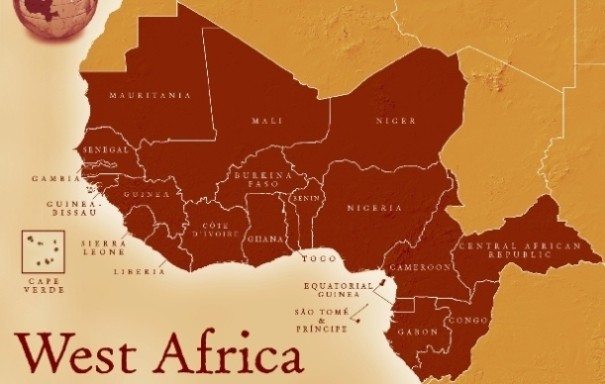

Inequalities in West Africa the worst on the continent, says report

West Africa suffers the most inequalities on the continent but many governments prefer to ignore problems despite economic growth, a report by Oxfam and Development Finance International reads.

According to the “West Africa Inequality Crisis” report, six of the 10 fastest-growing economies in Africa are in West Africa, with the Ivory Coast, Ghana, and Senegal among the world’s 10 fastest-growing economies. “In most countries, the benefits of this unprecedented economic growth have gone to a tiny few,” the report reads.

“Inequality has reached extreme levels in the region, and today the wealthiest 1% of West Africans own more than everyone else in the region combined.” The report reads the vast majority of West Africans are “denied the most essential elements of a dignified life, such as quality education, healthcare, and decent jobs”.

In Nigeria, for example, the wealth of the five richest Nigerian men combined stands at $29.9bn — more than the country’s entire budget in 2017, the report reads.

Rather than tackle inequality, some of the region’s governments are underfunding public services, such as health and education, and failing to tackle corruption, Oxfam’s regional director Adama Coulibaly said.

The report called on governments to do more to promote progressive taxation, boost social spending, strengthen labour market protection, invest in agriculture and strengthen land rights for smallholders. For example, it said the region loses an estimated $9.6bn annually because of corporate tax incentives offered by governments to attract investors.

But not all governments are tackling inequality the same way. Cape Verde, Mauritania, and Senegal are among the most committed to reducing inequalities, it said, while Nigeria, Niger, and Sierra Leone are among the least.

Ivory Coast farmers expect bigger cocoa crop as rains beat average

Above-average rainfall last week in most of Ivory Coast’s cocoa-growing regions will boost the October-to-March main crop, but more sun is still needed, so says Ivorian Cocoa farmers. The mid-crop, which lasts from April to September in the world’s top cocoa producer, is coming to an end as few beans were leaving farms and producers focus on the main crop.

Farmers said they were happy with the rains, which would bring many pods to be harvested from mid-September to November. But more sun would be needed over the coming weeks to avoid diseases in plantations and help pods grow bigger, they said.

In the center-western region of Daloa, which produces a quarter of Ivory Coast’s cocoa, growers said they were confident the start of the coming main crop harvest would be abundant and of good quality. “Everything is going well on the cocoa trees.

A lot of pods have grown well and within a month and a half we will start harvesting,” said Marcel Kamenan, who farms near Daloa. “We still need good rains and sunshine (in August),” Kamenan said. Data showed rainfall in Daloa, including the region of Bouafle, was 58.2mm last week, which is 35.3mm above average.

In the western region of Soubre, at the heart of the cocoa belt, farmers said they were expecting as healthy a crop as last season’s if the weather remained adequate in August. “We have a lot of big pods on trees, and flowers and cherelles are still proliferating. It’s a good sign,” said Kouassi Kouame, who farms near Soubre. “Sunshine is average,” however, he said.

Data examined by Reuters’ show rainfall in Soubre, which includes the regions of Sassandra and San Pedro, was 33mm last week, 14.5mm above the five-year average. Farmers were optimistic about the main crop in the southern region of Divo, which had 43mm of rain last week, 28.6mm above average.

In the central region of Bongouanou, the rain was at 28.7mm (13.2mm above average) while the central region of Yamoussoukro saw 38.6mm of rain, 22.7 mm above average. In the western region of Man, farmers were concerned heavy rains would bring diseases, after rainfall reached 75.9mm last week, 45.8mm above the five-year average.

“If it keeps raining like this over the coming weeks, we fear insects and diseases will spread on the plantations,” said Moussa Kone, who farms near Man. Rains were below average in the southern region of Agboville and in the eastern region of Abengourou but farmers there reported no damage. Average temperatures ranged between 23.9°C and 26.2°C.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.