Mauritius is preparing for some radical reforms to its current tax regime. Its 2019–2020 budget proposal is saying so. Changes range from international tax reforms; value-added tax changes; new corporate tax relief measures, including a new patent box regime; a regime for peer-to-peer lending; individual tax breaks; and a tax amnesty scheme.

Below are some of the changes.

Companies or Startups Involved In Innovation Activities Would Get An Eight-Year Tax Holiday

Mauritian 2019–2020 budget is proposing a big incentive for highly innovative companies and startups. For newly established startups and companies, in innovation-driven activities, they stand a greater chance of benefiting from an eight-year tax holiday on income derived from their intellectual property assets which were developed in Mauritius. For existing startups or companies, the eight-year tax holiday would be on income derived from intellectual property assets developed in Mauritius after June 10, 2019.

The Budget also makes changes concerning loss carryforwards for companies. Presently, in Mauritius, the accumulated losses of a company lapse if there is a change in the ownership of the company. However, in the case of a manufacturing company, the Minister may allow the carry forward of the losses if he is satisfied that it is in the public interest to do so and provided conditions relating to the safeguarding of employment are complied with. This derogation will be extended, under the new rule, to any company facing the financial difficulty that is taken over by another shareholder provided conditions imposed by the minister are met. This amendment will be deemed to be effective as from July 1, 2018.

A Five-Year Tax Holiday For E-commerce Startups, Peer-To-Peer Lending

The Budget also proposes a five-year tax holiday for a startup or company setting up an e-commerce platform provided the company is incorporated in Mauritius before June 30, 2025.

Also within the five-year bracket are peer-to-peer lending operators, provided the company starts its operation prior to December 31, 2020.

All interest income received by an individual from peer-to-peer lending will be subject to income tax at the rate of three percent (3%). Any bad debt and fees payable to the peer-to-peer operator will be deductible from taxable interest income. No tax deduction at source will be applied to peer-to-peer interest income.

Also, Mauritian businesses spending on capital goods, which are goods that are used in producing other goods, rather than being bought by consumers, would now breathe some relief. This is because the Budget also improves tax relief for expending on capital goods. Presently, capital expenditure incurred on plant or machinery may be fully expensed in the year incurred if the amount does not exceed MUR30,000 (USD835). The threshold will be raised to MUR60,000 under the new regime.

Four Year Tax Holiday For Oil Bunkering

The new budget also places a four-year tax holiday on all income derived from bunkering of low Sulphur Heavy Fuel Oil.

Under Its Tax Amnesty Rule, Small and Medium Enterprises Will Be Given An Opportunity To Regularize Their Tax Default

To this effect, Small and medium enterprises (with a turnover not exceeding MUR50m) will be given the opportunity to regularize any undeclared or underdeclared income with the Mauritian Revenue Authority free from penalty and interest, provided payment is made on or before March 31, 2020.

The proposed tax amnesty scheme also allows a person making a voluntary disclosure on or before March 31, 2020, to be subject to tax on the disclosed chargeable income at a rate of 15 percent, free from any penalty and interest. However, criminal proceeds are excluded from this grace.

Value-Added Tax (VAT) Also Saw The Greatest Reforms

Under the new VAT regime, cooking gas for domestic use by households in cylinders of up to 12 kg is being made zero-rated for VAT, and certain foodstuffs, including bread, will be newly exempt.

The Budget also says that a wholesale dealer in liquor and alcoholic products will have to be registered with the Mauritian Revenue Authority as a VAT-registered person. The Budget also provides that where there is a splitting of a business entity into different entities to avoid registration for VAT purposes, each entity will be required to be compulsorily registered for VAT.

Consequently, with a view to expediting the processing of VAT refunds, all VAT-registered persons will have to file their VAT return and pay VAT electronically as from March 1, 2020.

As it stands now, a VAT-registered person in Mauritius may claim repayment of input tax in respect of capital goods such as building, plant, machinery, or equipment. The Budget also proposes for provisions to be made to allow repayment of VAT paid on goodwill on acquisition of a business; and the acquisition of intangible assets such as software, patents, or franchise agreements.

Mauritian Banks Who Grant Loans And Other Credit Facilities To Startups, Agric and Renewable Energy Businesses Would Receive 5% Less Tax On Their Taxable Income

Under the new arrangement, a reduced tax rate of five percent (5%) is applicable on the chargeable income of a bank in excess of its chargeable income in the base year (year of assessment 2017/2018) if the bank grants at least five percent of its new banking facilities to any of the following categories of businesses: SMEs in Mauritius; enterprises engaged in agriculture, manufacturing, or production of renewable energy in Mauritius; or operators in African or Asian countries.

Generally, a new taxation system for banks will be re-modeled as follows:

- income derived by banks from Global Business Companies will be exempted from the levy under the Value Added Tax Act;

- The rate of the levy will be increased from four percent to 4.5 percent of operating income for banks having operating income exceeding MUR1.2bn in a year;

- a cap will apply on the increase in levy payable by a bank in order to ensure that no bank is burdened by an excessive levy amount;

- it will be clarified that the levy is not a deductible expense under corporate tax; and

- no foreign tax credit will be allowed.

Mauritians Will Become Increasingly Tax-Free Under The New Proposal

The new tax regime also sees major changes to personal income tax, including increases to tax-exempt allowances and relief for carers for persons with disabilities.

The Budget that as it concerns inheritance tax, the lump-sum income received by a person by way of payment of pension before the legal due age, death gratuity, or as compensation for death or injury will be excluded from the computation of the solidarity levy. This change will be backdated to take effect as from July 1, 2017, the date the solidarity levy was introduced.

The law will, however, be amended to clarify that an individual’s share of income in a society or succession will be taken into account in the computation of the solidarity levy.

There Would Be Major Changes In The Way International Taxes And Transfer Pricing Are Done In Mauritius

The budget also seeks to amend the Income Tax Act of Mauritius. The amendment of the Income Tax Act would be to implement the recommendation of industry stakeholders regarding the determination of tax residency for companies so that a company will not be considered as tax resident in Mauritius if it is centrally managed and controlled outside Mauritius.

The budget will also address the deficiencies identified by the EU in the territory’s partial exemption regimes.

To this effect, the Income Tax Regulations 1996 will be amended to:

- define the detailed substance requirements that must be met in order for a taxpayer to enjoy the partial exemption benefit; and

- lay down the conditions that must be satisfied where a company outsources its core income generating activities — namely:

- the company must be able to demonstrate adequate monitoring of the outsourced activities;

- the outsourced activities must be conducted in Mauritius; and

- the economic substance of service providers must not be counted multiple times by multiple companies when evidencing their own substance in Mauritius.

Mauritius also intends to introduce controlled foreign company rules, and the legal provisions relating to the arm’s length test for transfer pricing purposes will be fine-tuned, the Budget says, “to remove any doubt or uncertainty about its application.”

Mauritius Would Soon Be A Regional Hub For Fintech

The budgets are not taking the disruptive and profitable nature of Fintech for granted. It sets out measures the territory will take to establish Mauritius as a hub for Fintech in the region. Accordingly, the Financial Services Commission will:

- establish a regime for Robotics and AI enabled financial advisory services;

- introduce a new license for Fintech Service providers;

- encourage self-regulation for Fintech activities in consultation with the United Nations Office on Drugs and Crime;

- introduce the use of e-signatures and e-licenses on a pilot basis; and

- create crowdfunding as a new licensable activity.

Development of Real Estate Investment Trusts

The Budget announces proposals for new rules and an attractive tax regime to promote the development of Real Estate Investment Trusts (REITs); an “umbrella license” for wealth management activities; and a scheme for headquartering of “e-commerce” activities.

Tax Break For Electric vehicles

The Budget proposes improvements to tax breaks for electric vehicles, including a double deduction for businesses investing in a fleet of eco-friendly cars.

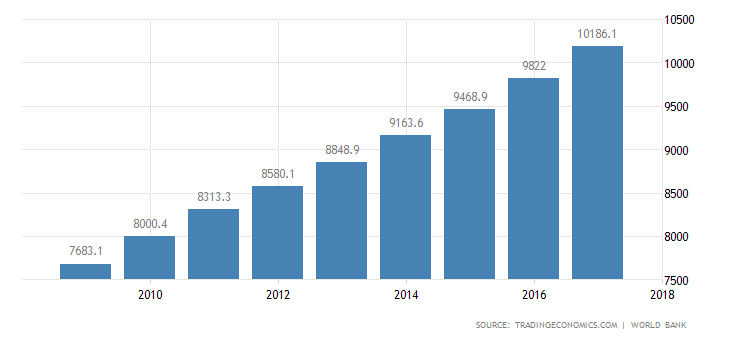

The Gross Domestic Product per capita in Mauritius was last recorded at 10186.10 US dollars in 2017. The GDP per Capita in Mauritius is equivalent to 81 percent of the world’s average.

Gaming Tax Enforcement

The Budget says appropriate amendments will be made to the Income Tax Act to reduce the possibility for a casino or a gaming house to split payment to winners in order to avoid the 10 percent tax on winnings exceeding MUR100,000.

Tax Perks For Marinas

The Government has announced incentives for the development of marina, including new regulations for marinas and a yacht code; an eight-year income tax holiday for a newly set-up company developing a marina; and a VAT exemption will be provided on the construction of marinas.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.