Paystack, the Nigerian fintech startup that was acquired by American payments company Stripe for over $200m last year, doesn’t look like it will be left out of the ongoing waves of expansion sweeping across startups in Africa. The startup is headed for South Africa, out of its home country Nigeria, which has been disemboweling startups with unfavourable regulations in recent times. The South African expansion comes on the heels of a six-month pilot phase in the country.

“South Africa is one of the continent’s most important markets, and our presence there is an important step in our mission to accelerate trade in Africa,” said Shola Akinlade, CEO of Paystack.

“We are delighted to continue to develop the financial infrastructure that empowers ambitious businesses in Africa, helps them scale and connects them to global markets,” he added.

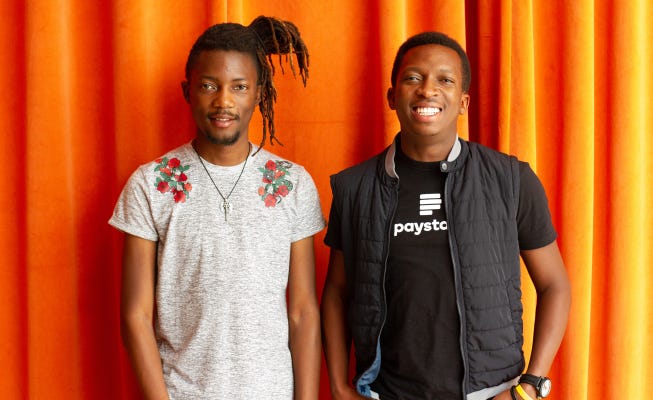

Founded in 2015 by Shola Akinlade and Ezra Olubi, Paystack helps businesses in Africa get paid by anyone, anywhere in the world. The company is active in Nigeria and Ghana, before expanding to South Africa.

A Strategic Way Of Dodging Regulatory Bullets

Startups are on high alert. Regulators across Africa, especially in Nigeria, are not smiling any more.

Nigeria’s central bank recently blocked banks in the country from hosting accounts associated with cryptocurrency trading. It has also stopped fintech startups from receiving remittances into Nigeria. The country’s Lagos state government has also banned bike-hailing activities on its major highways, a singular act that has put so many investments in bike-hailing startups in the West African country at risks of failure.

Shooting sporadic shots of expansion into other African countries is therefore a strategic way of diversifying regulatory risks.

Paystack’s fellow country startup, Flutterwave, apart from headquartering in the United States, also maintains legal presence in countries where it is currently in operations. This strategy was crucial in assisting the startup to achieve a unicorn status.

Before Paystack is a host of other startups, some of which are listed below.

| S/N | AFRICAN STARTUP | SECTOR | BASE COUNTRY OF OPERATIONS | COUNTRY EXPANDED INTO IN 2021 (AS AT MAY 7TH) |

|---|---|---|---|---|

| 1 | mPharma | Healthtech | Ghana | Ethiopia |

| 2 | Aza Finance | Fintech | Kenya | South Africa |

| 3 | Gozem | Ride-hailing | Togo | Gabon |

| 4 | Andela | Edtech | New York, USA | Latin, South America |

| 5 | SWVL | Ride-hailing | Egypt | Saudi Arabia |

| 6 | GOMYCODE | Edtech | Tunisia | Morocco; Senegal |

| 7 | FairMoney | Fintech | Nigeria | India |

| 8 | Autochek | Car listing | Nigeria | Ghana |

| 9 | Daystar Power | Solar energy | Nigeria | Togo |

| 10 | ZeePay | Fintech | Ghana | Zambia |

| 11 | Catch | Ride-hailing | Ethiopia | Kenya |

| 12 | AURA | Security | South Africa | Kenya |

| 13 | Paystack | Fintech | Nigeria | South Africa |

Aiming At Unicorn Status

Another way of explaining the spate of expansion among African startups is that the chase for ‘unicorn’ status is on, especially after Flutterwave became the continent’s latest startup to join the gang. The Nigerian fintech launched operations almost immediately at the time it was founded, across Ghana, Kenya, and Uganda (and later to other countries), a key factor which eventually aided it in attaining the highly coveted $1bn valuation.

Paystack South Africa Paystack South Africa

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer