Pushed Against The Odds, This Entrepreneur Is Rebuilding His Life From Cryptocurrency And Blockchain Technology

When Mr. Tola Fadugbagbe relocated back to Lagos, Nigeria’s largest city for the second time in his young life, there was nothing yet like cryptocurrency or bitcoins or tokens or Blockchain technology. He could only be fused into one of the over 17.5 million people living in the city. And it appeared he was merely making up the population because it seemed the city looked too overwhelming to fit in. It didn’t take long before several months of homelessness hit him hard in the face.

‘‘For several months, I stayed in an uncompleted building. Life was nothing but hell. I was running around struggling to get funds to complete my education to university level,’’ he tells Afrikan Heroes.

Then a job stint at a highly successful real estate development company. A break-away to start up a local block making factory, and a sudden bankruptcy and closure of the facility because clients who promised to pay took delivery of his blocks but never cared to pay back, Mr. Fadugbagbe says he is still banking on his integrity, determination, cryptocurrency and blockchain technology to take him farther than he has ever thought.

‘‘ One thing I always prove to people about myself wherever I go is integrity. Anywhere I am, people always get to know me as someone with integrity. That was why I stayed longer than expected at the real estate company,’’ he said.

Mr. Tola said he learned his lessons about running his first startup the hard way:

While I was working in the real estate company, I discovered that there was a problem that needed to be solved: the quality of concrete blocks being delivered to this site. You know, the blocks they usually supplied the real estate company were not strong enough. So I thought that if I ventured into this business, I could make some future from it. So after I left the real estate company, I set up a block making factory.

When the factory was up and running, I was so happy that I was progressing. I was generous and selling on credit. But before I knew what was happening, people were withholding my money and they were telling me stories. As I’m talking to you now, these people are still owing me. I was back to square one after that nightmare: I could not even produce even though my equipment was on ground.

‘‘Till Date, It Has Been Marvelous Getting Involved in Cryptocurrency.’’

While reading about cryptocurrency and blockchain technology sometime in 2016 from two of his Facebook friends ‘who were not usually detailed about the terms and the philosophy behind the concept’, Mr. Tola got interested and began extensive studies and inquiries into what cryptocurrencies are, only to discover that cryptocurrencies suited his philosophy. Since then, he says it has been ‘‘marvelous getting involved in cryptocurrency.’’

Today, he is part of a local network in Lagos and Nigeria that hosts conferences, seminars, boot-camps, and workshops training people on what cryptocurrency is and how they can trade in it.

I believe that cryptocurrency is a big deal. Big corporations can’t stop talking about cryptocurrency. They can’t stop implementing cryptocurrency in one way or the other. Look at the CEO of JP. Morgan, Jamie Dimon, who once told his workers that if they ever got involved in bitcoin they would be fired. He called Bitcoin a fraud, a scam and an evil. Few weeks later he bought bitcoins on Poloniex. Right now, J.P Morgan is using fragments of JPM Coin, the native coin of JP Morgan Bank. I mean JP Morgan is a US banking giant that move trillions of dollars across the globe daily. Right now they want to use their own token to scale payment protocols and remittances,’’ he says.

Mr. Fadugbagbe is not far from the truth. Earlier in February 2019, J.P. Morgan became the first major U.S. bank to create its own cryptocurrency with the launch of “JPM Coin.” The digital token was designed to settle transactions between clients of its wholesale payments business, specifically for international payments and securities transactions that migrate to the blockchain.

Mr. Fadugbagbe remembers one incident about how cryptocurrency has been more than a helpful innovation in the payment system.

‘‘Someone in the US sent bitcoins to me today. I sent Naira equivalent to the person’s beneficiary in Nigeria. If they are to rely on Western Union, the fees, the delay and all that would be too much,’’ he said.

‘‘I believe that cryptocurrency has come to stay. You know, there are some people in Diaspora that find it difficult to send money back home. Now, crytopcurrency has made it a lot more easier for them because they could just create crypto accounts over there and using those accounts, they can now send bitcoins to me, and I, in turn pay off their beneficiaries in Nigeria the Naira equivalent of the bitcoins sent to me. These things happen within a space of few minutes.

He says that unlike fiat currency that government can only print more, borrow more and yet remain heavily in debt, cryptocurrency always has an edge.

‘‘You can’t inflate it. Instead you can only reduce it. This means that, with time, crypto can always gain value. The only downside of it that it that it is highly volatile. That is why people should be cautious about the type of crytocurrrency they get involved in. In fact, the crypto market is highly competitive right now. So if you lay your hands on a token doing similar things to other similar tokens in the similar same crypto market, and if the token is not highly innovative, then it would not scale,’’ he says.

‘‘Whether You Like It or Not, Everybody Will Get Involved In Cryptocurrency’’

Mr. Fadugbagbe said the only thing remaining for cryptocurrency to become widely accepted is for governments to give their nod to it. For that, he sees a huge opportunity for early investors.

”So if you look at the future of cryptocurrency, you can’t but be part of it at this early stage. Many people see Bitcoins, ethereum and cryptocurrency as the dark part of the internet because some governments are yet to approve it. Whether we like it or not government plays a major part in controlling the mindset of the citizens. Just take a look at the stories of MTN and DSTV before they became big players in their industries. We all know are they were first rejected by governments,” he says.

Why Africa is Lagging Behind In Cryptocurrency and Blockchain Technology?

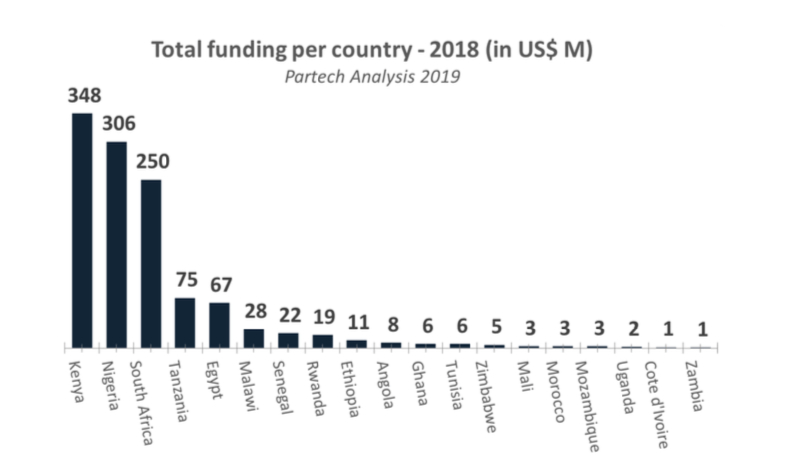

Mr. Fadugbagbe says Africa is lagging behind because of the continent’s low rate of adoption of the innovation. He says anything revolutionary will be adopted quickly in any continent or any country when the government welcomes it wholeheartedly. Although he says African governments are usually ‘‘just slow in adopting something as disruptive as cryptocurrencies,’’ he has hope that Africa would get there someday.

”This is one of the reasons why we’ve been hosting seminars, workshop, bootcamps. We still need to engage the government.We just have to keep talking about this. We hope that one day, we would get the attention of the government to approve the necessary framework for cryptocurrency and blockchain technology. Just take, for instance: if you can now travel to all West African countries using Bitcoins. It would really mean that more people would get interested in bitcoins. If the government also says you can now pay your tax with bitcoins, many people would be eager to pay tax,” he says.

Mr. Fadugbagbe also finds a big problem with the way international communities see cryptocurrencies coming out of Africa.

”International communities believe that an average Nigerian or African is a scammer,’’ he says. ‘‘ Once cryptocurrencies are coming out from Africa or Nigeria, the international community doesn’t usually trust them, even when the intention is good,’’he says.

How Startups Can Leverage Crypto To Boost Their Businesses

Mr. Tola says smart startups can leverage cryptocurrencies to boost their business even without any formal partnerships with any blockchain organizations or blockchain platforms. To do this, he says African startups may consider accepting cryptocurrencies such as bitcoins, bitcoin ethereum or any other viable coins. Doing this not only boosts startups’ businesses but also gives their businesses free advert.

”Free advert because cryptocurrencies guys everywhere in the world will begin to refer your business. Take for instance, the impact of having a barbershop somewhere in Nigeria where you can now have hair cut and pay with bitcoins. In trying to convince your folks about the existence of such barbershop, you may begin to refer to such words as ‘‘look at the barbershop here. Look at its office phone number.’ The same way, you may refer to a hotel in Cameroon where you can now check into, pay with bitcoin and get discount. Or somewhere in Zambia where you can vacation to and pay with cryptocurrency. This will give startup owners free adverts. Just imagine a consumer in Nigeria, Cameroon, Senegal, South Africa, Uganda talking about your business.”

”This is why celebrities keep progressing because we keep talking about them. Who knows? But Reginal Daniels has so much been in the news and may be landing brand ambassador deals even. So this will give startups free adverts, thereby generating more leads for their businesses.”

‘’Governments Can Use Blockchain Technology To Keep Records Of The Number Of Books Received By Each Student’’

Mr. Fadugbagbe tells prospective blockchain technology investors in Africa to start submitting proposals to the government because there is a huge opportunity in that regard.

‘‘Africa needs blockchain tech the most. We can use blockchain to curtail the inefficiencies in the system. In most education ministries in Africa, for instance, books are distributed from time to time. Government can use blockchain tech to keep records of the number of these books received by each student. For every book the students receive, they can thrown in a token from their backends, using a smartphone. This is the smartest way to get feedback from Africa’s cluttered data management system. So let’s begin by sending in proposals,’’ he said.

Mr. Fadugbagbe says blockchain technology makes for more accountability and efficiency in the system, and unlike humans, data stored in blockchains cannot be tampered with.

‘‘You look at blockchain as a record that cannot be edited,” he said. ‘‘For instance, a list of items or names, or a football team. When humans are involved, they can add or remove the names at will, but with blockchain technology, the list cannot be padded. So once added, the information cannot be altered.”

Moving On

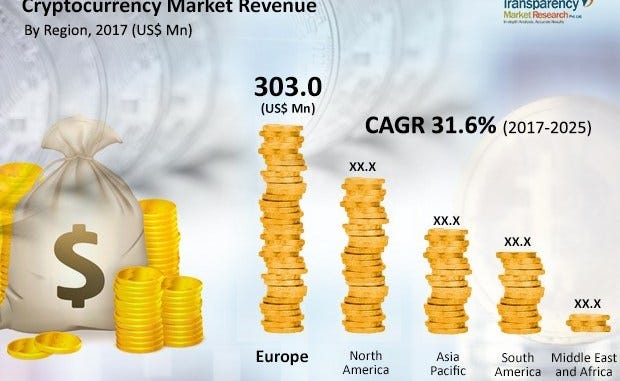

For a business model that was worth over $700 billion as of January 2018, the global cryptocurrency market is booming and is not relenting. Mr. Tola Fadugbagbe does not see this ending too. No longer homeless and frustrated by bad debt, at least not in the category he once fitted in at his former startup, he has since moved on.

‘‘Right now,’’ he says, ‘‘I am living in a good and comfortable apartment. I have been reinvesting into large scale agriculture — a cocoa farm and and poultry — from the proceeds of my blockchain business. My aim is to grow them into the biggest phase they could ever be in. I like my life so simple because of what I have experienced in the past. I’m not going back to that nightmare.’’

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.