Bigger Market Share For SWVL In Kenya As It Partners Matatus For Long Distance Trips

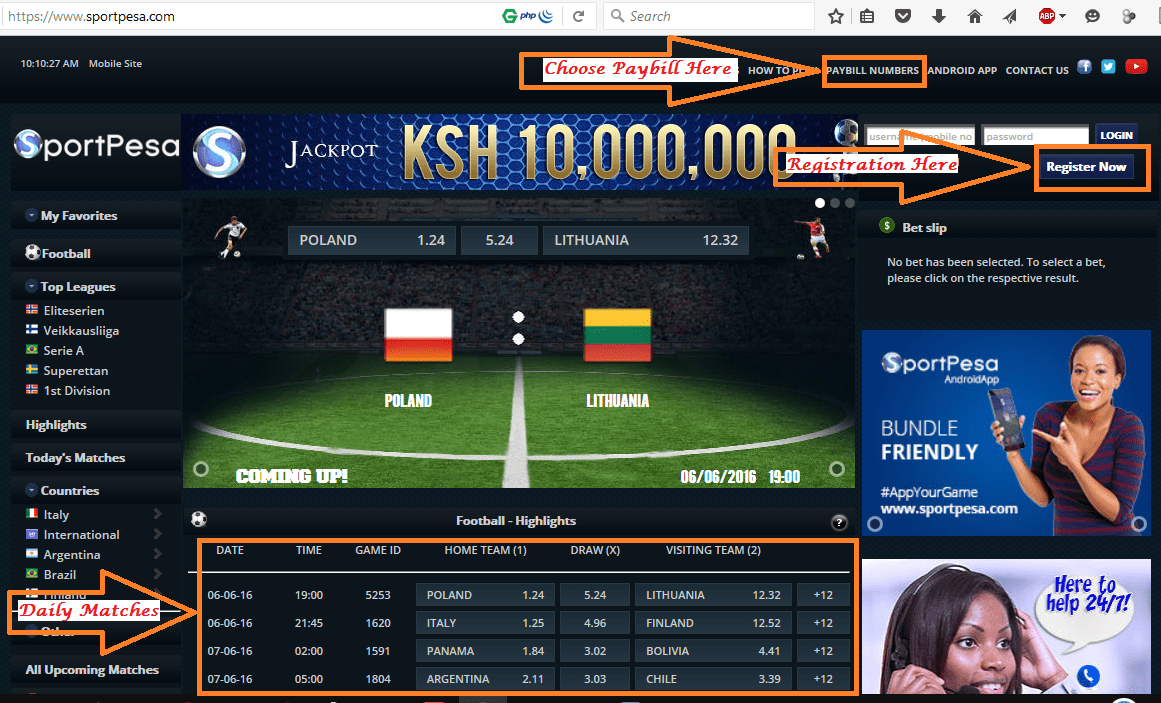

Before now, you would need to hail ride-sharing startup SWVL for trips only within the Nairobi city. Although there was a previous announcement in February this year that the company would be exploring long distance journeys, now, it looks clearer. In a landmark partnership with local matatu cooperatives (saccos), SWVL has made it possible to hail public buses, popularly known as matatus, via the SWVL app for long distance trips say, from Nairobi to Kisumu or from Nakuru or Eldoret to Nairobi.

“We are looking to make it easier for Kenyans to make their journeys upcountry, especially as we approach the festive season next month. This desire is what prompted us to partner with the matatu saccos who already provide this service and help them in streamlining the process of filling up their vehicles by giving them a digital platform,” said Dip Patel, the General Manager for Swvl in Kenya.

Here Is What You Need To Know

- The long distance rides will be available on the SWVL app and can be booked in the same way as regular rides within the city. All you need to do is pick a date and time as well as your location and destination. The app will then proceed to give you options of the available rides and you can choose the nearest and most convenient time for you.

- In the meantime, SWVL customers can travel to a total of twelve upcountry destinations including Naivasha, Nakuru, Molo, Eldoret, Narok, Bomet, Kericho, Kisii, Kisumu, Nyeri, Nanyuki and Machakos.

A Major Win For Matatus Themselves

Perhaps the fear of disruption that came with the arrival of the Egyptian ride-hailing startup, SWVL, in the Kenyan public transport sector has been quelled. Matatus are now part of the grand scheme of things and will, going forward, not only determine the future of SWVL in Kenya, but also its success .

One of the saccos, Metrotrans Sacco — a leading PSV transport Saccos operating in Nairobi — is already leading the new chapter. The union has rolled out 45 additional new buses from Isuzu East Africa with financing from Co-op Bank in form of a lease worth Kes 225 Million. The lease will enable the Sacco to respond to increased demand in their existing routes and to also serve their customers better by offering cashless payments enabled by technology company SWVL that allows users to make and track bookings through the SWVL app.

Read also: Kenya’s Transport Authority Cracks Down On Startup Swvl’s Drivers And Vehicles

Swvl’s Operation In Kenya

Swvl recently invaded its Kenyan market with over Sh1.5 billion ($14.5 million) investment to finance an aggressive route expansion plan in Nairobi.

- Swvl, already operational on multiple Nairobi routes, has set a target to grow its network to 500 routes served by 1,000 buses.

- The app-based public service transport operator which started in Cairo, is seeking to take advantage of Nairobi’s chaotic and largely unreliable public transport system.

“Kenya is a market with a need for a stable solution for the perennial traffic snarl ups and SWVL believes that we can be of great benefit to the local consumer and the transport sector as a whole,” said founder, Mostafa Kandil.

- Before now, the tech company has been leasing its vehicles that currently include 11-seater and 14-seater vans as well as 22-seater shuttles at a daily rate of $70 (Sh7,000) and $150 (Sh15,000) to ply the various routes. The company tops up the daily collection if the earnings for the day are less than the daily leasing amount, but collects any income above the agreed rate.

- The app-based service allows users to book trips using their mobile devices, which notifies them of the nearest pick-up point, price and time by the bus.

- The driver’s contact and registration number of the vehicle as well as live map update appear on the app interface for easy identification once the buses arrive.

- In early October 2019, Kenya’s National Transport and Safety Authority (NTSA), the authority in Kenya in charge of road use and safety asked SWVL and Little Shuttle to cease operations or face arrests for operating under Tour Service License but engaging in commuter services.

- SWVL’s license was restored in May this year.

“We aim to continue our operations and we are very pleased about the consideration of the regulatory framework to incorporate technological developments coming up in the industry,” said SWVL’s General Manager, Dip Patel.

The firm says its popular routes include Ruiru to the CBD/Upper Hill, Karen to CBD/Westlands via Upper Hill, Ongata Rongai to Westlands/CBD via Upper Hill, Ruiru to Westlands, Ndenderu to CBD/ Upper Hill, and Kikuyu to CBD/ Upper Hill.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer