Do Accelerator Programmes Really Matter For Startups In Africa?

Not every startup will not struggle to raise funds in Africa. In fact, it is harder to do so if the founder is little known, previously untested, and expectedly naive to established venture capital firms, family houses, banks, High Net Worth Individuals (HNWI), etc. And although accelerators are not primarily houses of funds for startups left out of this implicit bias in access to funding, they have come to serve as one, and most importantly, the final hope of these founders ever accessing funds.

In a lugubriously-fashioned language, accelerators, also known as seed accelerators, are fixed-term (usually lasts from three to twelve months), cohort-based programs, that include mentorship and educational components and networking, often with investment. In simple terms, accelerators are to startups what schools are to students.

But does it really matter if a startup based in Africa does not make it through an accelerator? The answer is neither here nor there. African startups, from data, mostly go through accelerators to improve their access to funding, and if the accelerator is more glorified (like Y Combinator, 500 Startups, Techstars), to latch some flesh onto their valuations and consequently brighten their bargaining power when accepting investments.

Funding

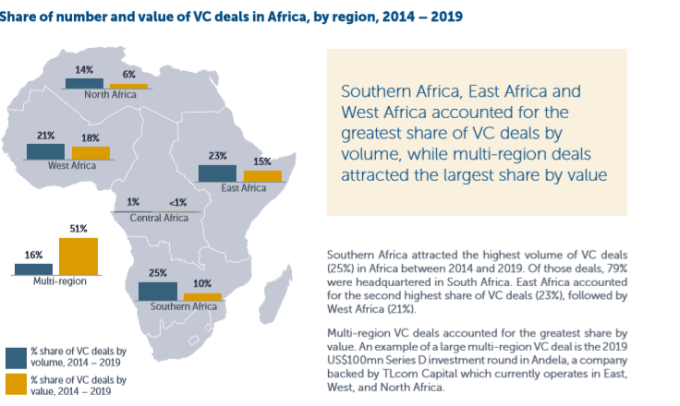

While funding accruing to the African startup ecosystem from venture capital firms is increasing year-on-year, the number of startups involved in the funding are relatively small compared to available data about the number of startups in Africa. In 2019, for example, while a platform like VC4A listed a total of 13,500 startups in Africa, only about 427 startups raised over $2 billion in funding. This means that if you are a startup in Africa, you are only about 3% more likely to raise funds from venture capital firms.

Hence, being accepted into an accelerator may be a major escape from this reality. Data show that most startups from Africa who went through the path of notable accelerators had it easy with funding. For example, Paystack’s participation in Y Combinator’s 2015 accelerator program was a deal breaker. It gave room for immediate funding to the startup from global giants like Tencent, Stripe, Visa, among others. By industry stereotypes, Paystack’s founders Shola Akinlade and Ezra Olubi could easily have been dismissed as high-risk investments. Both founders studied in Nigeria, with some of the lowest ranked educational institutions, and have equally lived much of their lives in the West African country. And so there is every reason to doubt their capacity to deliver good returns on investments. Which is why both founders sought to first plug the startup into the global ecosystem, through Y Combinator’s accelerator, before deeply treading the startup path. Paystack was recently acquired by Stripe in a deal reportedly worth more than $200m.

Another example is Chipper Cash which raised $6 million in seed funding, after 5 months of being selected into the Catalyst Fund. In fact, Catalyst Fund was part of that round. African genomic startup 54gene is also an example. After being part of the 2019 Y Combinator batch, the startup raised $15 million led by Adjuvant Capital, with a follow-on investment from the US-based seed stage accelerator.

Valuation

Another way of looking at accelerator programmes is that a good number of them help to boost the valuation of most startups. That is to say, being part of a reputable accelerator will most certainly increase the market value of a startup. This will correspondingly draw in investors in their numbers. If this happens, startup founders will have much more bargaining power around certain issues such as the percentage of equity participation in the business available to investors, among other things.

“Accelerator programs like Y Combinator are world-renowned for launching companies like Airbnb, Dropbox and Stripe,” writes Alex Gold, Co-Founder of Myia Health and former Venture Partner at BCG Digital Ventures. “There are thousands of other programs similar to Y Combinator around the world. Usually, each one takes between 3 and 7 percent of equity in a business in exchange for an investment sometimes no greater than $200,000. Founders will trade off what is usually an extremely low or discounted initial valuation for a premium from investors when they graduate.”

