Preparing For July 4 Airtel IPO in Nigeria: Quick Facts You Need To Know

Airtel Africa Plc is preparing to list (IPO) on the Nigerian Stock Exchange and on the London Stock Exchange at the same time. This is another chance for investors in stocks or shares of companies to cash out big time.

Here Is The Timeline For The Nigerian Offer

- Announcement of the offer price, offer size, the publication of the pricing statement and allocation of ordinary shares — 28 July 2019.

- Allotment of new ordinary shares to the shareholders — 29-Jun-19

- Crediting of ordinary shares to accounts — 3-Jul-19

- Nigerian listing and start of unconditional dealings on the NSE — 4-Jul-19

The Amount Of Offer And Share Price

- In a prospectus released by Airtel Africa Plc (“the Company”), the global Initial Public Offer ( IPO ) would put ordinary shares worth $750mn (or N270.0bn) out for public subscription.

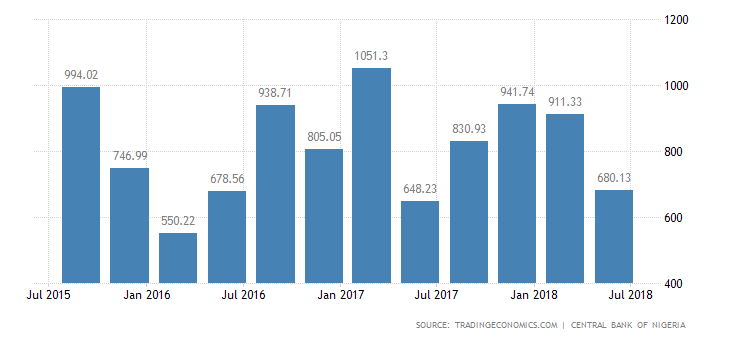

- Airtel Africa says the price for each of the shares is at a range of 80 pence and 100 pence/share or (£0.8-£1.0/share) for the London issue.

- The Nigerian offer of the issue is opened at an offer price expected to be between N363 and N454/share (technically a naira conversion of the pounds sterling expected price per share) which will be followed with a secondary market listing on The Nigerian Stock Exchange (NSE).

- The price range stated above (between N363 — N454/share) is indicative only and may change in the course of The Offer or be set within, above or below the price range.

- The Company is expected to be admitted to the premium listing segment of the main board of the London Stock Exchange (LSE) at the end of the transaction.

- Application has been made to the Nigerian SEC for the registration of all of the ordinary shares to be issued in connection with The Offer and to the council of the NSE, to be listed and admitted to the official trading list of the NSE.

Analysis of Airtel’s Intended IPO

- The amount Airtel Africa intends to raise is $750mn. This is adding the London and the Nigerian IPO together. This offer is 14.0% and 18.9% of Airtel’s issued ordinary share capital, depending on the offer price.

- Airtel, from their prospectus, would be allowing 10% of the issue to be ordinary. This is in accordance with the over-allotment option described in the company’s prospectus.

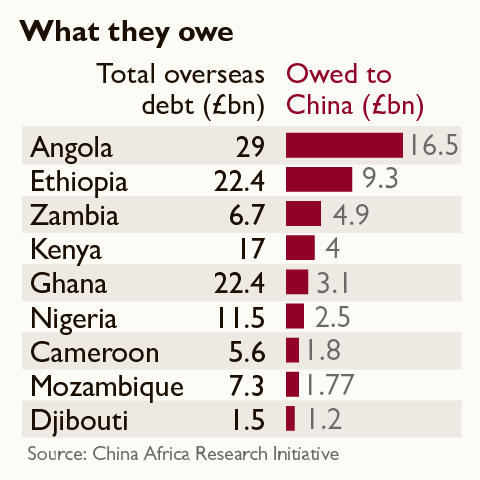

- Airtel is looking at using the proceeds from the issue to reduce the level of their indebtedness on their balance sheet, particularly to achieve a targeted leverage ratio of 2.5x.

- Airtel is being strategic about the Nigerian offering. It is planning that the Nigerian IPO (or ‘The Offer’) will be offered through a ‘book-building’ exercise pursuant to Rules 320 to 323 of the Nigerian SEC Rules, to determine the issue price and the level of demand. That is, the price may be readjusted according to the demand and response from the public about the offerings.

- All ordinary shares subject to The Offer will be issued or sold at the offer price, which will be determined by the Company, following a book building process and in consultation with the Joint Global Co-ordinators.

- From the prospectus, interested individual in the Nigerian offer will be deemed to have represented and agreed that it is either a ‘High Net Worth Investor (HNI)’ or a ‘Qualified Institutional Investor (QII)’ as such terms are defined in Rule 321 of the Nigerian SEC Rules.

- Airtel may have to consider a number of factors in determining the Offer price, share size and the basis of allocation. This will include the level and nature of the demand for The Offer during the book-building process and prevailing market conditions. In simple terms, it is most likely the share prices will fluctuate.

- From the prospectus, there are no restrictions on the free transferability of the Nigerian Offer Shares, meaning that prospective investors may buy and resell their shares at will. This is expected to lead to fluctuation in share prices. Most times, first to buy always win in this kind of situation.

Caveat

- The Nigerian Offer is not underwritten, meaning that the consequences of the customer’s actions on the IPO day are not insured.

- From the prospectus, it does appear that if UK Admission does not occur or unsuccessful, all conditional dealings will be of no effect and any such dealings will be at the sole risk of the parties concerned. Temporary documents of title will not be issued. UK Admission shall not be conditional on Nigerian Admission, but the Nigerian Admission shall be conditional upon the UK Admission. There can be no assurance that Nigerian Admission will occur on the date indicated above or at all.

Issuing Houses

In relation to the Nigerian Offer and the listing on the NSE, Barclays Securities Nigeria Limited and Quantum Zenith Capital & Investments Limited have been appointed as Nigerian joint issuing houses. Greenwich Securities Limited and Chapel Hill Denham Advisory Limited have been appointed as Nigerian receiving agents.

Points To Have In Mind When Investing In Stocks of Companies

- Own at least 10–30 different stocks, preferably in different industries: Don’t put all your money in one company/mutual fund/industry and invest in a wide variety of them.

- Invest in established leaders in the industry, preferably companies in the top 25% or 30%: Choose great and stable companies. Remember: We’re investing in businesses, not gambling on racehorses.

- The Company you’re buying should have a Long, Unbroken Record of Dividend Payments: If a company gives good dividends to their stockholders, it means it has actual earnings to pay it.

- Choose companies with a 7-year Price-to-Earnings (P/E) Ratio of Less than 25 (and less than 20 in the past 12 months): Choose good companies with a moderately low P/E Ratio (less than 25).

NB: These points were postulated by Benjamin Graham, author of the classic “The Intelligent Investor

Additionally,

- Set a minimum limit of the amount you can invest in companies.

- Invest in companies that are making profit or has all the metrics to make profit.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.