Tracking Layoffs And Shutdowns: Is Kenya The New Hotbed Of Failed Startups In Africa?

The nascent startup ecosystem in Kenya is embattled. In a space of four months before October this year, about six funded startups have, in full or in part, bitten the dust, vanishing as though they never existed. In late June this year, Kune Foods with headquarters of operations in Nairobi, announced bitterly that after close to a year in operation and failing to secure new investors’ funding, it had chosen the difficult path of infamy — that of liquidation. Founder and Frenchman Robin Reecht called this a failed vision, “for which I will never forgive myself.”

But it was as though Kune Foods was only starting a series of what would later zigzag into uncertainty and assume a new normal. A few months after it shut down, other fellow country startups such as Notify Logistics, WeFarm, BRCK, Sendy and Sky-Garden felt empowered to piggyback on the legacy left behind by Kune, including reinstating that Kune Foods’ famous mantra “current economic downturn and investment markets tightening up”.

Read also Here’s How Kenyan EV Startup BasiGo Plans To Finance Lease Of Its Electric Buses

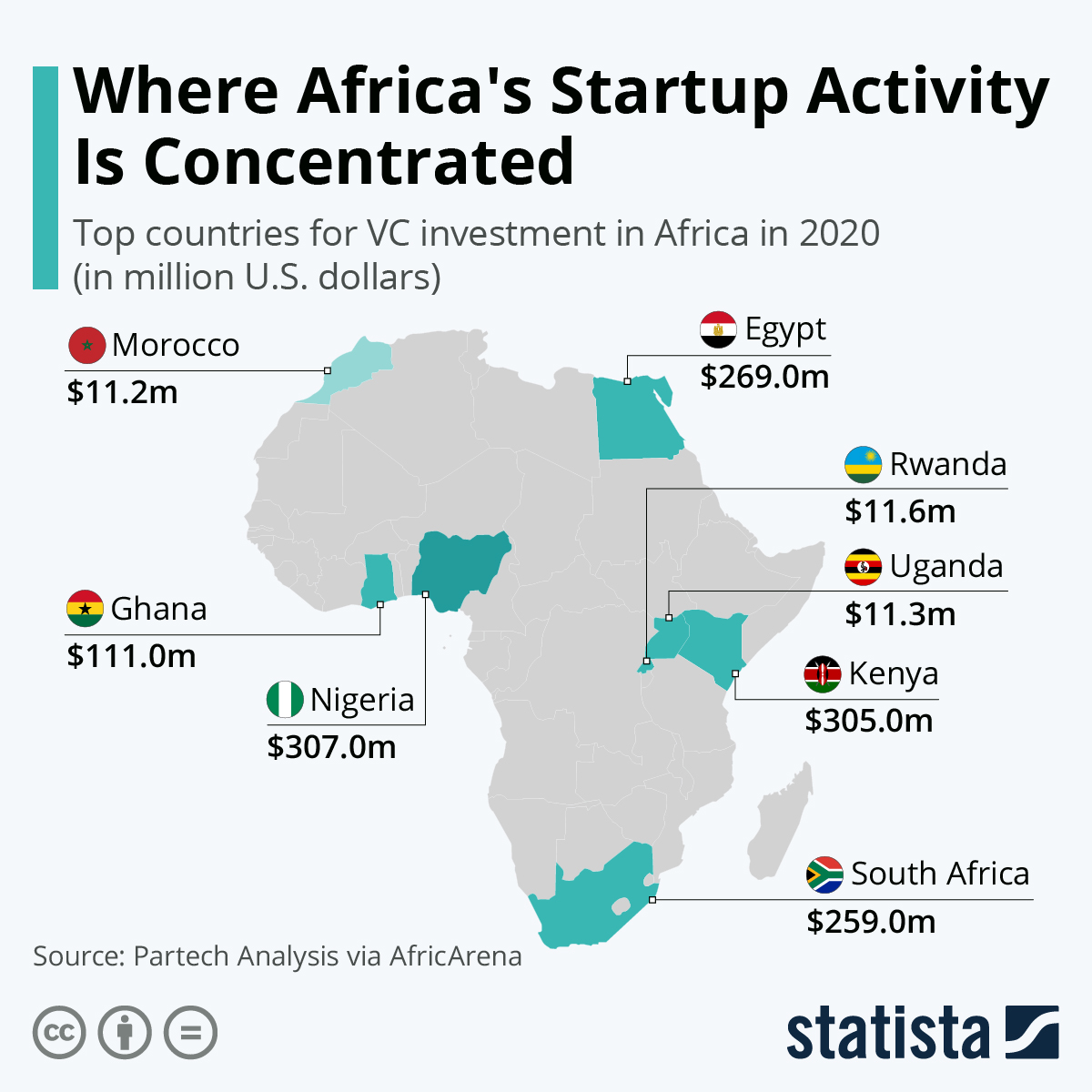

Below is a comparative analysis of shutdowns or downsizing across 4 key African startup markets (Nigeria, South Africa, Kenya, Egypt) between January 2022 to October 2022.

Nigeria

| S/N | Name of Startup | Nature of Affected Operations | Founders And Their Nationality | Total Funding Amount Raised | Reasons for shutdown |

|---|---|---|---|---|---|

| 1 | Kloud Commerce | Total Shutdown | Olumide Olusanya (Nigeria) | $765K | Mismanagement and misuse of funds. |

| 2 | Kuda | Staff Downsizing | Babs Ogundeyi and Musty Mustapha (Nigeria) | $91.6M | Cost reduction |

| 3 | 54gene | Staff Downsizing (including exit of both co-founders who double as CEO and VP, Engineering respectively) | Dr. Abasi Ene-Obong and Ogochukwu Osifo (Nigeria) | $94.7M | Cost reduction |

| 4 | Alerzo | Staff downsizing | Adewale Opaleye (Nigeria) | $16M | Cost reduction |

| 5 | Edukoya | Staff downsizing | Honey Ogundeyi (Nigeria) | $3.5M | Proposed pivot |

Kenya

| S/N | Name of Startup | Nature of Affected Operations | Founders And Their Nationality | Total Funding Amount Raised | Reasons for shutdown |

|---|---|---|---|---|---|

| 1 | Kune Foods | Total shutdown | Robin Reecht (French) | $1M | Failure to raise funding; high operational costs. |

| 2 | Notify Logistics | Total shutdown | Waweru Nderitu and Hellen Waweru (Kenyans) | $370.7K | Inability to break even due to high operational costs |

| 3 | WeFarm Shop | Total shutdown | Kenny Ewan and Claire Rhodes (UK) | $1.6M | Inability to scale |

| 4 | BRCK | Total shutdown | Erik Hersman, Jon Shuler, Philip Walton, Reg Orton (US) | $4.2M | No reasons adduced but COVID-19 largely blamed. |

| 5 | Sky-Garden | Total shutdown | Martin Majlund (Denmark) | $6.1M | Ran out of cash. |

| 6 | Sendy | Staff downsizing | Evanson Biwott and Don Okoth (Kenya) and Malaika Judd. T (US) | $26.5M | Economic difficulties. |

| 7 | MarketForce | Staff downsizing | Tesh Mbaabu and Mesongo Sibuti (Kenya) | $42.9M | Redundancy. |

South Africa

| S/N | Name of Startup | Nature of Affected Operations | Founders And Their Nationality | Total Funding Amount Raised | Reasons for shutdown |

|---|---|---|---|---|---|

| 1 | Snapt | Total shutdown | Dave Blakey (South Africa) | $7.7M | Difficulty raising funds. |

| 2 | NextNow | Total Shutdown | Lindelwa Ntombela (South Africa) | Undisclosed | Stiff competition led by industry leaders Uber and Bolt adduced as reasons. |

Egypt

| S/N | Name of Startup | Nature of Affected Operations | Founders And Their Nationality | Total Funding Amount Raised | Reasons for shutdown |

|---|---|---|---|---|---|

| 1 | Capiter | Total shutdown | Mahmoud Nouh and Ahmed Nouh (Egypt) | $33M | Economic difficulties. Dispute between board and founders. |

| 2 | Vezeeta | Staff downsizing | Amir Barsoum, Ahmed Badr (Egypt) | ≈$90M | No reasons adduced. |

| 3 | SWVL | Staff downsizing | Mostafa Kandil, Mahmoud Nouh and Ahmed Sabbah (Egypt) | $264M | To focus on its highest profitability operations, enhance efficiency and reduce central costs |

| 4 | Elmenus | Staff downsizing | Amir Allam (Egypt) | $19.6M | Cost reduction |

| 5 | Trella | Staff downsizing | Omar Hagrass (Egypt) | $41.7M | Cost reduction |

| 6 | ExpandCart | Staff downsizing | Amr Shawqy and Sameh Nabil (Egypt) | $5.4M | Cost reduction |

| 7 | Brimore | Staff downsizing | Mohamed Abdulaziz and Ahmed Sheikha (Egypt) | $56.5M | Cost reduction and boost profit. |

High Operational Costs Mostly Responsible For Woes Of Embattled Startups

While it may appear that startups in Africa are raking in money by way of investment, the money seems to be disappearing almost as rapidly as it comes in. Consider the case of Kune Foods which raised $1M in venture capital only to close one year after. Although Kune Foods’ CEO Robbin Reecht partly blamed tough funding market, coupled with rising food costs which deteriorated the startup’s margins especially as it strove to keep its food prices low, the heavy investment the startup made in research and development was largely responsible for its demise.

Read also Francophone African Based Startups Urged to Apply for Equity Funding from Digital Africa

This is the same story for the Nasdaq-listed Egyptian mobility tech firm SWVL, which in May year this announced it had laid off 32% of its entire workforce. Although the company stated that the downsizing was made so the company could be cash-flow positive in 2023, it is common knowledge that the transport company has been hemorrhaging cash in recent times.

“We believe this is a Crucible Moment,” advises Sequoia Capital, the iconic venture firm known for early bets on Google, Apple and WhatsApp, last month in a 52-page presentation titled “Adapting to Endure.” “First and foremost, we must recognize the changing environment and shift our mindset to respond with intention rather than regret.”

“We do not believe that this is going to be another steep correction followed by an equally swift V-shaped recovery like we saw at the outset of the pandemic….Companies who move the quickest have the most runway and are most likely to avoid the death spiral. Look at this as a time of incredible opportunity. You play your cards right and you will come out as a strong entity,” the presentation further reads.

failed startups Africa failed startups Africa failed startups Africa

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh