Until recently, Mauritius used to be the tax haven where all businesses flock to. But that is about to change. The Mauritius government’s proposal to amend tax residency rules for companies is giving jitters to foreign funds operating from the tax haven. The current order is that companies set up their corporate offices in Mauritius while having their business operations overseas, in other countries.

The new proposal by the Mauritius government is that any moment from now, a company will not be considered tax resident in the country if it is centrally managed and controlled outside Mauritius. In other words, the era of tax haven in Mauritius is crawling to an end. Consequently, funds may lose tax benefit after the rule amendment.

To Understand The Implication of This, Here Is A Quick Recap of Ways of Taxing Foreign Companies In Mauritius

Under the Mauritian Global Business sector, a foreign company can fall in either one of two categories: GBC1 or GBC2.

A Global Business Company (GBC 2)

A Global Business Company (GBC 2) is a company that has its office in Mauritius but does business outside Mauritius. At all times, the company has the Management Company acting as Registered Agent in Mauritius. The GBC 2 is non-resident for tax purposes and therefore is a tax-exempt entity and cannot avail itself of the relief under the Double Taxation Treaty in force in Mauritius. Thus, a GBC2 company pays no corporate tax; no withholding tax on dividends; no interest and royalties; no Capital Gains tax; and has no access to the Double Taxation Avoidance Treaty.

The proposed amendment announced in the latest budget said that the Partial Exemption Regime under the Income Tax Regulations 1996 will be amended to define the detailed substance requirements that must be met in order for a taxpayer to enjoy the partial exemption benefit.

A Global Business Company 1(GBC 1)

A Global Business Company 1(GBC 1) can be in the form of a Trust, Sociéty and Partnership. This includes small and medium scale businesses. A GBC 1 is considered to be tax resident in Mauritius and is subject to corporate tax at 15%. Tax advantages for GBC 1 in Mauritius are that there is no capital gains tax and also no withholding tax on dividends, interest, and royalties paid or estate duties.

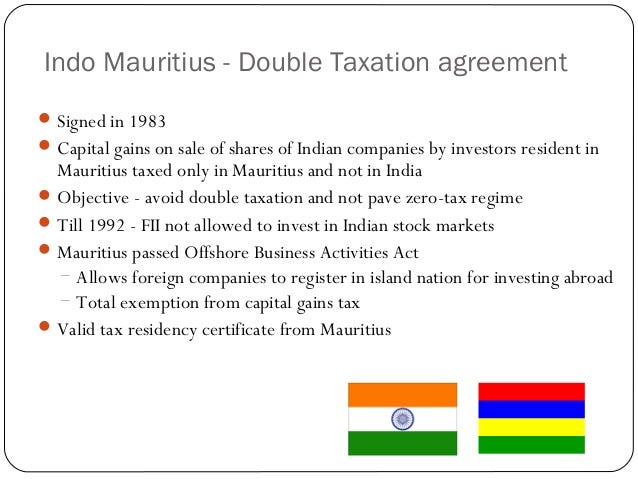

The expanding network of Double Taxation Treaties has further reinforced Mauritius as a tax efficient jurisdiction and is also one of the prime reasons explaining the growing investment in GBC 1. Activities commonly undertaken by a GBC 1 requiring no specialized license are Investment Holding, Trading and International Consultancy and it normally takes an average of 3–4 weeks to incorporate a GBC 1 with such standard activities.

Interpretation of The Intended New Rule

From the above, only the GBC 1 has access to Double Taxation Treaties between their countries and Mauritius. That is, where the business is run in South Africa and Mauritius at the same time. South Africa is a party to a Double Taxation Treaty with Mauritius. And as such, the business in Mauritius would be considered tax resident in Mauritius and is subject to corporate tax at 15%. Tax advantages for GBC 1 in Mauritius are that there is no capital gains tax and also no withholding tax on dividends, interest, and royalties paid or estate duties.

Should this new rule come into effect, hundreds of similar offshore funds operating out of the island nation would be heavily hit.

The question now, therefore, will be what operations are centrally managed and controlled?

The general rule is that a company will have to demonstrate that its entire management resides in Mauritius and if it is centrally managed and controlled outside, then it may not be entitled to it.

“If the authorities find that it is not in Mauritius, then the entity is not a tax resident at all, and if it’s not a tax resident, then the treaty benefits it gets with other countries will not be available to it,” experts said.

This change would hit hundreds of offshore funds operating out of the island nation and invest in their countries to take advantage of the double taxation treaties between their countries and Mauritius.

As An Example

In determining what operations of a company are centrally managed and controlled, let’s study this scenario.

A South African company may have its board of directors in Mauritius while it is managed from South Africa. In this case, the authorities could say the company is not eligible for tax residency. They will now look at the substance on the ground in Mauritius.

In many cases, the board meetings happen in Mauritius, directors are in Mauritius but the control and management are actually not in Mauritius. This would no longer be the case under the new arrangement.

Also See: Inside Mauritius Where A Majority of South Africans Are Migrating To And Their Reasons

The Implication of This

The fallout of this move will be that many of the structures currently set up in Mauritius and claiming treaty benefits on the basis that they have tax residency certificates may now have to take a look at the structures again.

So, many of the Mauritius structures may get challenged in Mauritius itself and several existing structures will be forced to increase the substance requirements within Mauritius for them to continue getting the tax benefits, experts said.

In simple terms, the consequence of not being considered tax resident in Mauritius is that the company would not benefit from the numerous tax advantages that obtainable from running its business in Mauritius. So, it is not a case of claim benefit from Mauritius, but do business in your home country. You have to manage your business in Mauritius before you claim the benefits.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.