Ethiopia Awards First Private Telecoms License To Kenya’s Safaricom

The Ethiopian government has granted the Ethiopian Communication Authority permission to grant a license to Global Partnership for Ethiopia, a consortium led by Safaricom and consisting of Vodafone, Vodacom, Safaricom, and Sumitomo Corporation. The consortium will pay $850 million for the license and will spend $8.5 billion.

“We will soon open a bid for the remaining licence,” said Balcha Reba, director-general of the Ethiopian Communications Authority speaking to Reuters.

MTN, the other competitor, bid $600 million but did not receive the license.

A Look At The Winning Consortium — Global Partnership for Ethiopia

Making up the winning consortium is Vodafone, a British multinational telecommunications firm which has partnered with Vodacom, Safaricom, CDC Group, and Sumitomo Corporation.

While South Africa’s Vodacom will have a 6.2 percent stake in the consortium, Safaricom, a Kenyan telecommunications behemoth will retain 56% and consequently be the lead partner in the bid. Sumitomo will, however, own 25% of the company while the CDC Group — the UK’s development finance institution — is expected to hold 10% of the new consortium’s shares.

Read also:MTN, Safaricom Jostle for Ethiopia’s Telecoms Operating Licences

“The respective consortium members may invest through special-purpose investment vehicles for structuring purposes,” Safaricom said of the new Ethiopian entity’s structure to Reuters.

Safaricom Most Likely To Launch Its Mobile Money Arm, M-PESA In Ethiopia Soon

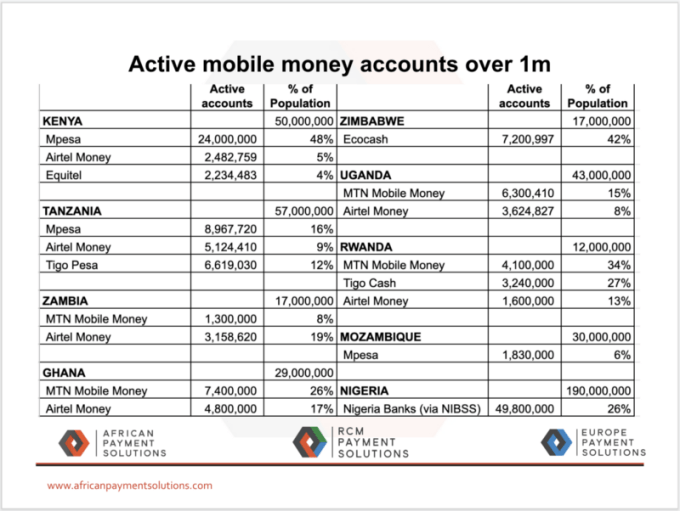

The newly granted license will mean so many things for Safaricom, including the launch of its famous mobile money brand, M-PESA in Ethiopia.

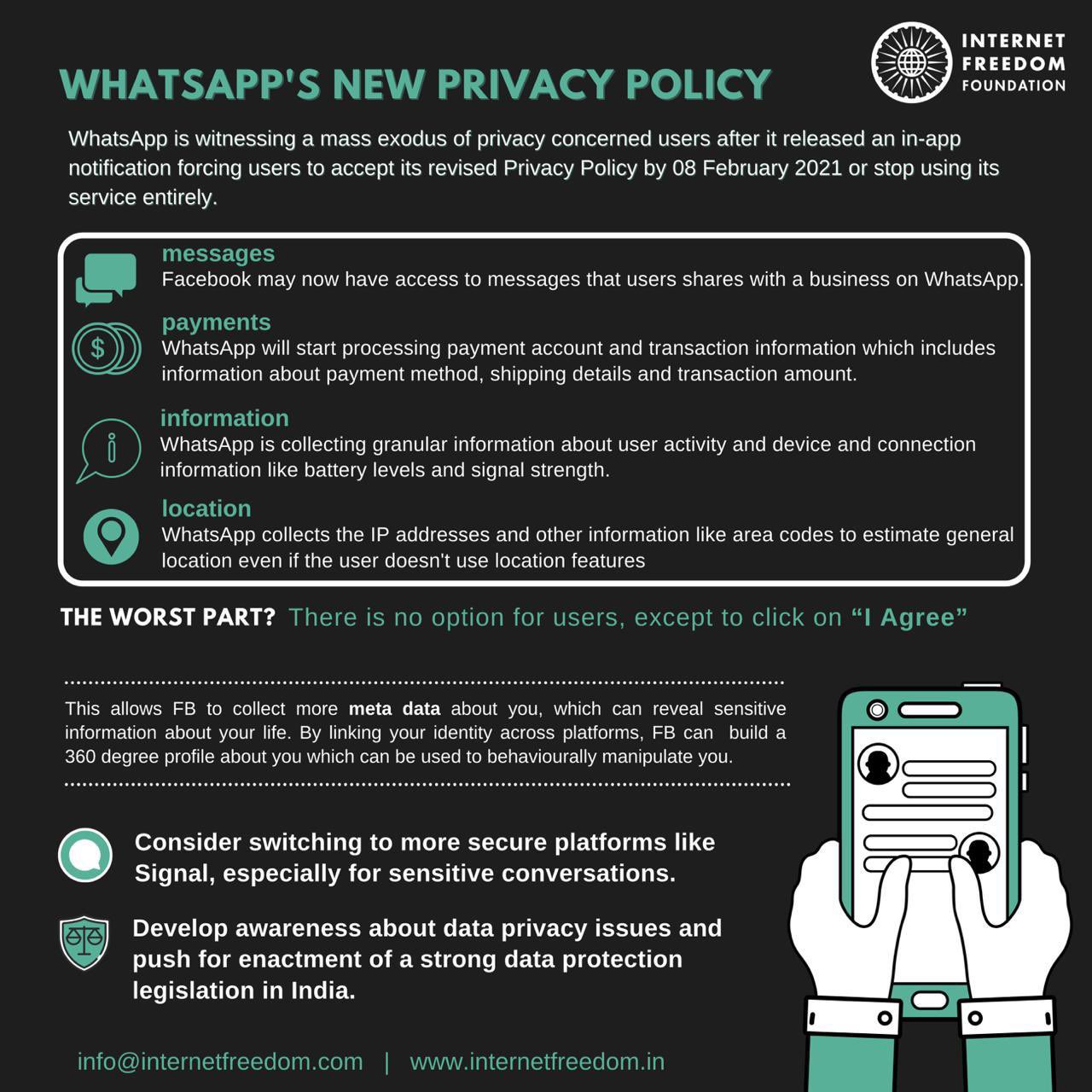

This follows a recent review of its previous position on foreign participation in Ethiopia’s mobile money services by the ECA. Hence, for the first time in history, the country would be letting foreigners into its financial services. According to a source, the proposed new telecom licenses will enable licensees to sell mobile money services. They will also not be limited to using Ethio Telecom’s infrastructure, according to the same source.

Notwithstanding the expected entry of Safaricom into mobile money services, Ethio Telecom, the state-owned telecoms outfit had proceeded to launch Telebirr, its mobile money service recently. Ethio Telecom’s Telebirr is already available to the company’s over 53 million customers.

Read also:African Fintechs Invited To Participate In FinTech Accelerator 2021. How To Apply

Ethiopia had received harsh criticism from a number of authorities, including the World Bank in February, for its policy of prohibiting new operators from offering mobile money and restricting infrastructure competition.

Despite the latest move to allow foreign participation in the provision of mobile money services, Ethiopia (which is Africa’s second most populated country after Nigeria) continues to place a bar on foreigners owning stakes in banking, insurance, brokerage services, and legal consultancy businesses.

In October 2020, after series of negotiations and deliberations, the National Bank of Ethiopia (NBE), finally granted a license to state-owned telecoms company, Ethio Telecom, to start mobile money service in the country. This followed the issuance, in April 2020 by the bank, of a regulation called Licensing & Authorization of Payment Instrument Issuers. For the first time in Ethiopia’s history, the regulation allowed mobile money transactions.

The regulation has also opened up the country’s financial services sector to include that a licensed payment instrument issuer may, with the relevant agreement with regulated financial institutions and pension funds, be allowed to provide micro-saving products; micro-credit products; micro-insurance products; or pension products in the country.

Read also:MainOne’s Cloud Connect to Increase Business Connectivity in West Africa

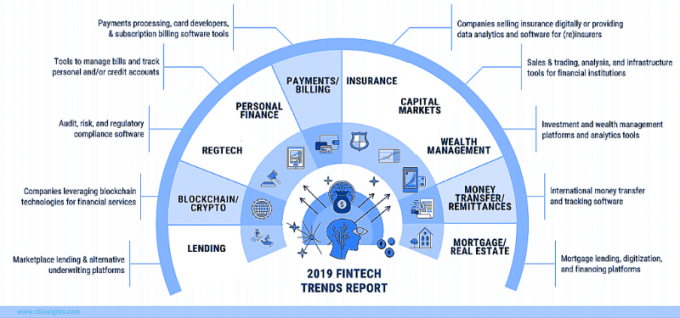

The National Bank of Ethiopia also issued, that same year, a “Licensing and Authorisation of Payment System Operators Directive (ONPS/02/2020), allowing financial technology companies (fintechs) to start off payment processing and related services in Ethiopia.

Five licenses under the payment system operator directive include National Switch, Switch Operator, ATM Operator, POS Operator, and payment gateway license.

Although not yet there, it does seem that the days of bar against foreign participation in the country’s financial services sector are numbered.

Ethiopian license Safaricom Ethiopian license Safaricom Ethiopian license Safaricom

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer