Mobile Money Platforms in Africa Attracts Global Attention.

The fast paced growth of mobile money platforms in Africa is attracting global attention. While the continent lacks the broadband connectivity and internet penetration obtainable in the developed economies of the world, the rapid adoption of mobile phones has drawn the global attention, for example, Africa has 122 million active mobile money accounts which accounts for nearly half of all global mobile money subscribers. While this presents huge economic and social opportunities for growth, it however, is not without its downsides, as the continent is exposed to immense risk. Recent data found that mobile malware attacks in Africa doubled in volume in 2018, targeting the 456 million mobile subscribers across the continent.

To this end, key representatives from over eight countries in Africa gathered at a workshop organized by Vodacom to look into trends and developments shaping the mobile money industry in Africa. Leading telecom company Vodacom also released its Future-Proofing Mobile Financial Services report at the workshop. The report, the first of Vodacom’s Public Policy Series, demonstrates how mobile money is driving economic growth and empowering lives through financial inclusion.

Read also : Kenyan Fintech Startup Asilimia Raises $350k Funding For Expansion

Managing Executive, Legal and regulatory from Vodacom Group, Judith Obholzer, said that Sub- Saharan Africa has witnessed rapid growth in mobile money operations and innovations enabling broad based participation and access to financial services. Sub-Saharan Africa is home to the 10 economies worldwide where more adults now have mobile money accounts than at a financial institution. A game changer in this region, Mobile Money continues to drive economic growth and social benefit by providing access to financial services to the millions of people who have a mobile phone, but do not have or have only limited access to a bank account.

“Our aim is to provide a platform for leading experts to express their views on trends and developments shaping the industry. The industry continues to evolve at a rapid pace with policy makers and regulators playing a central role in facilitating and enabling environment for financial inclusion,” said Ms. Obholzer.

Read also : Africa-focused Fintech Startup OPay Raises $120 Million From Chinese Investors

Representative of the Bank of Tanzania who is Assistant Manager–Oversight and Policy at the National Payment systems Department, Mr. Albert Cesari underscored the important impact Mobile Financial Services have made on the economy and the important role of the workshop in ensuring sustainability of the mobile financial service industry.

“The government is committed to ensure that mobile financial providers continue to be effective players in the future, and that they are able to provide the innovations and investments necessary in the technical and business dynamics in the financial payment market.” Cesari explained.

M-Pesa has been Africa’s most successful mobile money service. Research illustrates that mobile money has significantly contributed to social empowerment, economic growth and poverty reduction. It provides people with a safe, secure and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries and get a short-term loan.

Speaking during the launch of the new research on mobile money, Hisham Hendi, Managing Director, Vodacom Tanzania said “Mobile money – supported by extensive mobile reach – has proven to be a platform for economic opportunity, transforming the financial services landscape, in particular on the African continent.” Mr. Hendi added “I am glad that this report brings together contributions by leading experts that speak to these three broader themes. They are diverse in their views and ambitions, critical and inspiring.”

Read also : South Africa’s Fintech Startup ProfitShare Partners Raises $1.7m Capital From Vumela Fund

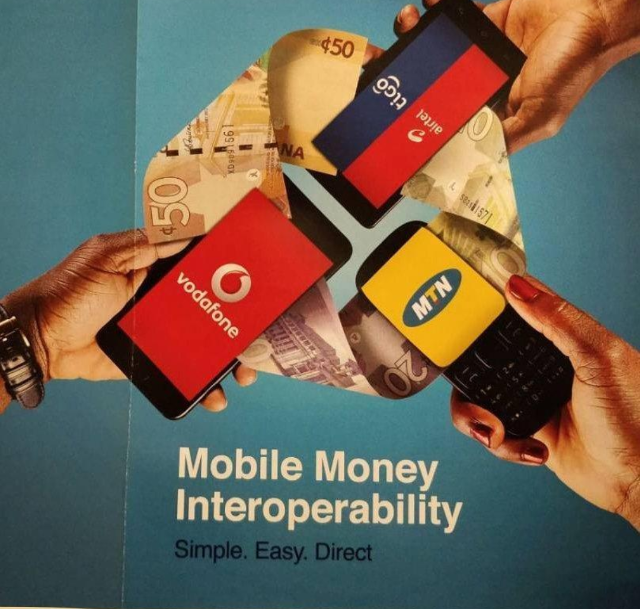

The event brought together representatives from mobile network operators and a cross section of sectors including Telecommunication, financial service providers, banking, CSO and regulators who addressed various topics including: Future-proofing Mobile Financial Services, Enabling Interoperability Frameworks – Payment Systems, Regional Integration and Cross-Border Opportunities, How to solve the legal identity problem, Best Practice Sharing and The Cloud Opportunity – Getting the Conditions Right.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.