Gold says for companies that progress through Y Combinator’s program, for instance, they can command a significant valuation increase over similar companies in the market or even those that went through other accelerator programs.

“Often, investors engage in pattern-matching; and the “rubber stamp” of having gone through a prestigious accelerator is viewed as a marker of potential success, even though the data doesn’t necessarily support this,” he says.

Accelerator startups Africa Accelerator startups Africa Accelerator startups Africa Accelerator startups Africa Accelerator startups Africa Accelerator startups Africa Accelerator startups Africa

Read also: Why Many African Early-Stage Startups Fail To Secure VC Funding

A Distraction?

Although accelerators could be instrumental in securing a successful startup, it is also arguable that they may, themselves, be distracting to entrepreneurs, especially noting that most successful entrepreneurs were not molded in a traditional brick-and-mortar (and now, probably virtual) settings.

“A few years ago, I was speaking to another founder who had just entered an accelerator in Colorado,” writes Gold. “Despite its status as a nationally recognized program, the founder became exasperated at having to spend days in classes learning about subjects as elementary as incorporation, human resources and business development. They really go over the basics,” he recalled to me on the phone. “If I didn’t know many of these things, I wouldn’t be anywhere near where I am in my current business. They totally think we don’t get it, and it’s a massive distraction.”

The Bottom Line

In Africa, accelerators are not compulsory in building successful startups. Founders who have large network of investors or those passionate about executing quickly may consider accelerators a complete waste of time. In any case, the startup journey is not a straight-line destination; the vagaries of the society, the founder’s resilience, previous and continuing experience, and a host of other factors, largely shape the journey. Even startups funded by VCs, most times, equally have access to useful resources from the investors, who usually sit on the startups’ boards by virtue of their investments. Nevertheless, while they exist, accelerators are still a strong force in attempting to bridge the funding gap for startups on the continent.

Find a few of the active startup accelerators on the continent, below.

| S/N | NAME OF ACCELERATOR | LOCATION | FOCUS | DIRECT FUNDING YES/NO | NOTABLE AFRICAN STARTUP GRADUATES | |

|---|---|---|---|---|---|---|

| 1 | Founder Institute | Palo Alto, USA. | Pre-seed Stage. | No | DigiFi (Egypt) | |

| 2 | Betraton | Hong Kong | Startups seeking to expand to Asia. | YES | OkHi; ThankUCash | |

| 3 | Changelabs | Cyprus | Accelerates mostly North African startups. | YES | Hospitalia; El-Dokan | |

| 4 | Openner | USA | Egypt; Pre-seed; Seed. | YES | Recently launched. | |

| 5 | Google Business Startup Accelerator | USA | Early Stage. | NO | Crop2Cash (Nigeria); Curacel (Nigeria). | |

| 6 | Start Path Accelerator, Mastercard. | USA | Reg-tech; Fintech. | NO | uKheshe (South Africa) | |

| 7 | F-Lane Accelerator | Berlin, Germany | Female founders. | NO | Bidhaa Sasa | |

| 8 | Flat6Labs Accelerator | Egypt | Seed. | YES | Logistics startup ILLA; Instabug (Egypt); Dabchy (Fashion, Egypt) | |

| 9 | Catalyst Fund accelerators (Inclusive Digital Accelerator, etc) | USA | Early stage; African startups. | YES | Sokowatch; ChipperCash; Cowryrise | |

| 10 | “I’M IN” Accelerator | South Africa | South Africa; Female founders. | YES | MomSays; Droppa; Lightbulb Education. | |

| 11 | Akro Accelerate | South Africa | South African startups. | YES | DentX (Insurtech, South Africa) | |

| 12 | FoodTech Africa Accelerator | Norway | Kenya-based Agritech enterprises. | YES | iFarm360 (Kenya); Ecodudu (Kenya); Digicow (Kenya) | |

| 13 | FRAGG Impact Growth Accelerator | Nigeria | West Africa-based startups. | YES | ||

| 14 | DIFC Fintech Hive | UAE | African startups in fintech; Insurtech; Islamic fintech. | YES | Amplified Payment System (Nigeria) PaySky (Egypt) | |

| 15 | Facebook Accelerator (Community, Commerce) | USA | Invests in community-focused, commerce and other early stage startups. | YES | BoxCommerce; ShoppingFeeder. | |

