Kenya: How Smallholder Farmers Can Benefit From The Newly Signed EU Bank ’s EUR 50 Million Deal For Smallholder Farmers

Good news for small-scale farmers in Kenya. This is a huge opportunity to benefit from the newly signed deal between the European Investment Bank and Equity Bank of Kenya. The two banks have signed an Sh5.7 billion (EUR 50 Million) deal to finance agricultural development in the country.

Here Is The Deal

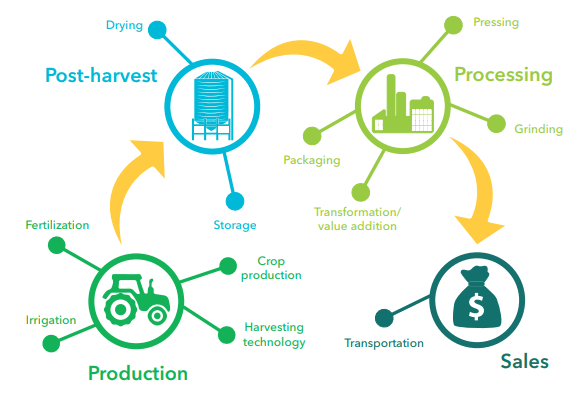

- In the deal with EIB, Equity Bank through the program termed Kenya Agriculture Value Chain Facility will provide smallholder farmers and small agriculture-based Small and Medium-sized Enterprises (SMEs) with credit to expand their operations.

- Working with Equity Bank across the country, the new Kenya Agriculture Value Chain Facility will help agriculture companies to modernize and harness the full economic, employment and export potential of agriculture as well as expand business with local smallholders.

- The European Investment Bank aims to extend the project to other financing partners in the future with a focus on service providers expanding their reach to rural communities and smallholder farmers.

- Agriculture is the leading source of economic activity, employment, and exports in Kenya. Agriculture contributes directly and indirectly to 51% of Kenyan GDP and accounts for 60% of jobs in the country.

Who May Get The Loan?

The loan program is strictly for agriculture companies and ventures that intend to modernize their ventures as well as embark on agriculture projects that are capable of creating employment opportunities for Kenyans. Agricultural businesses that are also interested in expanding their venture capacities may also apply. The enterprises targeted include Value Chain SMEs in agribusinesses that are supporting a smallholder farmer base.

“Equity Bank has aligned its strategy with the Big Four agenda, which includes agriculture, and our focus is on growing the agribusiness portfolio through servicing all segments from retail to SME to large enterprises and corporate banking customers,” said Equity Bank Kenya Managing Director Polycarp Igathe.

Is The Loan Attractive Enough For Kenyan Small Scale Farmers?

The sum of £50 Million has been budgeted to make this happen. This is the first ever dedicated support for long-term investment by agriculture companies in Africa backed by the European Investment Bank, the world’s largest international public bank.

When procured, beneficiaries will have up to seven (7) years to pay back. This is expected to take care of the highly risky agricultural sector mostly affected by adverse weather patterns.

The maximum amount of loan to be procured by the beneficiaries is 50% of the project cost as long as the beneficiaries are eligible.

Presently, the duration of most loans in Kenya is 12 months. 7 years to pay back the principal sum is a big edge. The new funding would be made available in Kenya Shillings. This will mitigate exposure to foreign exchange risks that currently hinder agriculture investment in Kenya.

“It is good to see the European Union’s bank, the European Investment Bank, partner with Equity Bank. This is the first time the EU funds the private sector in the agricultural sector in Kenya directly. There is a great deal of expectation on this new approach. The EU chose it in Kenya because we recognize that smallholder farmers do not need handouts: they need an enabling environment to be successful market operators. This requires access to finance and reducing the risk of investing in a difficult environment.” said Walter Tretton,Chargé d’affaires of the European Union delegation to Kenya.

Which Bank To Get The Loans From?

Equity Bank is the only Kenyan bank to get the loan from, in the meantime.

Equity Bank is the first Kenyan partner to participate in the Kenya Agriculture Value Chain Facility and other financial institutions are expected to join later. Equity Bank is one of the key financial institutions supporting the agricultural sector in Kenya and is a leading provider of financial services to rural communities and smallholders, the EU bank noted.

The EIB also noted that Equity Bank has identified the potential for growth, by adding medium size and large commercial farmers to the Agriculture portfolio as well as focusing on the financing of the Agri-Food processing companies.

Since 2007, the European Investment Bank has made available one billion euros (Sh114 billion) for private sector investment in East Africa through credit lines in both local and international currency in partnership with more than 25 banks and financial institutions.

Equity Bank Now Has Branch In Addis Ababa Ethiopia

Small scale farmers and businesses in Ethiopia may also now benefit from Equity Bank’s line of credit. This is because the bank has set up a commercial representative Office in Addis Ababa, Ethiopia as it prepares to expand into the hitherto protectionist economy. The bank’s Ethiopia branch is expected to be fully operational next month.

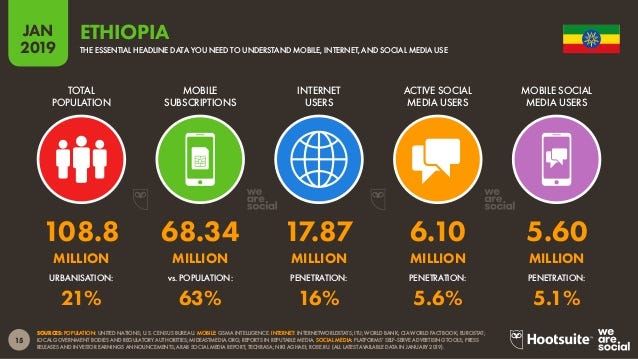

The entry into Ethiopia, a country with a population of nearly 100 million people, follows the Government’s appointment of a privatization commission and the ongoing reforms which are aimed at promoting a growing private sector.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.