Nigerian Y Combinator-backed Fintech Startup CredPal Raises $1.5m In New Funding Round

Funding galore for Africa’s fintech ecosystem this year, inspired by Paystack’s successful exit! Latest startup to join the funding queue is the Nigerian consumer fintech company, CredPal, which has announced a new $1.5 million investment from leading investors including the US-based accelerator, Y Combinator.

“We’re building the American Express of Africa. And our goal is to make credit cards mainstream across Africa as is obtainable in the United States and other advanced economies. With this funding, the growing market demand for consumer credit, and our recent product launch to solve these needs, we know that we’re on the right track,” says co-founder Fehintolu Olaogun.

Here Is What You Need To Know

- Investors in this round of funding include US seed-stage accelerator, Y Combinator, Lagos-based investment firm, GreenHouse Capital, as well as other undisclosed investors.

- Powered by this investment, CredPal will launch its own credit card as well as fast-track its expansion plans.

- In 2019, CredPal, alongside other African startups such as Wallets Africa, Schoolable, and 54gene participated in the Y Combinator Winter batch. The startup received $150k from the accelerator.

Read also: Here Is What Paystack’s $200m Acquisition Is Teaching Other African Startups

Why The Investors Invested

CredPal’s validation by Y Combinator is a deal breaker. Startups previously backed by Y Combinator have gone ahead to raise millions in VC money. Early Y Combinator investee African startup Paystack was recently acquired by Stripe in a deal reported to be valued at more than $200m.

In June 2020, CredPal was part of the fifth edition of Google for Startups Accelerator Africa, a three-month-long programme, designed for startups to gain access to mentorship, funding, and PR support, among other incentives. The program opened the startup up for funding opportunities.

A Look At What CredPal Does

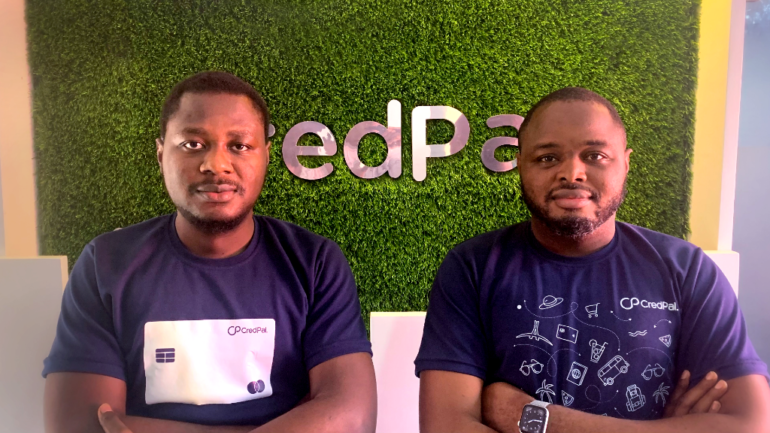

Founded in 2018 by Fehintolu Olaogun and Olorunfemi Jegede, CredPal is a revolutionary credit solution geared towards providing seamless credit access for businesses and individuals across developing economies.

Although CredPal has competence in consumer credit infrastructure that which makes it possible for financial institutions to deliver consumer credit in real-time across POS channels, the startup’s customers didn’t have access to credit cards. The startup has been relying on ATM debit cards which served as credit cards for users at POS channels. However, with the new funding and planned expansion outside Nigeria, CredPal plans to launch and take its credit cards mainstream.

“With our current raise and the launch of our credit cards, we’re confident about meeting these customers’ needs,” Olaogun says.

“We are obsessed with the desire to see that working professionals no longer have a thing to worry about as it concerns dealing with their financial needs, a world in which every working person is rewarded with a CredPal card that has their back,” he further says.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer