German Bank KfW To Commit $44.7M To Partech Africa New Fund Focused On African Startups

The German Federal Ministry for Economic Cooperation and Development (BMZ) has indicated that the KfW Development Bank will invest up to 45 million euros ($44.7 million) in the Partech Africa fund II, which will finance African startups and small and medium-sized enterprises (SMEs) active in the digital sectors.

“KfW is pleased to serve as the lead investor in the Partech Africa Fund II. We share the aim of assisting innovative entrepreneurs who are driving digital innovation in Africa while also stimulating the growth of the African venture capital ecosystem,” said Stephanie Lindemann-Kohrs, KfW’s Head of Equity Finance.

The bank will join a diverse group of international financial institutions and investors that have already signalled their intention to participate in the second Partech Africa venture capital fund. The International Finance Corporation (IFC), for example, proposes to spend $25 million in it, as does the Dutch Development Finance Bank.

Read also Africa’s Trade Bank Gets Good rating With a “Stable” Outlook

The company hopes to improve its strategy of discovering and promoting technical innovation, as well as the next generation of African market leaders, with this second fund. The vehicle will appeal to technological firms in all stages of development, from seed to growth, with start-up financing ranging from $1 to $15 million. It will follow the same investment approach as Partech Africa I, but will raise twice as much money.

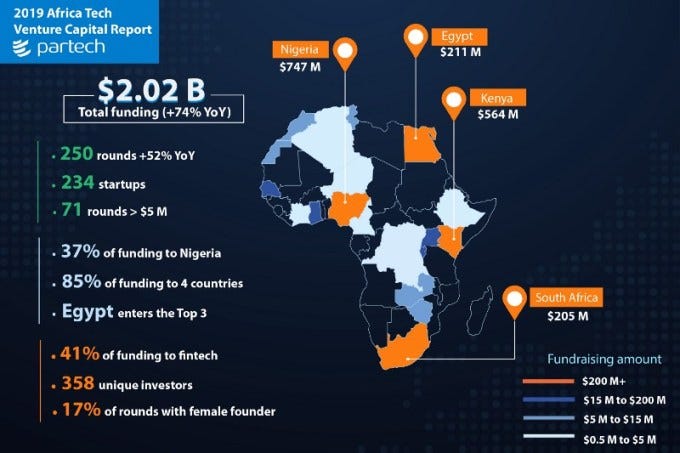

Partech Africa I was launched in early 2018 and concluded a year later, with total commitments of roughly €125 million. It has invested in 16 companies based in nine countries. Meanwhile, the new fund will capitalise on the prospects given by the fast increasing African tech industry in 2021, with a total of $5.2 billion raised by 640 start-ups in 681 rounds, according to the annual report of 2021 from Partech Africa on venture capital investment for African startups.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh