As an unknown startup founder in Africa looking for funds — with little education; from middle or the lowest of the income classes; few or no resourceful connections; little to no previous experiences at major startups — the odds are against you. You might have probably read Partech Africa’s 2020 report when the going was good and the coronavirus had not enveloped the world. That report is important because it revealed how investors in the African startup ecosystem could behave at the peak of the funding bubble — that is, who they invest in; how they invest; and which startup areas they prefer. And like you must have also read, over $2 billion was raised by only 234 startups across all the 54 countries in Africa, homes to a population of more than 1.2 billion people that year. To show you how small this number is, an all-encompassing Africa-focused startup/investor networking platform like VC4A has about 14,000 African startups listed on it. This means that only about 1.6% of the startups listed there secured funding from investors that year, and that over 98% others didn’t (assuming they all looked for funding). It will also strike you to discover that a substantial number of the 1.6% came from startups with previous investments, and from the same investors who have previously invested in them.

And so, any hope?

It’s going to be tough, but we may lead you through a few secrets. We take the shots:

1.

While looking for funds as an unknown African startup founder, please look again at who is on the team. Investors like traction, but about 80% of them are foreigners and are full of doubts about who you say you are. Even the remaining 20% who are local investors have little funds to spare. So, make sure to tinker your team. Balance the age differences. Match education and skill deficits. Don’t worry about gender diversity, the VCs have not, themselves, shown that in their pattern of investments.

Don’t also fail to appoint a co-founder; the environment is risky and you may be shot dead, and who remains to execute on their investments will be a major issue.

A small, formidable board of directors also does wonders. Make the quality of the board members so dense in character, influence and professions that investors feel a little bit intimidated. It’s the first telltale that you are on the right track, even if you have a bad product.

2.

While looking for funds as an unknown African startup founder, look at the product again. Nobody says you should not be creative enough. In fact, the pleasure of stringing a few codes together is that you can always creatively manipulate your way through may ideas, but this also calls for caution — your creative liberty begins and ends when you dump your pitch decks into investors’ inboxes and get no replies.

You may have read on TechCrunch or elsewhere that Buzzfeed, a website full of animated gifs, listicles and quizzes, raised $50 million dollars; or that Snapchat, the messaging app known for helping teenagers sext one another, received a $10 billion valuation from its investors. But before you become so filled with overwhelming inspiration that you reproduce those ideas or something similar in Africa, note that investors in Africa care less about them.

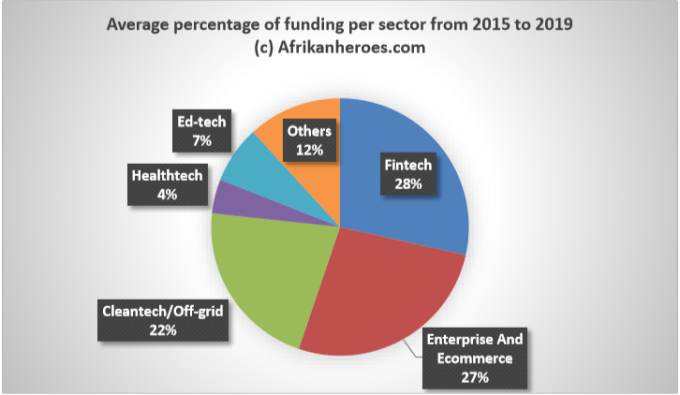

And so, look at your product more critically. Place it side by side the map of startups that have raised funds about two years ago. Does it match any? If your startup sector is not favoured in the funding reports, add a few more features to the product if you can. At least, let people pay for something even it is just a ride-hailing app. Make it prominent to investors that even though it is a social media app, there is still a feature that looks like fintech or cleantech, or ecommerce or healthtech, and so on.

Only settle for bizarre ideas if you can show not just the thousand of users who have downloaded and are using your product, but also the thousands of users who pay — or other ways you have earned revenue from the product.

3.

While looking for funds as an unknown African startup founder, make sure you speak to the press. Get your name across different tech media platforms. Announce you have just launched a product, even if the product is just a skeleton under your bed. Announce you have struck a major partnership deal with a major dealer in your country. Announce your transaction volumes have surged as result of more users dumping other products for your own. Grant an interview to Afrikan Heroes, to Disrupt Africa, to WeeTracker, or any other international tech blogs of significance out there. Say how passionate you are about taking the startup to the next level. Say the value proposition you are offering through your product. Say you see an IPO coming soon in 2050. The kind of words investors would like to hear. In worst case scenarios, just spill the beans and say you are fundraising, and that although you have already secured enough commitments from leading investors, you would be extending the round by two months. But make sure, when investors come knocking, that documents are on ground to back up your claims. If not, congratulations! You just blew away a life-time opportunity!

4.

While looking for funds as an unknown African startup founder, get into YC or Techstars or 500 Startups or Endeavour Catalyst or other similar accelerators if you can. In fact, don’t fail to keep submitting your applications even if there is information out there in the media that you have previously raised a seed round and are about to do a pre-Series A. African startup investors are not yet as adventurous as you think; they follow a pattern.

Therefore, joining the programs above apart from being a huge badge of validation, makes certain bizarre clauses in your term sheet — such as the no-shop clause — more of a reality than a concept. You may also get some little shiny power to decide which investor signs you a cheque and which does not. And there is this sudden ballooning of your startup’s valuation, from a venture worth just little over $100,000 to a startup worth over $100m.

Read also:Morocco Gets A New Crowdfunding Law, Puts No Limits On How Much A Startup Can Raise

So, another smart way to avoid dumping thousands of unread pitch decks into VC’s inboxes is to toe this path. And yet, don’t be naïve to believe your product is so unique that it cannot be rejected by any of the accelerators. Go back, analyse the type, age, founders, countries, etc. of African startups that have ever participated in the program in the last five years.

5.

While looking for funds as an unknown African startup founder, make sure you are from the “Big Four” — that is Nigeria, Kenya, South Africa, or Egypt. Investors know these markets have been tested, and so with little time to speculate, they beam their funding pumps into those countries.

If you are an unknown startup from Kinshasa in the Congo, the odds are heavily against you. In fact, it seems African startup investors don’t just like the French-speaking countries. Does that give you a hint about why there is so much bickering as to whether Healthlane is a Cameroonian or Nigerian startup when it announced it raised $2.4m in funding recently?

Even where you are so sure your country is the go-to destination, do not overlook the importance of plotting your product against yearly funding reports. For instance, if you are an online fashion shop in Nigeria, your funding chances increases more if you move towards Egypt; same way they would do if you are an agritech startup moving towards Kenya.

But then while looking for funds as an unknown African startup founder and you are stuck outside the Big Four, say to the investors that you have already expanded or are planning to expand to any of the Big Four countries, although it is always safer to play the former card.

Read also:AFRALTI Partners IBM to Launch a Digital Training Programme in Kenya

If you can’t expand, emigrate.

And if you can’t do either, stay behind, bootstrap and hope for the best.

6.

While looking for funding as an unknown African startup founder, remember to pitch more to foreign investors — especially those from North America, Dubai, the Netherlands, Japan, etc. — than local investors, because they hold more keys to funding — more than 80% of it. This is so true except you are from South Africa where Section 12J forces venture capital firms to invest in ventures like yours; or from Tunisia, if you are lucky to get a startup label (not many yet).

But do not worry if all of the so-called foreign investors decline to invest in your product, no matter how fantastic it is . They are probably busy with startups founded by their kinsmen in Kenya, South Africa, Egypt or Nigeria and the ones registered in California or Delaware or the United Kingdom or countries and cities with more investment-friendly regulations than yours. They are, also, probably more busy attending to former founders of already successful startups like Andela or Jumia or Interswitch, who are now experimenting with new products, even if the chances of the products failing is 70:30. They are also more likely busy attending to founders who have once worked with Google, or Apple or studied in MIT or Harvard, even if they do not understand what the African entrepreneurial environment looks like.

But don’t worry, there are also a few good investors; but they are, like said, few! And they may not even write big cheques; but they will write, at least.

7.

While looking for funds as an unknown African startup founder, try the accelerators and the incubators. Yes, some of them do not give funds, but endure the endless — sometimes boring — sessions and build some strategic connections. And grab those Demo Day opportunities! Most investors avoid the stress of going through pitch decks by investing via accelerators.

Most importantly, while at the accelerators and the incubators secure a good contact in the funding ecosystem, not necessarily funding. If you are lucky to have been chosen, out of so many applications, it means that funding is underway if you till a little bit harder.

But do not go there and sit and watch only the sessions. Accelerators, in as much as they care about you, also care about their continued relevance; so you may just be a number. Therefore, presented with that opportunity, develop a powerful connection/contact in the funding ecosystem.

Read also: Do Accelerator Programmes Really Matter For Startups In Africa?

8.

While looking for funds as an unknown African startup founder, use referral or a consultant for introduction. Get recommendation from an investor, a serial founder who has, himself/herself, previously raised funds. Get recommendation from a consultant who has facilitated several deals, although you may have to pay through the nose.

As the unknown African startup founder, stop dumping your pitch decks — most times poorly crafted — randomly into investors’ inboxes. You may get called up for a Zoom meeting or Google Hangouts, but watch out for the booby-traps of PR and image-making.

Investors are cult-like: meeting and, in most cases, syndicating investments from ‘trusted’ sources, and usually among themselves; and at the same time, within the infinitesimal cliques among themselves.

Therefore, as the unknown African startup founder, it is better to spend three to six months aiming at recommendations/referrals or consultations than mindlessly sending out pitch decks.

Speak to top startup writers of the ecosystem, also. Even if they don’t have the funds, they have a Behemoth of data, They may also know your product’s chances of securing funding; and know who they may recommend you meet next for funding.

9.

While looking for funds as an unknown African startup founder, make sure you have gained and successfully defended your product’s traction over a considerable period of time. Unless you choose to go through grants or other similar routes, note that there aren’t so many idea-stage investors on the continent. So, have a product that has gained traction, generated revenue (even if negligible) and consistently defended itself against the vagaries of the market.

Even if it means bootstrapping do so, but do not waste unreasonable amounts of time chasing shadows and bombarding investors with your idea-stage product, except the product is so exceptionally brilliant and frontier that it can always defend itself successfully against market forces.

Remember you are that unknown African startup founder looking for funds, and when in doubt about how brilliant your idea stage product is, consult your annual startup funding report.

10.

While looking for funds as an unknown African startup founder, make sure your accountability and regulatory compliance are second to none. Be ready to show investors the papers. Regulatory environments across Africa are neither here nor there, and so while looking for investors, find a way to deny that the most recent policy directions or regulations by government will affect you.

Show this more intensely as due diligence questions go hotter. Show them that even though government has shut down cryptocurrency and bike-hailing startups, you are so sure your business model is entirely different and that it would only be unlawful for government to sweep the model under the carpet. In fact, show them this more than you show them the financials because this is their biggest turn-off. Investors, especially the foreign ones, are not that extremely excited about investing or experimenting with African startups yet.

And don’t also fail to show them how prudent you are with your spending. Put reasonable figures in your financials; don’t show them you have the capacity to burn down a houseful of cash in a record time on non-strategic projects, especially hiring and remuneration. Watch the salary figures you allocate to the founders. Watch the method for vesting shares and other benefits to the co-founders and the formula around employee stock options. Watch the funds disbursement mechanism in place.

Read also:Morocco, Senegal to Increase Cooperation in Business, Research

Show them your up-to-date tax filings and other regulatory clearance certificates, because nobody wants to buy liabilities. Show them your patent, trademark and copyright certificates, because if the business gets sued, they may share liabilities too. If you can’t hire a lawyer or an accountant, give them stocks and investors will understand.

11.

While looking for funds as an unknown African startup founder, make sure you are also considering the option of headquartering your startup in a foreign country, with better investment policies than your country. You see, most investors do not like over-taxation on returns on their investments in your company; and so, they try as much as possible to avoid it.

To paint the picture more clearly about how they have been avoiding this in Africa, note that about one fifth (21%) of the total number of venture capital (VC) deals between 2014 and 2019 went to startup companies headquartered outside of Africa, with the majority (53%) based in the United States.

At 21%, foreign-registered startup companies received exactly the same quantity of investments as startup companies based in South Africa (which got 21% of the total funding accruing to Africa in four years (2014–2019).

This, therefore, means that, at 21%, it is a little bit easier for an African startup registered in the United States, for instance, to secure funding from VC investors than for locally registered startups based in, say, Kenya (which received about 18% of total VC investments in Africa between 2014–2019); or Nigeria (14%); or Egypt (9%); or Ghana (3%).

To begin with, think about registering in Delaware, California, Nevada, Texas, the UK, Mauritius, Singapore, Estonia, Sweden and Finland, Seychelles, among others.

Do not blame anybody: it is not your money, but investors’, and so they have wide, unlimited powers to decide how to play the game. And do not bother too much about Africanism: there is still a lot of double standard, even among your favourite African founders, about how to approach African brands. So play the game.

Read also: A List Of Over 500 Active Startup Investors In Africa In The Last 5 Years

12.

While looking for funds as an unknown African startup founder, do not joke about the power of a beautiful pitch deck but do not dump so much information into it.

Investors barely have time to scan through pitch decks. So, emphasize the most crucial points: your value proposition; your business model; what problem you are looking to solve; your total addressable market; your competitors and your competitive advantage; your growths and financial projections; the exact amount you are looking to raise; how you intend to spend the proceeds of your fundraise; how you intend to return investors their money; and of course, your team.

Do not delegate this function; it is the first shot your have at telling your startup’s story. But while you cannot delegate, do not under-tell your story. Use the services of experts (through collaborative information sharing) to distill your story, and make a more rounded presentation.

Most investors do not like typos, or poorly doodled graphics; so edit and weed out excess or tattered information.

You may ask why this matters; just give me the funds! Hang on: experience will teach you nobody wants to recommend or refer or even consult for sub-standard or poorly presented information. It not only damages their reputation, but questions their competence and sense of judgment.

So, while looking for funds as an unknown African startup founder, do not allow a poorly crafted pitch deck to end your promising journey even before it gets started.

And when it is the time to pitch, do not underestimate the power of your yearly funding reports. Ask these questions: Who are the investors? What type of startups do they like to invest in? What are their average ticket sizes? When last did they invest? What are their patterns of investment; do they stick to only a few companies or diversify their portfolios from time to time by bringing in new companies? What type of founders do they invest in; female-only, male-only or diverse, British, American, North African, Asian, South African, serial founders, founders with heavy educational qualifications, founders with disabilities, founders from the Mars, etc.? What region of Africa do they invest in, North, South, East, West, Central, etc.?

13.

While looking for funds as an unknown African startup founder and you are female, make sure you have a strong male force as a co-founder. Investors don’t seem to care how active gender rights activists have been in recent times. And they have been care-less year on year. Facts show it, for example, that 10% of west Africa-focused startups with at least one female co-founder successfully raised $1 million or more in the last ten years. Good news is that there are now more funds specifically targeting women-only startups. But there is still a long way to go.

14.

While looking for funds as an unknown African startup founder, start from the angel investors. These are probably the only category of investors who will, most likely, not be interested in your pitch deck, or how colourful it is — but send it anyway.

Begin by scouring through local business directories and looking for high net-worth individuals around you. Look for recommendations. Speak with friends of friends of friends. Reach out through members of your board of directors, previous founders who have raised funds, etc. Check how high scam rate is in your city, and find the most transparent way to introduce yourself without triggering a scam alert.

And when you eventually find one, make a good first impression: look like you are doing well already, but need to take your business to the next level. Do not lack confidence and never look haggard.

Then, tell them how the African technology startup space has been like a wildfire in recent times. Say that Jeff Bezos, the world’s richest man, has just invested in one. Show them reportage on how millions of dollars are poured into startups in Africa on a weekly basis. Show them that early investors who missed the opportunity to invest in Paystack made a huge investment blunder. Tell them how Y Combinator, a smart American accelerator is occupying strategic positions in startups across continents. Show them how the accelerator used $125k to get millions in Paystack within a space of five years or less. Show them how your startup is even more valuable than Paystack. Show them the figures you have made. Where possible, tell them that your startup is the next Bitcoin and that it is better than investments in real estate.

But, be ready to accept a check of between $5k to $100k for 50% (or more) equity. As an unknown African startup founder, it is either you accept or you look elsewhere.

15.

While looking for funds as an unknown African startup founder, never overvalue your startup. Start with the humble figures first.

16.

And when you have done all these and still can’t raise funds, just fund your startup from your savings or borrow from friends and relatives. Or, start on another good day.

*The views expressed here are the opinions of the writer.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer

African founder funds investors African founder funds investors African founder funds investors African founder funds investors African founder funds investors African founder funds investors African founder funds investors African founder funds investors African founder funds investors