WIC Capital Raises $1.6m To Invest In Female Founders Based In Senegal And Côte d’Ivoire

The initiative “Women’s Investment Club” (WIC) Senegal and Ecobank have inked a partnership deal worth one billion CFA francs (USD1,600,000) to promote female entrepreneurship in Senegal.

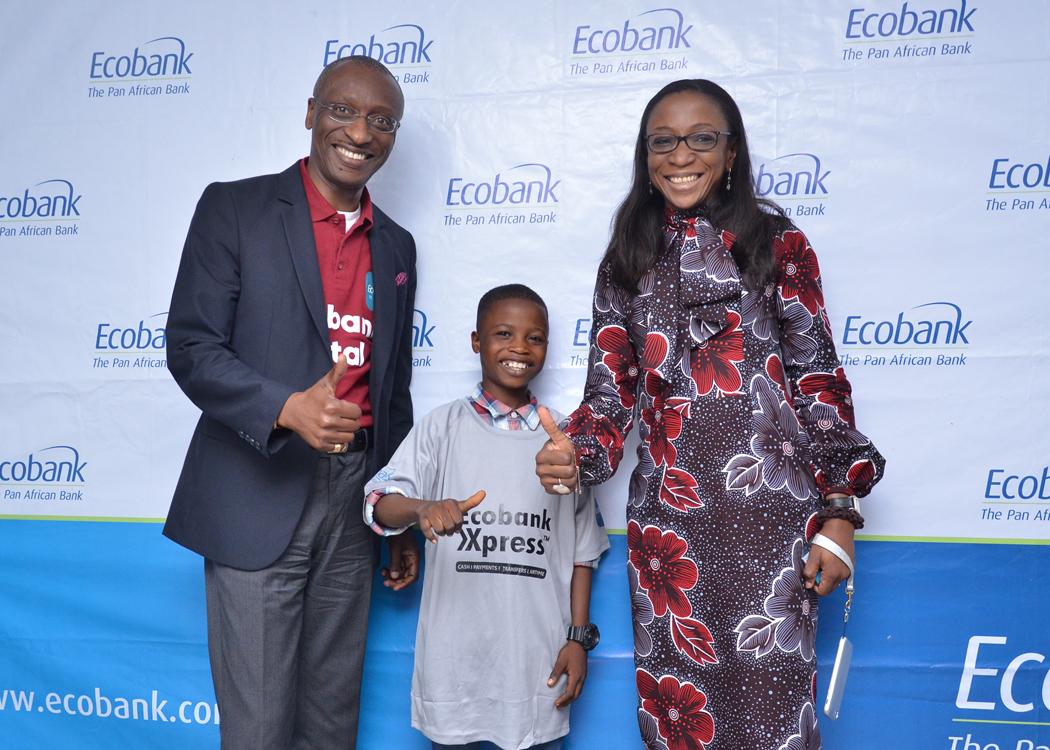

The symbolic cheque was recently handed over in the presence of Ecobank’s Managing Director, Sahid Yallou, and Evelyne Dioh Simpa, Executive Director of WIC Capital Senegal.

This financial collaboration, worth one billion CFA francs, is part of the “Ellever” program, which aims to assist women’s initiatives that promote financial independence for women by simplifying their access to contemporary and appropriate financial instruments.

Read also Congo Creates Autonomous Agency For Digital Economy Ahead Of Passage Of Startup Act

“Senegal has a particularly developed and dynamic entrepreneurial fabric; nonetheless, access to funding is one of the most significant barriers to growth. This is how the initiative assists female entrepreneurs and business owners,” Yallou elaborated.

According to him, female entrepreneurship has huge prospects, but women’s capacity is underutilized. “We’ve selected a collaboration strategy to ensure that we’re targeting the correct target and the right challenges,” he said.

Evelyne Dioh Simpa believes that by pooling efforts and resources, it will be possible to ensure that SMEs operated by women benefit more and more effectively from the financial support required for growth. She believes that “this relationship so comes at an opportune time for female businesses.”

Read also Egyptian Electric Mobility Startup Shift EV Raises $9m To Scale Business

Launched in March 2019 by the Women’s Investment Club (WIC) Senegal, WIC Capital is the first investment fund that exclusively targets women-led businesses in Senegal and Ivory Coast. The 11 billion CFA franc investment vehicle brings together local and international institutional and individual investors, who pool their resources to invest in micro and small women-owned enterprises (MSMEs) in Senegal and Ivory Coast. The Fund invests through a mixture of equity and quasi-equity in companies from all sectors, founded by women, owned or managed at least 50% by women, or with a management team predominantly female.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh