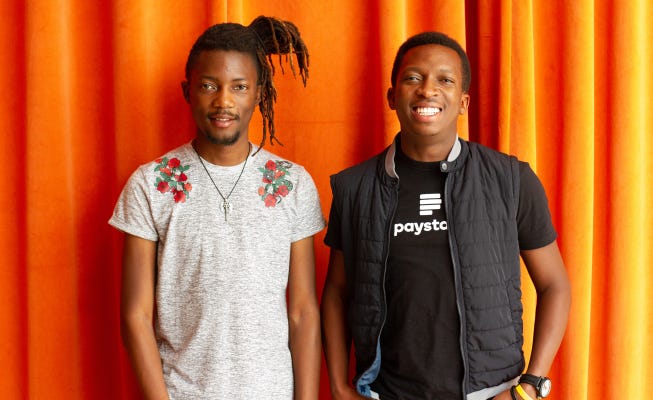

When Ezra Olubi set out to build a little known payments startup in 2015, alongside his university school mate, Shola Akinlade, he never knew that it would five years later be bought for $200 million. But that has happened!

In a remarkable African startup exit, exciting for American investors who constituted more than 40 percent of all venture capital investments on the continent between 2014–2019, Silicon Valley-based payments and software-as-a-service company, Stripe, has acquired Olubi’s startup, Paystack, in a deal reported to be worth more than $200 million.

While this is a huge entrepreneurial respite — and of course real cash — for him, the journey to building one of Africa’s strongest fintech companies has just begun.

“I quit my job in 2015 so I could work on Paystack,” Olubi said. “My friends and family definitely weren’t surprised. They were like: ‘Oh, he’s doing another new thing again!’ I’d been working with startups for pretty much my whole career until that point anyway. I’d always chosen startups instead of jobs with high salaries at big-name companies.”

With the excitement of a major Nigerian startup acquisition still raging on, a few insights into Paystack’s success may be helpful.

Building A Local Solution With A Global Mindset

By industry stereotypes, Paystack’s founders Shola Akinlade and Ezra Olubi could easily have been dismissed as high-risk investments. Both founders studied in Nigeria, with some of the lowest ranked educational institutions, and have equally lived much of their lives in the West African country. And so there is every reason to doubt their capacity to deliver good returns on investments. Which is why both founders instantly sought to first plug the startup into the global ecosystem before deeply treading the startup path.

“After starting the company, the first thing Shola and I did was apply for Y Combinator,” said Olubi. “It seemed like a really farfetched idea. I remember thinking: ‘There’s no way we can get into this program. We’re just a couple of young guys in Nigeria.’ We got rejected the first time, but we applied again and were accepted. We were the first ever startup from Nigeria to enter the program. It was a surreal time in my life. Firstly, because I had never traveled outside of Nigeria before. Secondly, because being accepted into the program was strong validation. I knew we needed to do everything possible to make the most of this opportunity. That meant a lot of learning — fast.”

Without meaning to deter intending startup founders in Africa, it is noteworthy to point out that there is always some “herd mentality” surrounding globally validated startups. Paystack’s validation by Y Combinator was a deal breaker. It gave room for immediate funding to the startup from global giants like Tencent, Stripe, Visa, among others.

Read also:How Fintech Startups In South Africa Can Apply For AlphaCode Incubate Programme’s $600k

But that was 5 years ago and things have changed. In as much as Y Combinator is still glamorised, there has been a consistent rise in the number of venture capital firms and accelerator programs across Africa.

The success of Paystack’s founders, nevertheless, marks a watershed in the Nigerian startup ecosystem, for it is the first time a startup founded by purely local talents will be witnessing the biggest startup acquisition in Nigeria.

Therefore building a local solution with a global mindset is crucial.

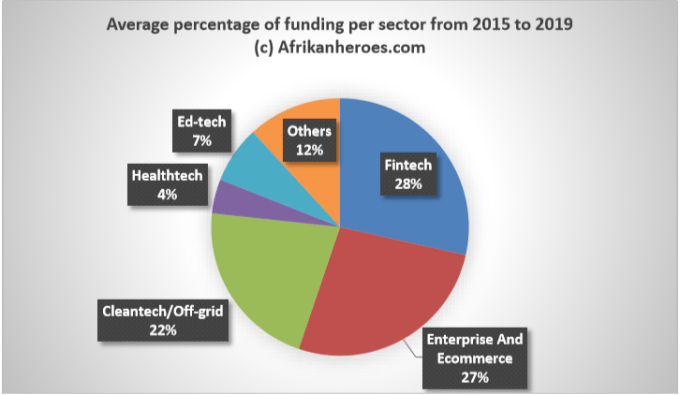

When It Comes To The Biggest Startup Acquisitions In Africa, Investors Are Biased Towards Fintech

Paystack’s high-figure acquisition is a confirmation of investors’ bias towards fintech in Africa. Record number of fintech startups have been acquired in Africa within the shortest period of time after they were founded. From Sendwave to Beyonic, the table below captures it clearly.

“It is really pattern recognition; they see the kind of deals that have happened in the past and they try to mimic that,” said Jean-Claude Homawoo, Co-founder & Managing Partner, Lori. “They (investors) look for the same makeup over and over again. So for founders that don’t look like those…in the past there is a hurdle.’’

It is therefore relevant that startup founders acquaint themselves with the sectors that have attracted the most acquisitions in Africa in the past. Although this may be one of the earliest guiding principles in choosing which startup idea to pursue, market size, market fit and strikingly innovative solutions (check out South Africa’s SweepSouth, for instance) and overwhelming passion from founders have always dragged investors’ interests into new areas.

However, since startups are themselves largely untested territories (considering that a majority of them have not existed for an appreciable length of time nor have they been affected by policy changes or market trends), investors tend to stick more to sectors that have proven to return most highly on their investments.

Apart from recording the highest number of high-figure acquisitions in Africa, fintechs have also topped the chart for venture capital funding in Africa. In 2019 alone, out of a total of 250 deals amounting to a record-breaking $2.02 billion reported by data firm Partech, financial technology companies (fintech), at 41%, received the lion’s share of the whole investment sum.

| S/N | Name of Company | Sector | Year Founded | Year Acquired | Value of Acquisition | Acquirer | Country |

| 1 | Sendwave | Fintech | 2014 | 2020 | $500m | WorldRemit | US; Kenya |

| 2 | Beyonic | Fintech | 2006 | 2020 | Undisclosed | MFS Africa | Uganda |

| 3 | Apposit | Software Development | 2017 | 2020 | Undisclosed | Paga | Ethiopia |

| 4 | Harmonica | Online dating | 2017 | 2019 | Undisclosed | MatchGroup | Egypt |

| 5 | StarterHub | Community | 2015 | 2019 | Undisclosed | RiseUp | Egypt |

| 6 | Menabytes | Media | 2017 | 2019 | Undisclosed | RiseUp | Egypt |

| 7 | Mobisol | Off-grid energy | 2011 | 2019 | Undisclosed | Engie | Kenya |

| 8 | PayFast | Fintech | 2007 | 2019 | Undisclosed | DPO Group | South Africa |

| 9 | Paystack | Fintech | 2015 | 2020 | Over $200m | Stripe | Nigeria |

| 10 | iHub | Innovation Hub | 2010 | 2019 | Undisclosed | CcHub | Kenya |

| 11 | Surf Kenya | Wi-Fi | 2015 | 2019 | Undisclosed | BRCK | Kenya |

| 12 | Haltons | Healthcare | 2013 | 2019 | $5 million | mPharma | Kenya |

| 13 | Amplify | Fintechs | 2016 | 2019 | Undisclosed | OneFi | Nigeria |

| 14 | OLX Africa | Online Classifieds | 2012 | 2019 | Undisclosed | Jiji | Nigeria |

| 15 | Konga | Ecommerce | 2012 | 2018 | $10m (Reportedly) | Zinox | Nigeria |

| 16 | Kngine | AI | 2008 | 2018 | Undisclosed | Samsung Electronics | Egypt |

| 17 | QuickHelp | AI (chatbot) | 2015 | 2018 | Undisclosed | 1001 Squared | Nigeria |

| 18 | Cape Networks | SaaS | 2013 | 2018 | Undisclosed | HP | South Africa |

| 19 | orderTalk | Foodtech | 1998 | 2018 | Undisclosed | Uber Eats | South Africa |

| 20 | TopCheck | Ecommerce | 2015 | 2018 | Undislosed | Silvertree | Nigeria |

| 21 | Careem | E-hailing | 2012 | 2020 | $3.1 Billion | Uber | Egypt |

Read also: Why Many African Early-Stage Startups Fail To Secure VC Funding

Long Term Friendship With Investors Almost Always Defeats Short Term Desperation For VC Funding

Paystack’s acquisition is remarkable in that it is one of the few African startups where the investor became the buyer. In looking to build a startup therefore, getting the right investors has, again, been confirmed as the single most important thing that will determine the success of the startup in the long run.

“When we invest in startups, we’re not trying to tie them up with complicated strategic investments,” Patrick Collison, Stripe’s co-founder and CEO said. “We try to understand the broader ecosystem, and keep our eyes pointed outwards and see where we can help.”

In 2018, Stripe led an $8 million funding round for Paystack, with others participating, including Visa and Tencent.

Therefore, while there may be pressing need to raise funds now, it is equally important to look at what the startup’s relationship with its investors will look like, say, 20 years from now.

Co-Founding With Less Squabbles

In as much as it is good to be in a hurry founding startups and bridging skills gap on the team, it is important to be mindful of who makes up the starting team.

“I first met my co-founder, Shola Akinlade, back in 2002,” said Olubi, “we hit it off at a software exhibition in my first year of university and we’ve been friends ever since. We’ve been working together, on and off, for more than a decade now. While Shola was consulting for a bank, he stumbled onto an easy way of doing recurring billing. Knowing my background and interests, he came to me and said: ‘Let’s start a company together. I want you to be a part of this with me.”

In essence, business acumen with a deeper touch of friendship may help take the startup project far.

lessons from Paystack acquisition lessons from Paystack acquisition lessons from Paystack acquisition lessons from Paystack acquisitionlessons from Paystack acquisition lessons from Paystack acquisition lessons from Paystack acquisition

A Look At What Paystack Does

Founded in 2015, Paystack, based out of Lagos, Nigeria provides a quick way to integrate payments services into an online or offline transaction by way of an application-programming interface (API).

The company currently has around 60,000 customers, including small businesses, larger corporates, fintechs, educational institutions and online betting companies, and the plan will be for it to continue operating independently, the companies said.

“Back in 2007,” Olubi said, “when I was working for another company, the internet was still quite inaccessible in Nigeria, outside of workplaces and cyber cafes. People relied on their mobile phones, but it wasn’t easy to top up airtime. We were working on a solution, and created a wallet system where customers could prepay and then send a text message when they wanted more airtime.”

“I thought: ‘If people have all this money stored with us, why don’t we let them spend it all over the internet?’ I built an API around that idea and found myself in the world of online payments. Eventually, I left that company and went on to do other things, but the seed was already sown in my mind for what would later become Paystack,” he adds.

Paystack’s acquisition is the biggest acquisition to date to come out of Nigeria, as well as Stripe’s biggest acquisition to date anywhere in the world.

“There is enormous opportunity,” said Collison. “In absolute numbers, Africa may be smaller right now than other regions, but online commerce will grow about 30% every year. And even with wider global declines, online shoppers are growing twice as fast. Stripe thinks on a longer time horizon than others because we are an infrastructure company. We are thinking of what the world will look like in 2040–2050.”

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer