Nigeria’s largest telco by subscriber base MTN, and its immediate competitor Airtel have taken up a new business — that of attempting to beat Nigerian banks at what they know how best to do. The two have been granted one of the country’s most expensive fintech licenses, a payment service bank license, costing over $12.8m in licensing fees. Last year, 9mobile, another of the country’s leading telco, became one of the first set of licensees, alongside Hope PSB and Moneymaster PSB.

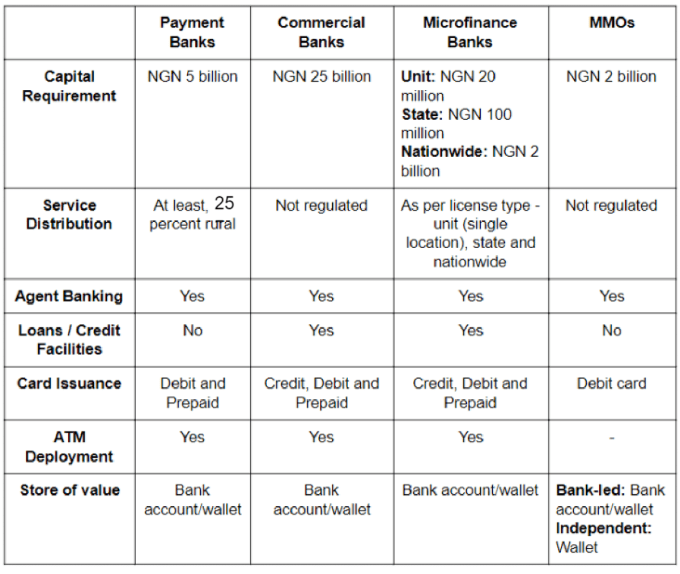

The payment service bank license is one of the many types of banking licenses a financial technology company in Nigeria seeking authorisation to operate from the country’s central bank may explore. It is different from other existing banking licenses for financial technology companies because it is one of the few types of fintech licenses that allow the licensee to operate across the country. A majority of others have geographical and structural limitations.

Read also Nigerian Cross-border Payments Startup, Lemonade, Raises $725k Pre-seed

Nigeria’s central bank in its latest update on the payment service bank licensing rules is clear about what purpose this type of bank would serve.

“PSBs are envisioned to facilitate high-volume low-value transactions in remittance services, micro-savings and withdrawal services in a secured technology-driven environment to further deepen financial inclusion and help in attaining the policy objective of 20 per cent exclusion rate by 2020,” CBN said it in its latest rules.

But it appears that MTN and Airtel strategically delayed their license applications for the PSB license for a reason: the recently introduced mobile money licensing framework. While all hopes were high that the mobile money operational guidlines would be wider in scope, these hopes were dampened with the eventual release of the guidelines in July this year.

The mobile money guidelines heavily limited the operational capabilities of its licensees, restricting mobile telecoms operators such as MTN and others, for instance, from carrying out substantial banking activities using the model.

Read also A $242m Acquisition Deal Underway For South African Fintech, Connect Group

A clearer picture about the differences between Nigeria’s payment service bank and mobile money licenses is painted in the table below. The differences also capture how the payment service bank design will function in practice.

| S/N | KEY REGULATORY REQUIREMENTS | PAYMENT SERVICE BANK LICENSE | MOBILE MONEY LICENSE |

|---|---|---|---|

| 1 | Can accept and hold deposits | YES | YES (mostly via mobile wallets) |

| 2 | Cross-border Remittance | YES ( including, inbound cross-border personal remittances) | NOT Specifically stated. Operationally improbable) |

| 3 | Deal in foreign exchange transactions | YES (only to the extent of sale of foreign currencies realized from inbound cross-border personal remittances to authorized foreign exchange dealers, only) | YES (only to the extent of sale of foreign currencies realized from inbound cross-border personal remittances to authorized foreign exchange dealers, only |

| 4 | Issue cards | YES | YES |

| 5 | Lending | NO | NO |

| 6 | ATM | YES | NOT Specifically stated (Operationally improbable) |

| 7 | Extent of participation allowed to telecommunications companies. | RESTRICTED from accepting payments from the public, apart from airtime billing. | ALLOWED (through their subsidiaries) to accept deposits from the members of the public. |

| 8 | Estimates of licensing fees | Over 5 billion naira ($12m) | Over 2 billion naira ($5m) |

| 9 | Geographical limitations | NATIONAL (provided not less than 25% financial service touch points in rural areas are set up) | NATIONAL |

| 10 | Use of network of agents permitted | YES | YES |

| 11 | Who may obtain the license? | i) Banking Agents; ii. Telecommunications companies (Telcos), through subsidiaries; 8 Classified as Confidential iii. Retail chains (supermarkets, downstream petroleum marketing companies); iv. Postal services providers and courier companies; v. Mobile Money Operators (MMOs that desire to convert to Payment Service Banks shall comply with the requirement of this Guideline); vi. Switching Companies; vii. Financial technology companies (Fintech); viii. Financial Holding Companies; and ix. Any other entity on the merit of its application subject to the approval of the CBN | Banks and corporate organisations |

| 12 | Primary Regulator | Central Bank of Nigeria | i) Central Bank of Nigeriaii) Nigerian Communications Commission |

What Difference Will A Payment Service Bank License, Therefore, Make?

A Payment Service Bank (PSB) is a new category of bank with smaller scale operations and the absence of credit risk and foreign exchange operations. In addition to accounts (current and savings), PSBs can also offer payments and remittance services, issue debit and prepaid cards, deploy ATMs and other technology-enabled banking services. Think of them as basically stripped-down versions of traditional deposit money banks, with limited functionality and a focus on onboarding more of the excluded and marginalised population.

Under Nigerian central bank’s regulations, subsidiaries of mobile network operators (aka telcos), mobile money operators, retail chains (supermarkets) and banking agents are welcome to apply for the PSB license, provided they can meet certain requirements, including a 5 billion naira ($12million) capital base, and a combined 2.5 million naira ($6.4k) application and license fee (which are non-refundable).

The new banking licenses for Nigeria’s leading telcos are coming after the CBN issued an updated and revised guideline for the licensing and regulation of Payment Service Banks in Nigeria on August 27, 2020.

Read also Nigerian Retail-Tech Startup Alerzo Acquires Payments Platform to Boost Growth

MTN has the largest chunk of the Nigerian telco market with over 74 million subscribers, followed by India’s Airtel with over 52 million users; locally owned Glo at 52 million; and then 9mobile with a meager 12 million users. Visaphone (which is merely an extension of MTN, having being acquired by the telecom giant in 2015 to boost its 4G capacity) comes last with just a little over 137, 000 users.

MTN bank Nigeria MTN bank Nigeria MTN bank Nigeria

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh