Kenyans living abroad are sending more money back home than their counterparts living in Uganda, Tanzania, Rwanda, Burundi, South Sudan, and Ethiopia put together. World Bank data says Kenya’s Diaspora remittances in 2018 stood at Sh280 billion (about $2.7 billion), while a total of Sh242 billion was sent to the rest of Eastern Africa — comprising Uganda, Tanzania, Rwanda, Burundi, South Sudan, and Ethiopia.

However, this does not stop there. In the first five months of 2019, Kenyan Diaspora remittances stood at Sh118.9 billion, a 3.8 percent increase in the same period in 2018.

Here Are The Facts

- A World Bank unit known as the Global Knowledge Partnership on Migration and Development prepared the report released in April 2019.

- With these figures, remittances in Kenya have now become the biggest source of foreign exchange for Kenya, far more than Kenya’s tourism, tea, coffee and horticulture exports.

- With these figures again, it means that in terms of contribution of remittances to the GDP of a country, Kenya’s now stands at (three percent), Uganda (4.5 percent) and Rwanda (2.4 percent) in the region, while Ethiopia saw the least contribution (0.5 percent) and Tanzania (0.8 percent).

- This report is significant because it shows that between 2017 and 2018, the rate at which Kenyans sent money back home grew by 39%. The rate has even further increased in the first five months of 2019. Between January and May 2019, a total of Sh118.9 billion, representing a 3.8 percent increase on the same period in 2018, was sent back to Kenya

Where The Money Is Coming From

- The money came from about 3 million Kenyans living abroad, many of whom have attained tertiary education and are working in the formal sector jobs.

- North America, particularly the United States accounts for much of the Kenyans abroad remittances. At least, 45 percent of all the remittances came from that region. This is followed by Europe at about 23 percent while the rest of the world accounts for about 32 percent.

- The US is a popular destination for Kenyans looking for greener pastures and further education, with the latter mostly remaining in the destination countries for work after graduation.

- In recent years, however, the Middle East and China are also emerging as a choice destination for those looking for external work opportunities, in line with the rapid economic growth in these regions.

Why So Much Is Being Sent Back Home

- Perhaps Kenyans are sending more back home because it has become easier to do so.

- The Central Bank of Kenya has, for instance, identified the ease of sending money back home as a major factor in the sharp growth of Kenyans abroad remittances.

- Local banks have entered partnerships with remittance service providers that allow them to handle larger volumes of inflows.

- The expansion of the popular M-Pesa service beyond Kenya’s borders is also helping, with direct cash transfers on mobile making it easier for the millions who actively use mobile money to receive money instantly from relative abroad.

- One of the biggest impediments to inward African remittances has over the years been identified as cost, partly attributable to the lower than global average penetration of formal banking in the continent.

- The World Bank report shows that remittances to sub-Saharan Africa remain the most expensive across the different regions of the world.

“The cost was the lowest in South Asia, at five percent, while sub-Saharan Africa continued to have the highest average cost, at 9.3 percent.

“Remittance costs across many African corridors and small islands in the Pacific remain above 10 percent,” said the World Bank in the report.

- It also helps if a country has a well-developed banking sector, which opens up formal channels of remitting money back home and reduces the cost of doing so.

- Ease of movement of capital also helps. Countries that do not restrict the movement of hard currency are, therefore, likelier to attract foreign investment flows, which encourage the setting up of more robust support infrastructure for remitting money.

Kenya Is Fifth On the Continent As A Whole

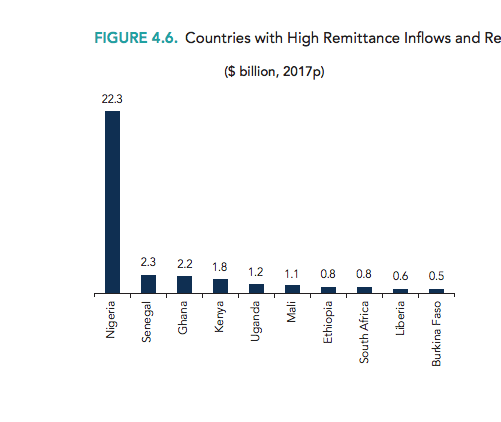

Looking at the wide continent, Kenya was fifth last year in terms of volume of money remitted.

- Egypt and Nigeria, which are two of Africa’s most populous countries and boast of a large diaspora, led the continent with inflows of Sh2.98 trillion ($28.9 billion) and Sh2.5 trillion ($24.3 billion) respectively last year.

- Morocco and Ghana saw remittances of Sh760 billion (7.38 billion) and Sh391.4 billion ($3.8 billion) respectively to also come in ahead of Kenya on the list.

- In East Africa, remittances stood at Sh128.4 billion for Uganda, Sh44.3 billion for Tanzania, and Sh42.4 billion in Ethiopia. Rwanda and Burundi had remittances worth Sh23.7 billion and Sh3.7 billion respectively, while there was no data available for South Sudan and Somalia for 2018 in the World Bank report.

“Remittances to sub-Saharan Africa were estimated to grow by 9.6 percent from $42 billion in 2017 to $46 billion in 2018. Projections indicate that remittances to the region will keep increasing but at a lower rate, to $48 billion by 2019 and to $51 billion by 2020,” World Bank noted in the report.

“The upward trend observed since 2016 is explained by strong economic conditions in the high-income economies where many sub-Saharan African migrants earn their income.’’

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.