| 14 | Hseven | Morocco | African startups | YES | ||

| 15 | I & P Accelerate, Investisseurs & Partenaires | EU | Startups in Benin; Burkina Faso; Cameroon; Côte d’Ivoire; Gambia; Guinea; Ghana; Mali; Mauritania; Niger; Chad; Togo and Senegal. | YES | ||

| 16 | First Digital Startup Accelerator, Forbes | USA | Nigerian startups. | YES | ||

| 17 | Land Accelerator Africa | Kenya | Agritechs aimed at land preservation. | YES | ||

| 18 | Innovate Ventures Accelerator | Somalia | Early stage. | YES | ||

| 19 | Falak Startups Accelerator | Egypt | e-health; Fintech; Logistics; 3D Printing; Remote work and ed-tech fields. | YES | ||

| 20 | Google’s Accelerator program on Sustainable Development Goal | USA | Startups working on SDGs. | NO | ||

| 21 | Africa Transformative Mobility Accelerator | Kenya | Kenyan and Ugandan mobility startups. | YES | SafariShare; Easy Matutu; Zembo Motorcycle. | |

| 22 | Grindstone Accelerator | South Africa | South African startups. | YES | WhereIsMyTransport; OneCart; Sentian (IoT, South Africa) | |

| 23 | Village Capital Agriculture Africa Accelerator. | USA | African startups. | YES | Complete Farmer; Reelfruit | |

| 24 | Vodacom Digital Accelerator, Vodacom; Smart Lab | Tanzania | Mobile; fintech; media, health; education; and e-commerce startups in Tanzania. | YES | Smart Class; Hastag Pool; MYHI | |

| 25 | Seedstars Tanzania Accelerator | Switzerland | Startups in Tanzania. | YES | Sheria Kiganjani (legaltech, Tanzania) | |

| 26 | The Baobab Network Accelerator | UK | Startups in Congo; Democratic Republic of the, Ethiopia; Ghana; Kenya; Rwanda; South Africa; Nigeria; Zambia, Zimbabwe, engaged in Agribusiness; Clean technology; Education; Financial services; Healthcare. | YES | Kakbima; Gladepay | |

| 27 | Y Combinator | USA | Seed stage; global accelerator. | YES | Paystack; 54gene; Helium Health | |

| 28 | AUC Venture Lab Accelerator | Cairo, Egypt | Seed Stage. | YES | SWVL; Agora | |

| 29 | JFN-IT E4 IMPACT Accelerator | Doula, Cameroon | Early Stage. | NO | – | |

| 30 | Catalyst Fund‘s Fintech Accelerator | USA | Early Stage; Fintech. | YES | Turaco (Kenya) | |

| 31 | ARM Accelerator | China | AI & IoT Startups. | YES | Kwaba (Kenya); | |

| 32 | Plug and Play Startup Accelerator Tech Center | USA | Morocco; Early stage; Smart city startups. | NO | – | |

| 33 | Tachyon Accelerator, run by Consensys Ventures | USA | Blockchain. | YES | Elkrem (Egypt) | |

| 34 | Starfleet Incubator | Sofia, Bulgaria | Blockchain. | YES | UTU Tech (Kenya) | |

| 35 | Binance Labs | Hong Kong | Blockchain. | YES | XEND Finance | |

| 36 | AlphaCode Incubate | South Africa | Early stage; fintech. | YES | Akiba Digital; ISpani Group; Nisa Finance. | |

| 37 | Start and Grow Your StartUp Accelerator, GIZ | Tunisia | Early Stage. | NO | ||

| 38 | Seedstars | USA | Seed; Early Stage Startups. | YES | Pezecha (Kenya); Chaka (Nigeria) | |

| 39 | MEST Africa (Pan African Fintech Accelerator, etc) | Ghana | Early Stage startups; Fintech. | YES | Shopa (Kenya); Tendo (Ghana); Amplify. | |

| 40 | DFS Lab Accelerator | Seattle, USA. | Early stage startups with at least two co-founders; Ecommerce; Fintech. | YES | Cherehani Africa (Kenya),Nobuntu (South Africa), | |

| 41 | Orange Fab Tunisia | Tunisia | Early Stage. | YES | Galactech (Tunisia) | |

| 42 | Passion Incubator | Nigeria | Early Stage. | NO | ||

| 43 | Enterprise Development for Women-Owned Ventures in Green Energy, AWIEF | South Africa | Women-led cleantech startups in Malawi and Nigeria | NO | ||

| 44 | Village Global Accelerator | San Francisco, USA | Early Stage. | YES | Eden Life | |

| 45 | Google Launchpad Accelerator Africa | USA | Seed; Early Stage. | YES | Piggyvest; ThankUCash; Thrive Agric; Eversend (Uganda); Aerobotics | |

| 46 | VC4A Venture Showcase | The Netherlands | All Stages. | YES | ||

| 47 | Afrikhaliss-Suguba | Cote d’ivioire | Early stage startups in French-speaking West Africa. | YES | ||

| 48 | Justice Accelerator, the Hague Institute for Innovation of Law | The Netherlands | Legaltechs in Africa led by committed CEOs. | YES | Lenoma Legal; Luma Law | |

| 49 | 500 Startups’ Global Seed Accelerator | USA | Early stage startups. | YES | Shezlong (Healthtech, Egypt); Source Beauty (Egypt). | |

| 50 | Startup Wise Guys Accelerator | EU | Fintech startups in Egypt, Morocco and Tunisia. | YES | Paylock (Ghana) | |

| 51 | Greenhouse Lab Accelerator | Nigeria | Female-led startups in Africa. | YES | Doctoora (Nigeria); Vesicash (Nigeria) | |

| 52 | She Leads Africa Accelerator | South Africa | Female-led startups Africa. | YES | DeliveryBros, Art Splash Studio, BathKandy Co. | |

| 53 | Egbank MINT | Egypt | Fintech Startups Egypt. | YES | Shahry (Lending, Egypt) | |

| 54 | Startupbootcamp AfriTech Accelerator | South Africa | Blockchain; fintech startups. | YES | MPOST (Kenya); CredPal (Nigeria); GotBot (South Africa) | |

| 55 | Impulse Accelerator | Morocco | Agritech; Biotech; Mining tech; Nanoengineering startups. | YES | Farmcrowdy (Nigeria); Coldhubs(Nigeria);Safi Organics (Kenya) | |

| 56 | Make IT Accelerator | Kenya | Banking; Computer software; Creative, media and entertainment; E-commerce; Internet, Mobile; Telecom. | YES | Doctoora E-Health Ltd DoLessons ; Embinix Automation ; Insight Africa | |

| 57 | Itanna | Nigeria | Sector-agnostic. | YES | Indicina Technologies | |

| 58 | GSMA Ecosystem Accelerator | UK | Telecom. | YES | Coliba (Ivory Coast) | |

| 59 | EFG-EV Fintech | Egypt | Fintech startups. | YES | Raseedi (Telecom, Egypt) | |

| 60 | SOSV Accelerator | Ireland | All Stages. | YES | CanGo (shutdown; delivery Rwanda) | |

| 61 | Wadi Accelerator, Oman Technology Fund (Partner 500 Startups) | Oman | Early Stage; Seed. | YES | Bekia (Waste Management, Egypt) | |

| 62 | Antler Startup Accelerator | Kenya | Early Stage. | YES | ChapChapGo; AnyiHealth; Digiduka | |

| 63 | Founders Factory Africa (Venture Scale, etc) | UK | Early Stage. | YES | Wella Health (Nigeria); Redbirth (Ghana); Truzo (South Africa) | |

| 64 | Pangea Accelerator | Kenya | Early Stage. | NO | – | |

| 65 | Bongo Hive | Lusaka, Zambia | All Stages. | NO | – | |

| 66 | Savannah Fund Accelerator | Kenya | Seed. | YES | – | |

| 67 | NEST | Kenya | Seed. | YES | – | |

| 68 | MMH Accelerator | Kenya | Ghanaian, Kenyan and Nigerian late-stage healthtech firms. | YES | – | |

| 69 | Technipole Sup – Valor | Yaounde, Cameroon | Cameroon Startups. | NO | – | |

| 70 | SW7 | Johannesburg, South Africa | Early Stage | NO | – | |

| 71 | Startup Reactor | Innoventures | Egypt | Early Stage. | NO | – | |

| 72 | TIEC Entrepreneurship Accelerator | Giza, Egypt | Early Stage | No |

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer