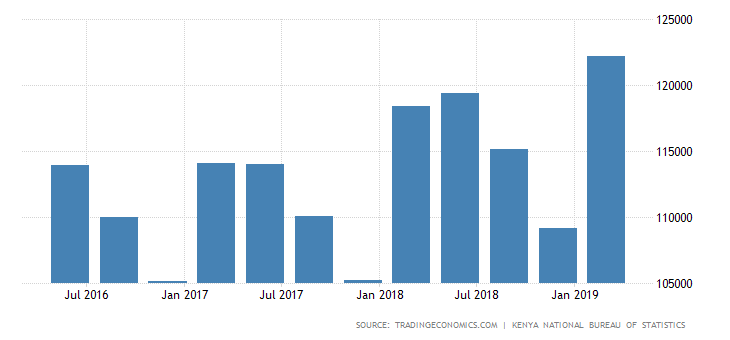

In Uganda, according to data from Bank of Uganda, the value of mobile money transactions grew to an all-time high in December, capping the year at 28.2 per cent in 2020 compared to 2019.The number of mobile money transactions, the report noted, grew by 25 per cent during the same period. The Central Bank noted mobile money transactions grew to 3.5 billion in 2020 compared to 2.8 billion in 2019. Value of transactions rose to Sh93.7 trillion in 2020 compared to Shs73 trillion in 2019.

Read also:FairMoney, Nigerian-Based fintech Expands Operations to India

In Uganda, 2020 saw transactions grow to double digits month-on-month having recorded Shs10.3 trillion in value of transactions in December. Deposits and withdrawals equally grew to Shs2.5 trillion month-on-month from an average of Shs1.5 trillion in 2019. The growth could be partly explained by the increase in subscriber numbers, which during December 2020, grew from 23.5 million to 30.5 million subscribers.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry