Finding Customers In The Time Of Coronavirus: What Startups In Africa Can Do To Survive

The next few months are going to be heavily uncertain, and if the report held out by Startup Genome that 41% of global startups have less than 3 months of cash is anything to go by, the lives of startups, especially those in Africa, would heavily be set on edge. And startups in Africa had better watch this because unlike the UK government that recently announced a $1bn pledge to support startups; the Portuguese who just launched a €25 million package for local startups; or even France which has pulled out a chest of €4bn cash injections for its startups, there is currently no African government announcing a major monetary intervention to forestall the looming disaster in its startup ecosystem. Although South Africa and Nigeria, the continent’s most valuable startup ecosystems have tried to intervene, that may not be enough. While South Africa and Nigeria said at least $10.5 billion and $130 million respectively should serve as coronavirus support packages in their respective countries, the packages all come by way of loan facilities, and there is nothing to show that startups have more exclusive access to them than, say, an ordinary household looking to raise funds for household expenses. This is very much unlike, for example in France, the UK or Portugal where the funds come by the way of grants and loans, or simply investments through venture capital or private equity firms. Although also some African governments such as Egypt, South Africa among others have announced a series of tax cuts and reliefs to cushion the effects of the economic hardship occasioned by the outbreak of the coronavirus, these may only be relevant for startups that are still going concerns. Startups first need cash to stabilize their operations and retain workers before going to file regulatory returns with the government. There therefore follows a hard but true statement that as the coronavirus pandemic lingers in Africa, startups are entirely on their own.

To that effect, could there be interim measures startups on the continent can initiate to ward off the short term impacts of the pandemic on their existence? We think there are.

Pivot!

Change the course of the ride! For startups who have been forced to obey government lockdown orders, and have therefore shut down their operations, especially those that are not in the essential services sectors at this time, this seems the safest route to take. This is however more true for startups and businesses in the same industry. For example, Max.ng, a delivery and motorbike ride-hailing company in Nigeria, has turned their full attention to delivery, in response to the government lockdown order. Another remarkable story of such pivot is at Uber, industry giant in ride-hailing, which has developed a new tool for drivers who were most hit by the coronavirus. The company is now making it easier for its drivers to jump from one of its businesses to another. The Work Hub lets Uber drivers receive other work from the company’s other platforms such as Uber Eats, Uber Works and Uber Freight as well as the options to work for other companies in search of workers such as Domino’s, Shipt and CareGuide.

“They’re doing essential work to keep our communities moving as we fight this virus, but with fewer trips happening they need more ways to earn,” said Uber CEO Dara Khosrowshahi on the Work Hub homepage. “With the Work Hub, we hope drivers can find more work opportunities, whether that’s with another of Uber’s businesses, or at another company.”

However, while most startups may be constrained by time, resources and talent to embark on a major short term shift in operation, acquisition of startups which are offering essential services, and which are threatened by lack of resources may seem a major economic decision of survival to take now, although the liability of brand awareness may pose greater challenges. A new report by the Middle East and North Africa (MENA)’s largest startup data platform MAGNiTT shows investor appetite has increased in startups covering grocery delivery, healthcare, e-commerce and edtech (or online educational startups). Interswitch, the Nigerian digital payment solution saw this in time. In 2019, the leading e-payments giant acquired a majority stake in healthcare technology company, eClat. Although, Interswitch already belongs in a very successful ecosystem — fintech — expanding to healthcare is a masterstroke that has effectively positioned the company to play a crucial role in the health crisis. Interswitch has integrated its famed payments infrastructure with eClat. eClat has over seven years experience providing support services to healthcare service providers, and currently has major operations in Lagos, Oyo, Edo, Delta, Enugu and Ondo states in Nigeria, most of the states already worst hit by the coronavirus pandemic.

This is therefore a crucial time for startups to pivot, from physical classroom to online classrooms; from physical events to online events, and so on.

Read also: Egyptian Event Startup Eventtus Raises Funding Round To Move Events Online

Partner!

For most startups who are already short of cash and afraid of the risk of pivoting, or are even pinned down by the resistance of their major investors, this is probably the best time to pull a pen and sign a partnership deal with businesses in the essential services industry. One of the major advantages of running a startup is the freedom and less bureaucracy to explore trends and disruption opportunities. Startup founders also have the capacity to make quick decisions, and at least in far less formal ways. Therefore, the time to pull the partnership plug may be now! FinTech company, AellaCare and leading health insurance enterprise Hygeia’s partnership in the wake of the outbreak of virus in Africa is a big case in point. People are most concerned about their health status now. Government’s policies on health insurance don’t just exist. By estimates, about 95 percent of Nigerian adults, for instance, do not have insurance coverage and 77.2 percent of the country’s population have no understanding of what insurance entails. Aware of the fact that it is not one of the leading fintech companies in Nigeria and amidst the fear of being forced to shut down, AellaCare immediately pulled a partnership deal with health insurance enterprise Hygeia which they hope would help bridge the gap between people and health care services in Nigeria with relatively affordable health insurance coverage.

Through the partnership, customers can get Hygeia’s insurance plans on credit via the Aella app, which guarantees tailored financial plans, the flexibility of payments and better-improved healthcare access. Additionally, people can seek and receive needed health services such as General Consultations, Pharmacy Benefits, Ante-Natal Care & Delivery services, Accidents and Emergencies, Surgeries, Outpatient and Specialist Consultations, HIV/AIDS Care and Treatment, Dental Care, Prescription Glasses, Family Planning Services among others.

Another notable story of partnership in Africa in this period of the coronavirus pandemic is that between Twiga Foods and Jumia Kenya. In a bid to capture more market and increase returns, Jumia Kenya quickly entered into a mutual partnership deal with Kenya’s fruits and vegetables delivery platform Twiga Foods.

“Our partnership with Twiga will allow customers to shop on Jumia for the fruits and vegetables they need. We are offering same-day free delivery on the platform in Nairobi. And will save customers money as Twiga cuts out the middlemen by buying directly from smallholder farmers across the country,” said Sam Chappatte, Jumia Kenya’s chief executive.

However, partnership doesn’t always have to be complicated; it is a common fact that a lot of online shops are now offering dealers spaces on their platforms to display their wares.

To read more on how startups can partner with big corporations in an era of fierce competition click here.

Digital Marketing

While there is a greater need to conserve cash this period by the advice of different investors, a lot of people are now living online. DataReportal analysis indicates that 4.57 billion people now use the internet, an increase of more than 7% since this time last year. Social media users are growing even faster, up by more than 8% since April 2019 to reach 3.81 billion today.

Particularly, detailed research from GlobalWebIndex reveals that people all over the world have been spending considerably more time on their digital devices as a result of coronavirus lockdowns.

Launching advertising campaigns that target these devices may therefore present an opportunity of signing on new customers, although companies, like Facebook, have some doubts about the convertibility of these numbers into customers. Facebook recently advised investors that recent increases in user activity may not translate into equivalent increases in ad revenue, stating that:

“Facebook doesn’t monetize many of the services where we’re seeing increased engagement, and we’ve seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of COVID-19.”

However, further research from GlobalWebIndex shows that more than half of internet users (51%) approve of brands continuing to advertise as normal despite the coronavirus outbreak, compared to less than one in five (18%) who say they disapprove. Just under a third (31%) say they neither approve nor disapprove.

No matter how the argument goes, companies with extra cash to spare may consider lean budgets on advertising, and digital advertising is the definitely the right space to be in in this trying time.

To learn more about the different digital marketing channels and strategies to explore for your startup during this period, click here.

Inform Your Customers!

Most consumers are clueless around this period of the pandemic. For the less tech-savvy ones among them who have been forced to move online, there is so much information and even insufficient information online to process. This group of consumers usually tend to stick with any tried and tested source of service provider they eventually meet. According to survey results from late-March, 84% of US consumers say how companies act during the current market is important to their loyalty moving forward. It then becomes important that businesses position themselves well to help solve this critical need for clear, specific information with details about where, how, and when to get needed things which will help people get by and adapt to the recent changes in life.

According to Google, search interest is spiking for the following topics: Retail; “Can you freeze” different types of food; Home delivery; Short term work employee; or even Suspension of rent on housing. Creating content that informs people about those topics is one of the ways marketers and brands can help consumers right now.

Google therefore offers these recommendations: Acknowledge the new reality; Give people credible, detailed, and current information about your operations. Reinforce that you’re there to help; Regularly update communications across your website, blogs, social handles, and Google My Business page; Be flexible. Help customers with cancellations, refunds, and customer service; Look for ways to connect your customers, locally and globally; Let people know that solutions are available whenever, wherever; Assess when people need you most, whether through your own first-party data (like site analytics or email opens) or Google Trends, and adjust your communications strategy accordingly; Update or publish often.

Put simply, Google recommends that there’s a need for content that informs, entertains, connects, and promotes wellness.

Develop A Culture Of Constantly Evolving

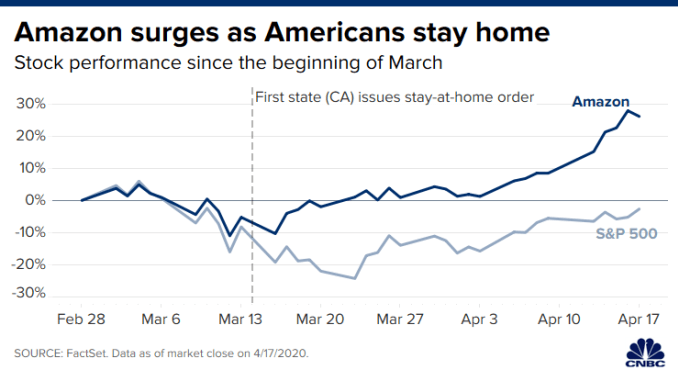

Think of it, traditional brick-and-mortar retail companies and businesses appear to be the worst hit by the pandemic. Companies which have constantly reinvented themselves, appear to be laughing last now. The statement that nothing would ever remain the same again after the coronavirus pandemic is only a truism for businesses that have adopted constant innovation and remodeling strategies and those who have the strong organisational culture to do so. Companies, like Amazon, have long moved on. And as one American newspaper puts it, “if Amazon dominated the retail market before the coronavirus pandemic began, there’s good reason to believe it’ll emerge from the crisis even stronger.”

Amazon’s success is not an overnight miracle. Its constant reinvention of itself through a culture of innovation, remodeling and reinvention has prepared it well to confront the current coronavirus pandemic.

This 2016 report about Amazon’s growing power, by Stacy Mitchell co-director of the Institute for Local Self-Reliance, a nonprofit that advocates for an economy built on strong independent businesses summarizes the company’s success as follows:

Amazon presents a vastly more dangerous threat to competition than Walmart, because its ambition is not only to be the biggest player in the market. Its intention is to own the market itself by providing the underlying infrastructure — the online shopping platform, the shipping system, the cloud computing backbone — that competing firms depend on to transact business.

In the interim, it may be expedient to pursue the above listed strategies, but when we say of the world not remaining the same again after the coronavirus pandemic, we mean that a new world order that may not be severely threatened by similar disease outbreaks in the future is going to be constructed. African startups therefore, cannot afford to be left behind both in the short and in the long terms.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.