ECO: As West Africa Takes the Single Currency Plunge

Analysts have started exploring opportunities inherent in the proposed single currency for the West African region; The Eco. It could be recalled that leaders of the 15 member states of the Economic Community of West African States (ECOWAS) met in Abuja, Nigeria, and formally agreed on the name of the planned common currency the “ECO” The currency according to a release from ECOWAS Secretariat Abuja, would be based on a flexible exchange rate regime, coupled with a monetary policy framework focused on tackling inflation.

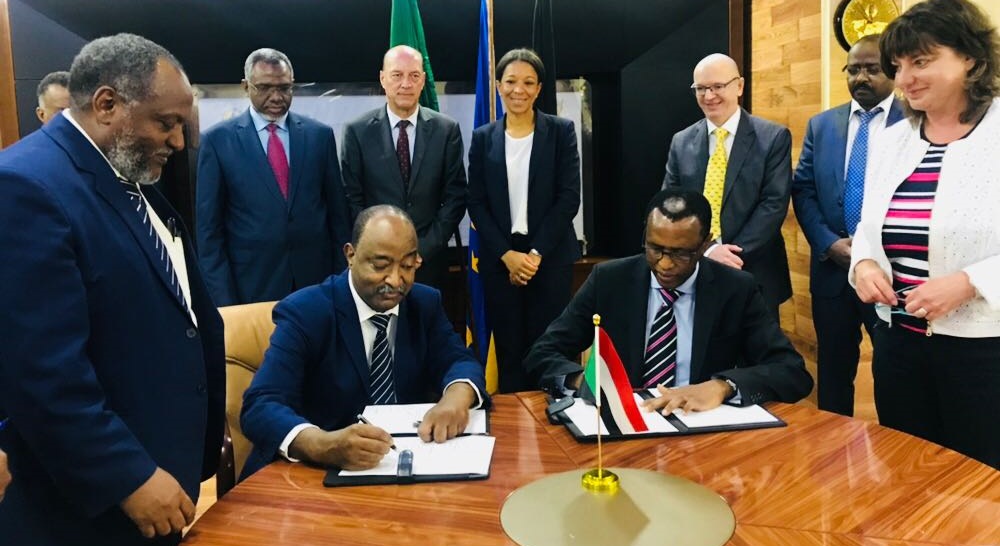

Observers say there seems to be a sense of urgency in this latest efforts, maybe being buoyed by the recently signed Africa Continental Free Trade Agreement (AfCTA). This is because the target launch date for Eco has been postponed several times; in 2005, 2010 and 2014; since the concept first arose in 2003. Now the Economic Community of West African States (ECOWAS) is planning to launch the currency in 2020, with member states agreeing to name it the ‘ECO’ there seem to be a new sense of urgency.

Reports indicate that governments in the region are keen on more integration and a single currency will facilitate trade, lower transaction costs, and payments amongst ECOWAS’ 385 million people.

Currently, eight of ECOWAS countries i.e. Benin, Burkina Faso, Guinea-Bissau, Ivory Coast, Mali, Niger, Senegal, and Togo jointly use the CFA franc while the remaining six members have their own independent currencies.

Some analysts are of the view that the single currency if properly implemented will improve trade by allowing specific countries to specialize at what they are good at, and exchange it for other goods that other countries in the bloc produce more efficiently.”

A report by the African Development Bank Group (Afdb) indicates that the 2020 deadline for the single currency will most like be postponed again unless the region can align with its monetary and fiscal policies.

Countries are required to meet a ten convergence criteria, set out by the West African Monetary Institute (WAMI), by the 2020 deadline. The primary four beings: a budget deficit of not more than 3%, an average annual inflation rate of less than 10%, Central Bank financing of budget deficits should be no more than 10% of the previous year’s tax revenue and gross external reserves worth at least three months of imports.

The six secondary criteria to be achieved by each member country are: Prohibition of new domestic default payments and liquidation of existing ones, tax revenue should be equal to or greater than 20 percent of the GDP, wage bill to tax revenue equal to or less than 35 percent, public investment to tax revenue equal to or greater than 20 percent, a stable real exchange rate and a positive real interest rate.

However, reports indicate that although countries may meet the criterion by the deadline they fall behind thereafter thus posing the main difficulty in inconsistencies.

As at today, only five countries, viz; Cape Verde, Ivory Coast, Guinea, Senegal and Togo of the region’s fifteen countries currently meet the single currency’s criteria of a budget deficit not higher than 4% and inflation rates of not more than 5%, as noted by Charlie Robertson, chief global economist at Renaissance Capital.

Additionally, while ECOWAS says the integration will be gradual as countries meet the criteria, it’s unlikely that a 2020 launch date is feasible as there is no significant progress in the design, production, and testing of the currency notes.

Given that various economies in the region are at “dramatically different levels of development,” the leadership of ECOWAS is being unrealistic in both its timing for the currency’s launch and expectations of what it might achieve, Robertson says. “You’ve got very different levels of debt, interest rates, and budget deficits. Trying to align these countries to operate as one is extremely difficult,” he says. “What currency policy is right for two such divergent countries like saying Ghana and Burkina Faso?”

There is also the glaring disparity in the economic size of Nigeria in the region. For example, Nigeria is 67% of ECOWAS’ GDP, so really this isn’t a single currency for 15 countries, this is the Nigerian Naira plus a few countries.

How the leaders hope to close all these gaps between now and next year remains to be seen.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.